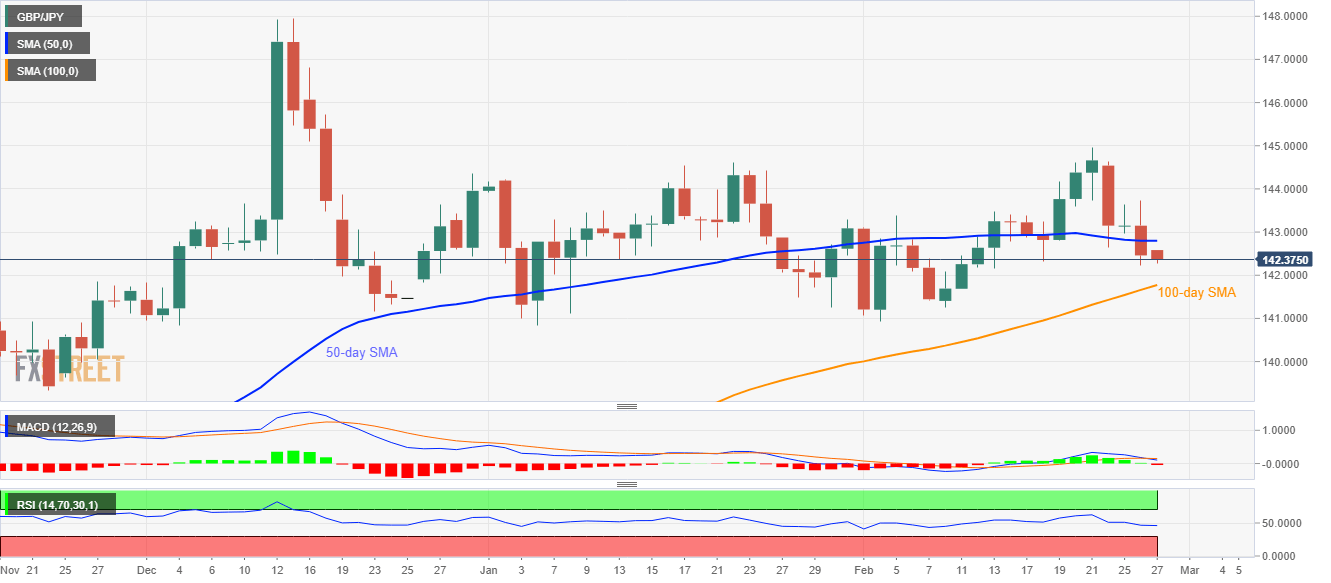

- GBP/JPY extends losses below 50-day SMA.

- Bearish MACD, a sustained trading below short-term key SMA keeps sellers hopeful.

- Buyers will refrain to enter unless clearing 143.70/75.

GBP/JPY declines to 142.40, -0.11%, as markets in Tokyo open for Thursday’s trading. In doing so, the quote stretches its downside break of 50-day SMA, marked Wednesday, while targeting 100-day SMA amid the bearish MACD.

In addition to the 100-day SMA level near 141.75, the monthly low surrounding 140.90 and 140.00 round-figure will also be on the bear’s radar unless the MACD turns its course.

During the pair’s south-run below 140.00, November 22, 2019 low near 139.30 might return to the charts.

Alternatively, a daily closing beyond 100-day SMA level of 142.80 will need to cross 143.70/75 confluence including the recent high and February 21 low.

Following that, the monthly top surrounding 145.00 and December 13, 2019 low around 145.50 should become the bulls’ favorites.

GBP/JPY daily chart

Trend: Bearish