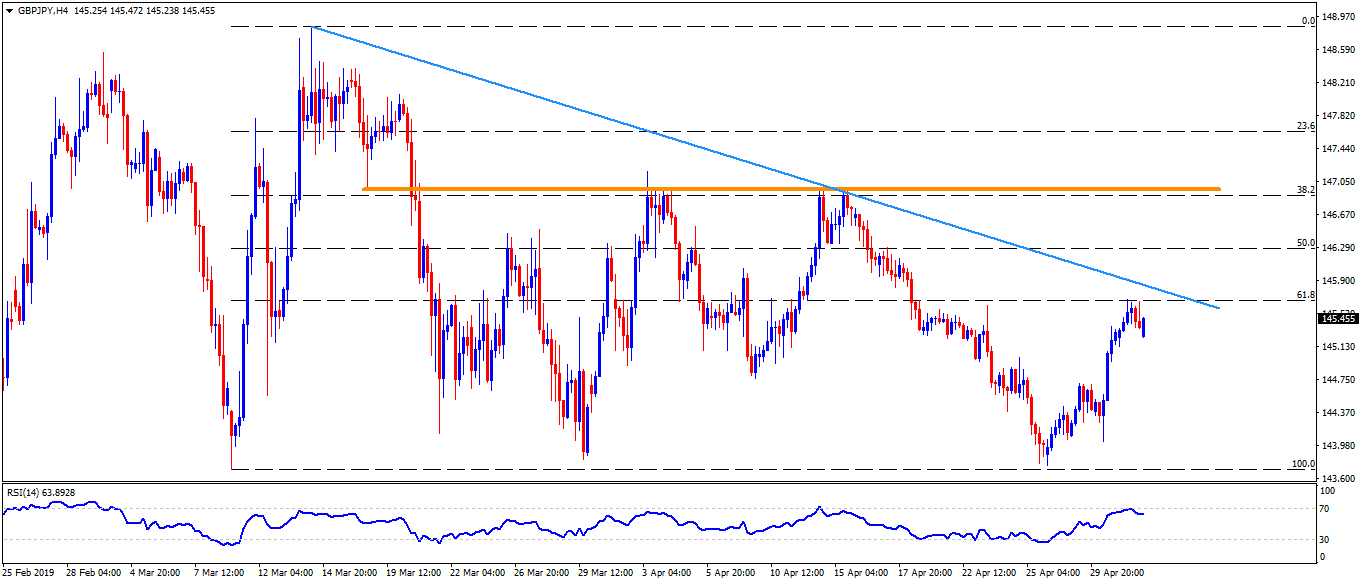

- Recovery from 143.70/75 fails to clear a 61.8% Fibonacci retracement level.

- Seven-week-old resistance-line also becomes an important upside stop.

In spite of the latest pullback, the GBP/JPY is on the bids around 145.50 during early Thursday. The pair fall short of extending its recovery from 143.75/70 as 61.8% Fibonacci retracement of its March month increase triggered the U-turn.

At the moment, 145.70 level acts as an immediate upside barrier ahead of seven-week-old descending trend-line at 145.85.

Though, pair’s ability to cross 145.85 can quickly propel it to 146.30 and then towards 147.00 horizontal-line.

If at all the quote declines, 144.70 may offer nearby support prior to highlighting 144.20 and 144.00 rest-points.

Also, pair’s sustained downturn beneath 144.00 needs to break 143.75/70, comprising 100-day simple moving average (SMA), in order to visit sub-143.00 area.

GBP/JPY 4-Hour chart

Trend: Positive