- GBP/JPY rallied on Thursday following a less dovish than expected BoE monetary policy decision.

- The pair also rebounded from a key area of support in the upper 142.00s.

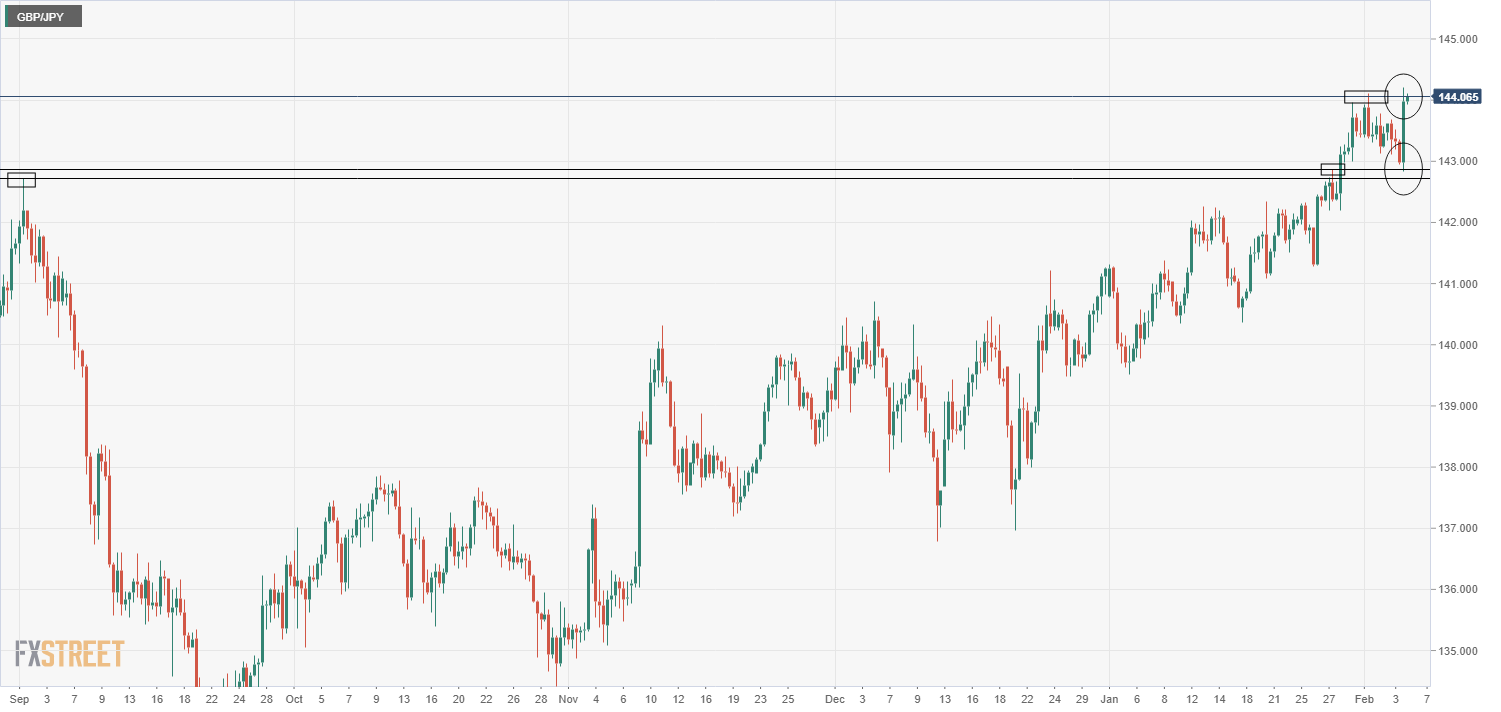

GBP/JPY rallied to fresh annual highs on Thursday, rallying above Monday’s 144.10 highs to above 144.20, the pair’s highest levels since February 2020. Indeed, the February 2020 high at just shy of the 145.00 level will be the bulls next target, but for now the pair needs to close above the 144.00 level, something which looks as though it might be a struggle; in recent trade, GBP/JPY has slipped back from highs and has been trading either side of the 144.00 mark. On the day, the pair trades with gains of around 0.5% or 70 pips.

Driving the day

It’s been a strong year for GBP/JPY thus far, with the pair already gaining more than 2% and moving from below 141.00 to current levels around 144.00. The strength reflects a combination of GBP appreciation amid the pricing out of no deal Brexit concerns and the pricing in of the UK’s comparatively fast national vaccination effort and weakness in the Japanese yen as a result of generally strong risk appetite (global stocks and commodities are higher).

Another factor boosting GBP in recent weeks has been the Bank of England; BoE Governor Andrew Bailey sounded reluctant to take the country into negative interest rate territory last week, leading markets to reduce their NIRP bets and lending support to sterling. The BoE gave GBP a further boost on Thursday; GBP/JPY, which had been on the back foot throughout most of the European morning and had actually slipped below 143.00 surged over 120 pips at highest levels in the immediate aftermath of the less dovish than expected event.

Bank of England Meeting Recap

As expected, the Bank of England’s Monetary Policy Committee (MPC) left interest rates unchanged at 0.1% and the bank’s Asset Purchase Facility at £895Bnin a unanimous vote. The bank reiterated that it will not tighten monetary policy until it is “achieving the 2% inflation target sustainability”. In what will come as a bit of a disappointment to some of the more dovish market participants, the bank said that negative interest rate policy (NIRP) is not yet operational and suggested that they will not be ready to implement NIRP for at least another six months.

Regarding negative rates, Governor Bailey was keen to impress in the press conference that just because the bank was going to include NIRP in its monetary policy toolbox that doesn’t mean the policy is definitely going to be used; “my message to the markets is do not read future MPC decisions based on toolbox moves” he said. Separately, BoE Deputy Governor Dave Ramsden said that the MPC will need to slow the pace of QE at some point and that the bank is on track to complete its QE programme by the year’s end; for reference, at the current rate of purchase (£4.4B per week) the bank will use up the remainder of the £150B it added back in November by mid-August. Thus, to extend purchases to the end of the year, a slowing weekly pace makes sense (in absence of a QE top-up).

The bank’s new forecasts were also fairly upbeat; admittedly, the H1 2021 forecast was downgraded to take into account the stricter than anticipated lockdown the country is currently in. But the growth forecast for H2 2021 was upgraded and the BoE now thinks the UK economy will return to its pre-Covid-19 levels by the end of the year, versus previous forecasts for the economy to return to its pre-Covid-19 peak in Q1 2022. In the bank’s inflation forecast, inflation is expected to rise above 2% in the second half of 2022 and then stay above this level throughout 2023. This implies the bank is likely to be looking to hike rates in 2023.

GBP/JPY finds strong support in upper 142.00s

Though the reason for the turnaround to the upside was fundamental (a less dovish than expected BoE), technicals may have also played something of a role in Thursday’s GBP/JPY rally. The pair fell into a strong area of support during the early part of the European session in the upper 142.00s (the 2 September 2020 and 27 January 2021 highs). If the bears do push the pair back from current levels, this will be a key area to watch.

GBP/JPY four hour chart