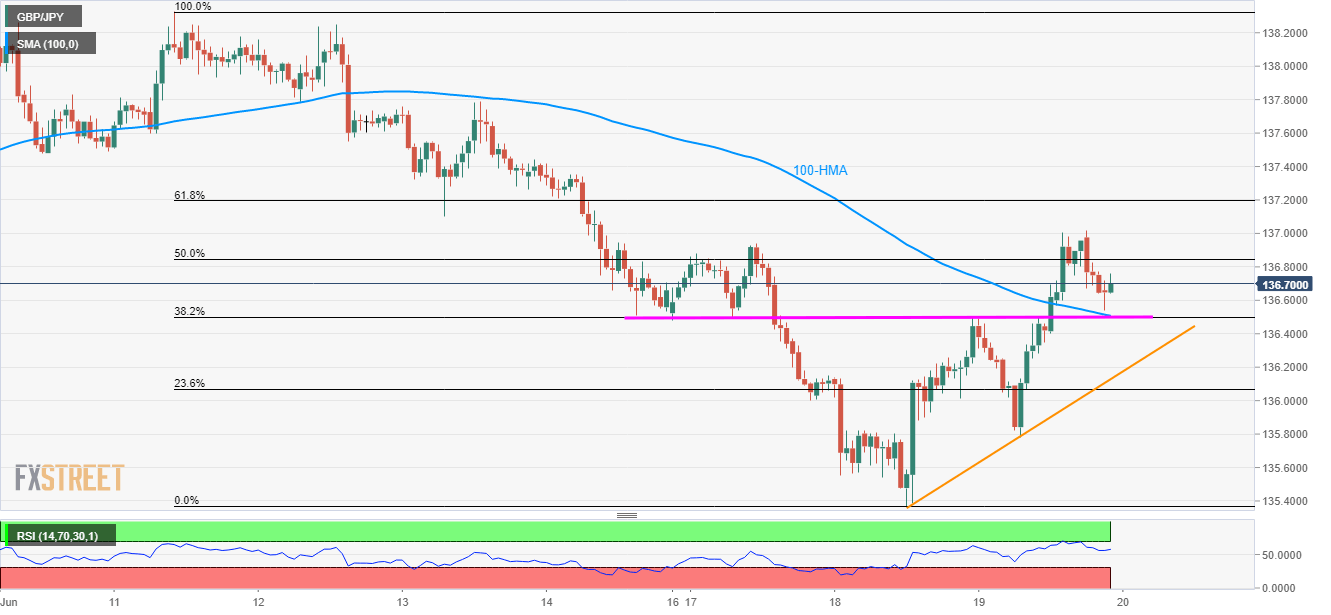

- 100-HMA, 38.2% Fibo. offers strong downside support.

- Immediate ascending trend-line also portrays the pair’s strength.

Failure to slip beneath immediate support-confluence portrays the GBP/JPY pair’s ability to again aim for 137.00 while it takes the rounds to 136.73 during the early Asian session on Thursday.

If prices manage to remain strong beyond the latest high near 137.00, 61.8% Fibonacci retracement of 137.20 and 137.80 can come back on the chart.

In a case, bulls manage to hold their bods above 137.80 last week’s high around 138.33 could be their next target.

On the downside break of 136.50/48 support-confluence including 100-hour moving average (100-HMA) and 38.2% Fibonacci retracement could open the door for the pair’s fresh selling towards 136.13 support-line.

Also, pair’s decline below 136.13 trend-line support might not refrain from dragging it to 135.80 and then to 135.40 rest-points.

GBP/JPY hourly chart

Trend: Pullback expected