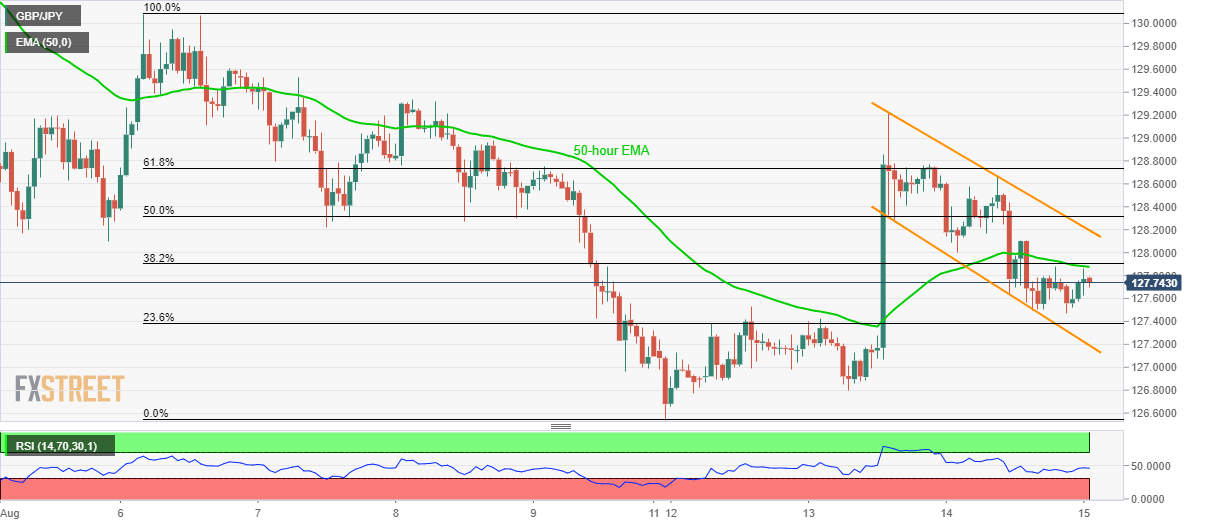

- GBP/JPY lags behind 38.2% Fibonacci retracement, 50-hour EMA.

- Two-day old descending trend-channel portrays the pair’s weakness.

Even after recovering recently, the GBP/JPY pair still trades below near-term key resistance confluence as it takes the rounds to 127.72 on early Thursday.

The 38.2% Fibonacci retracement of early-month declines and 50-hour exponential moving average (EMA) confluence, at 127.88/90, limits the pair’s immediate upside, a break of which can trigger its rise to short-term descending trend-channel resistance, at 128.20 now.

If at all the quote rallies beyond 128.20, its run-up to 61.8% Fibonacci retracement level near 128.75 and then the following increase to 129.00 can’t be denied.

On the downside, 23.6% Fibonacci retracement level of 127.38 and channel’s support-line at 127.20 can keep the pair’s weakness confined ahead of dragging it to 126.80 and a recent low around 126.50.

GBP/JPY hourly chart

Trend: Bearish