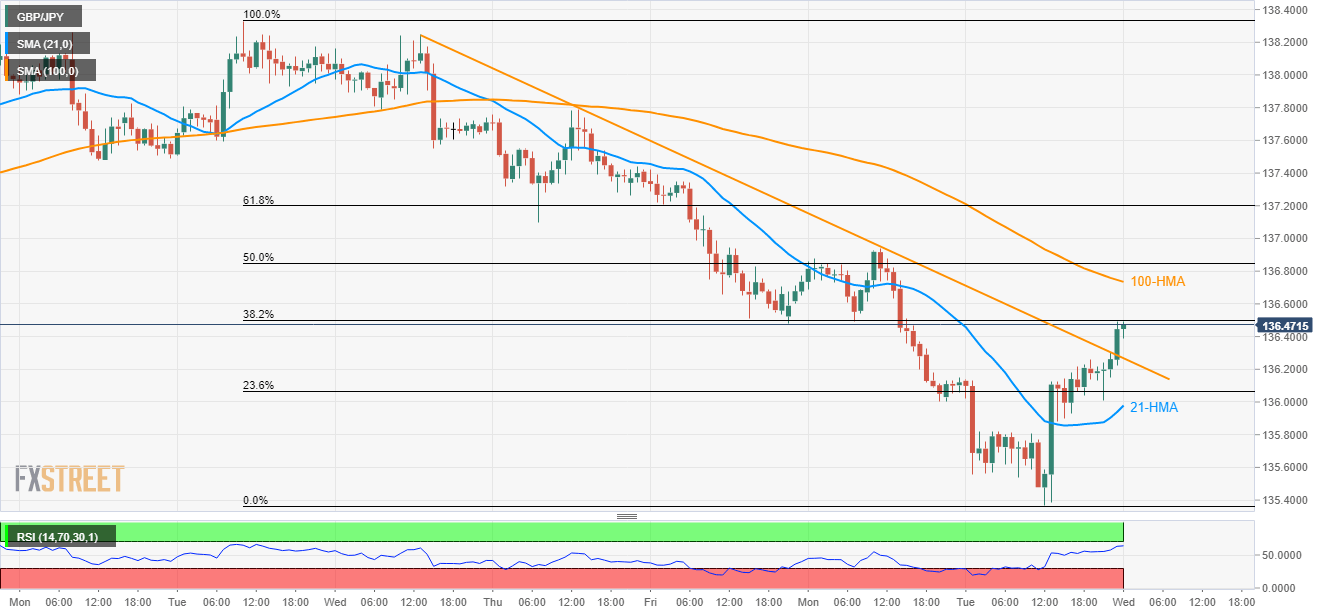

- 38.2% Fibo. holds the gate to pair’s rally towards 100-HMA.

- Overbought RSI questions recent trend-line breakout.

Even after breaking a week-long descending trend-line, 38.2% Fibonacci retracement limits the GBP/JPY pair’s immediate upside as it takes the rounds to 136.42 during early Wednesday.

A sustained break of 136.50 nearby resistance can escalate latest trend-line breakout in the direction to 100-hour moving average (100-HMA) level of 136.74 whereas 137.00 and 61.8% Fibonacci retracement level of 137.20 can question buyers then after.

In a case where prices manage to remain strong beyond 137.20, June 13 high around 137.80 and the previous week’s top near 138.33 could lure the bulls.

14-bar relative strength index (RSI) is into the overbought region indicating brighter chances of a pullback.

Alternatively, 136.15 and 21-HMA level of 136.00 seems nearby supports to watch ahead of aiming for 135.80 if holding a short position.

Additionally, 135.37 and 135.00 might flash on the bear’s radar during extended downpour below 135.80.

GBP/JPY hourly chart

Trend: Pullback expected