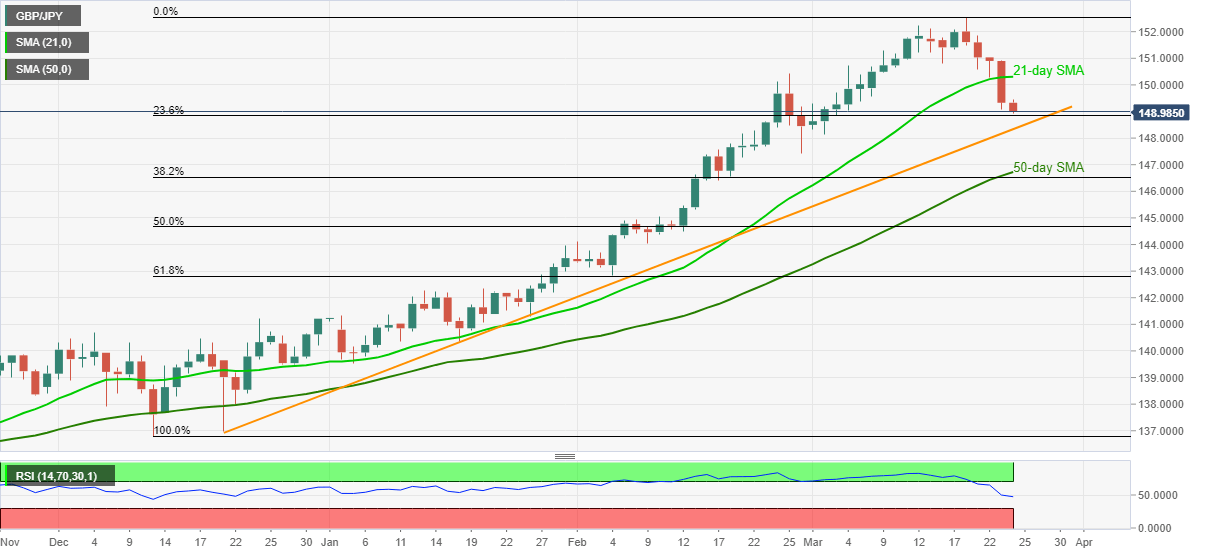

- GBP/JPY drops for fifth consecutive day, extends previous day’s downside break of 21-day SMA.

- Downward sloping RSI, risk-off mood joins break of immediate SMA to direct sellers towards the key support line.

- Bulls need comfortable journey past-151.00 to retake control.

GBP/JPY remains on the back foot, currently down 0.25% intraday while attacking March 03 low near 149.00, during early Wednesday. The cross-currency pair broke 21-day SMA on Tuesday as RSI eased from the overbought region.

The moves gain extra attention as the RSI line tilts to the south as GBP/JPY prices remain heavy below the short-term moving average.

As a result, the quote currently eyes an ascending trend line from December 21, 2020, around 148.30. However, any further downside will be questioned by late February lows near 147.40.

If at all the GBP/JPY bears ignore the previous swing low, 50-day SMA surrounding 146.70 will be on their radar.

Meanwhile, corrective pullback needs to cross the 150.00 first-hand before directing the GBP/JPY buyers toward regaining above the 21-day SMA level of 150.30.

Though, multiple tops marked during the early March around 151.00 and the recently flashed multi-month high around 152.55 could challenge the GBP/JPY bulls afterward.

GBP/JPY daily chart

Trend: Bearish