- GBP/JPY keeps breakdown of 13-day-old horizontal resistance marked the previous day.

- Bearish MACD, downbeat expectations from British jobs report keep sellers hopeful.

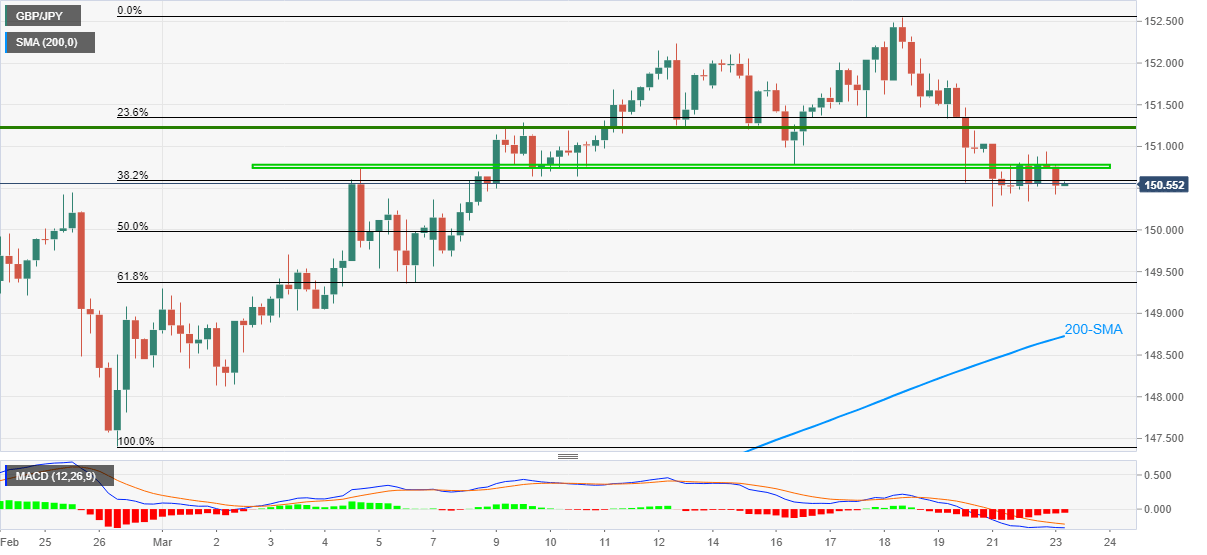

- Multiple upside barriers probe bulls above 151.00, key Fibonacci retracement levels lure bears.

GBP/JPY remains heavy around mid-150.00s, currently down 0.23% intraday, ahead of the key UK employment report on Tuesday. In doing so, the quote justifies pullback from nearly fortnight old resistance area amid bearish MACD.

Forecasts suggest the headline Unemployment Rate rise from 5.1% to 5.2% during the three months to February.

Given the sluggish consensus for the British data, coupled with the pair’s inability to cross immediate resistance-zone amid bearish MACD, GBP/JPY sellers can keep targeting the 150.00 threshold, comprising 50% Fibonacci retracement of February 26 to March 18 upside.

It should, however, be noted that the pair’s downside past-150.00 will have strong supports in the form of 61.8% Fibonacci retracement level and 200-SMA, respectively around 149.35 and 148.70.

Alternatively, an upside break of 150.80 isn’t a clear invitation to the GBP/JPY buyers as another horizontal line including levels from March 09, around 151.25 also stands tall to test the quote’s run-up.

If at all the GBP/JPY bulls manage to cross the 151.25 hurdle to the north, 152.10-15 should also be cleared before eyeing the monthly peak surrounding 152.55.

GBP/JPY four-hour chart

Trend: Bearish