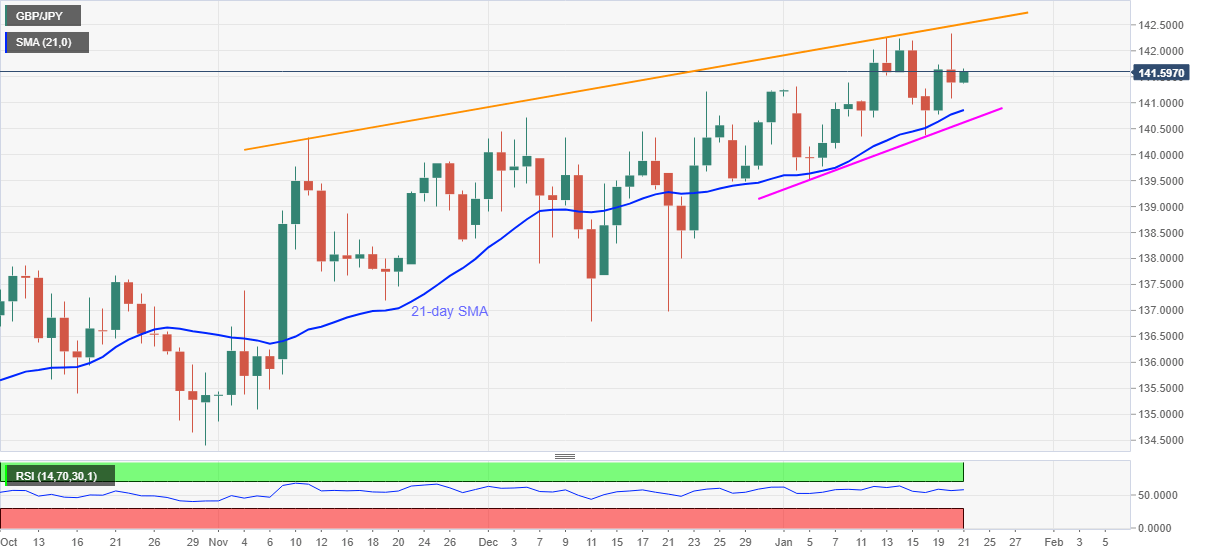

- GBP/JPY eases from intraday top while keeping positive sentiment on the table.

- Successful rise past-21-day SMA, 12-day-old support line favor the bulls.

- 10-week-long resistance line, September 2019 peak gain the buyers’ attention.

GBP/JPY trims early Asian gains while stepping back from the intraday high of 141.65 to 141.58, up 0.14% on a day, during early Thursday. The quote refreshed a four-month high the previous day before easing from 142.34. However, the pullback moves couldn’t last longer and bounced off 141.08.

Sustained trading above 21-day SMA and a short-term support line, amid an absence of overbought RSI, favor GBP/JPY bulls. Though, cautious sentiment ahead of the Bank of Japan’s (BOJ) monetary policy meeting and the coronavirus (COVID-19) worries in the UK seems to weigh the quote.

Read: When is the BOJ rate decision and how could it affect USD/JPY?

Hence, the latest pullback is less likely to spoil the mood unless staying past-21-day SMA and an ascending trend line from January 05, respectively around 140.85 and 140.60.

Also likely to challenge the GBP/JPY bears is the 140.00 psychological magnet, a break of which will direct the sellers toward the monthly low around 139.50.

On the contrary, the 142.00 threshold and the latest top near 142.35 can please the GBP/JPY buyers during the further upside.

Should the quote remains positive beyond 142.35, an upward sloping trend line from November 11, around 142.52 and September 2020 peak surrounding 142.70-75 will be in the spotlight.

GBP/JPY daily chart

Trend: Bullish