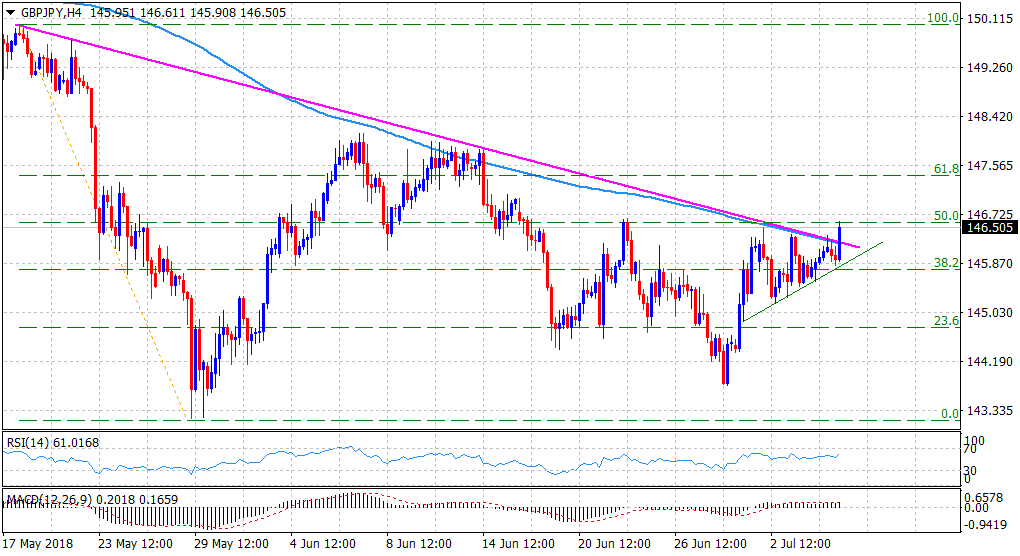

“¢ The cross to finally breakthrough an important confluence resistance, comprising of a short-term descending trend-line, extending from May 18 top through highs set on June 12/13/14, and 200-period SMA on the 4-hourly chart.

“¢ With short-term technical indicators building on the positive momentum, a follow-through buying beyond 50% Fibonacci retracement level of the 150.01-143.20 downfall would reinforce the bullish breakout and open room for additional gains in the near-term.

“¢ A combination of factors, like incoming positive UK economic data and fading safe-haven demand, remain supportive of the ongoing bullish momentum ahead of the BoE Governor Mark Carney’s scheduled speech at 1000 GMT.

Spot Rate: 146.51

Daily High: 146.61

Daily Low: 145.84

Trend: Bullish

Resistance

R1: 146.84 (R2 daily pivot-point)

R2: 147.00 (round figure mark)

R3: 147.40 (61.8% Fibo. level)

Support

S1: 146.25 (confluence resistance break-point)

S2: 145.84 (current day swing low)

S3: 145.24 (S2 daily pivot-point)