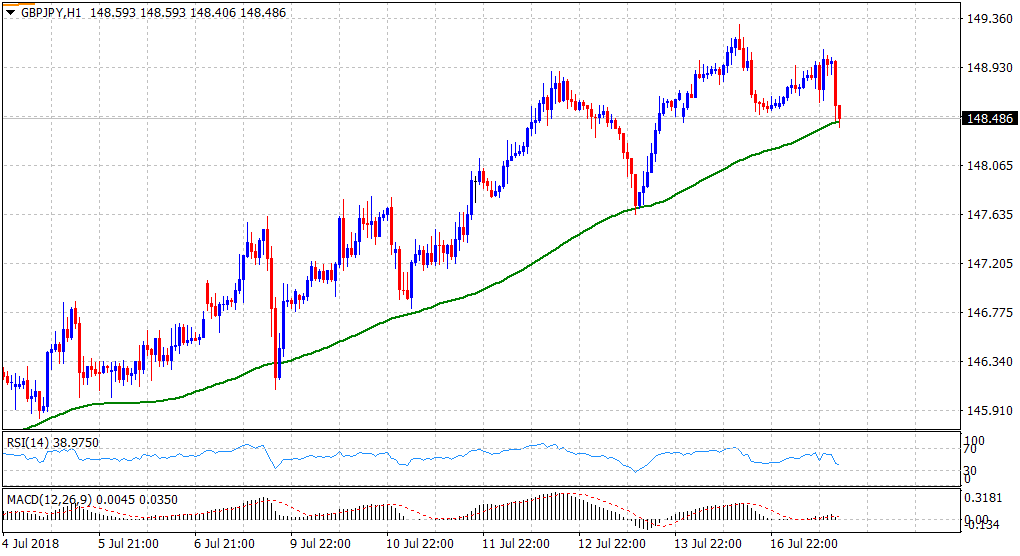

“¢ News of the UK PM Theresa May’s defeat over a new customs deal prompted some aggressive GBP selling over the past couple of hours.

“¢ The cross reverses UK jobs data-led uptick back closer to near two-month tops and has now dropped to test the very important 100-hour SMA support.

“¢ The mentioned support has been held since the beginning of this month and a follow-through selling might now mark the end of recent up-move witnessed over the past three-week.

“¢ On the 1-hourly chart, technical indicators have also started losing positive momentum and thus, add credence to a possible near-term bearish outlook.

GBP/JPY 1-hourly chart

Spot rate: 148.49

Daily High: 149.09

Trend: Turning bearish

Resistance levels

R1: 149.09 (current day swing high)

R2: 149.56 (200-day SMA)

R3: 150.07 (R3 daily pivot-point)

Support levels

S1: 148.24 (S1 daily pivot-point)

S2: 148.00 (round figure mark)

S3: 147.65 (200-period SMA H1)