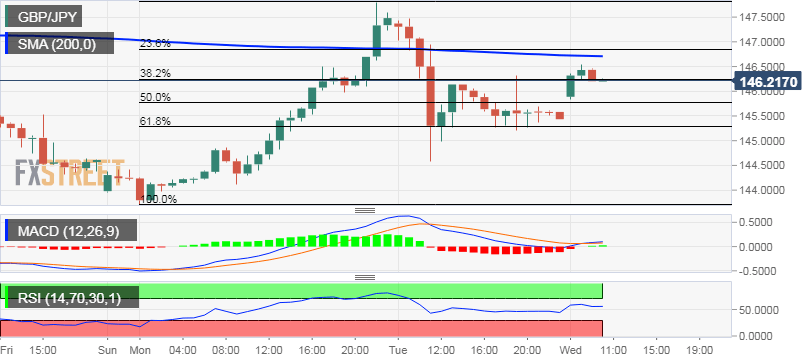

“¢ Despite the overnight sharp swings, the cross showed remarkable resilience below the key 145.00 psychological mark and 61.8% Fibonacci retracement level of the 143.72-147.78 recent upsurge.

“¢ The cross managed to regain positive traction on Wednesday and climbed further beyond the 146.00 handle, albeit the positive momentum seemed to have run out of steam ahead of 200-hour SMA.

“¢ Technical indicators on the daily chart maintained their bullish bias and have again started gaining positive traction on hourly charts, supporting prospects for an extension of the intraday up-move.

“¢ However, it would be prudent to wait for a sustained move beyond the mentioned hurdle before traders start positioning for a move beyond the 147.00 mark, towards retesting the 147.70 supply zone.

GBP/JPY 1-hourly chart

GBP/JPY

Overview:

Today Last Price: 146.2

Today Daily change: 63 pips

Today Daily change %: 0.43%

Today Daily Open: 145.57

Trends:

Daily SMA20: 145.34

Daily SMA50: 142.83

Daily SMA100: 143.43

Daily SMA200: 144.66

Levels:

Previous Daily High: 147.81

Previous Daily Low: 144.58

Previous Weekly High: 148.47

Previous Weekly Low: 144.31

Previous Monthly High: 148.28

Previous Monthly Low: 141.01

Daily Fibonacci 38.2%: 145.81

Daily Fibonacci 61.8%: 146.57

Daily Pivot Point S1: 144.16

Daily Pivot Point S2: 142.76

Daily Pivot Point S3: 140.94

Daily Pivot Point R1: 147.39

Daily Pivot Point R2: 149.21

Daily Pivot Point R3: 150.62