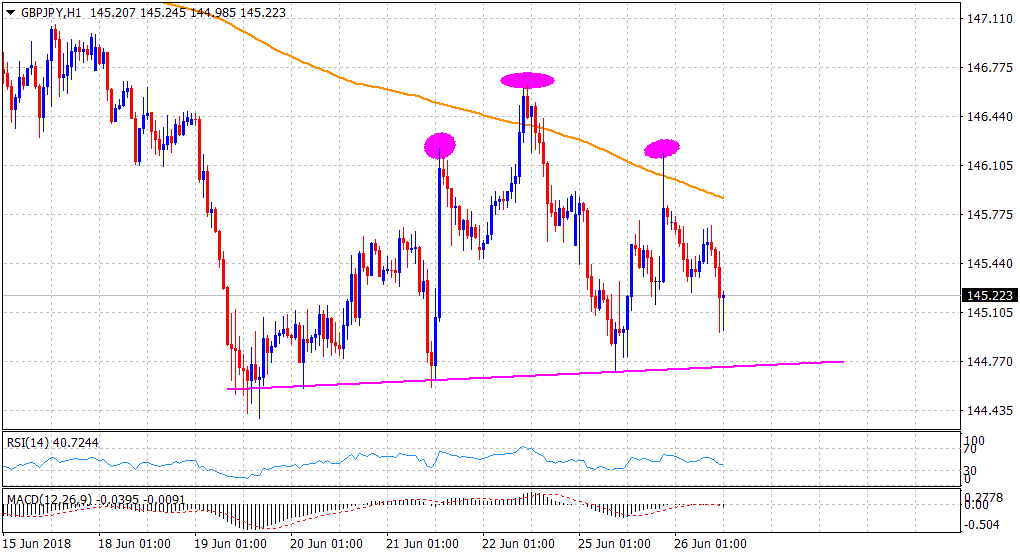

“¢ The cross seems to be forming a bearish Head & Shoulders chart pattern on the 1-hourly chart, with neckline support near the 144.75 region.

“¢ The fact that any up-move beyond 200-hour SMA is being sold into adds credence to increasing selling interest at higher levels.

“¢ Short-term technical indicators have struggled to move back in positive territory and further reinforce the bearish chart pattern formation.

“¢ A sustained move beyond mid-146.00s would now be needed to negate prospects for any further near-term downside.

Current Price: 145.22

Daily High: 145.80

Daily Low: 144.97

Trend: Turning Bearish

Resistance

R1: 145.55 (daily pivot-point)

R2: 145.89 (200-period SMA H1)

R3: 146.19 (overnight swing high)

Support

S1: 144.97 (current day swing low)

S2: 144.75 (bearish H&S neckline)

S3: 144.06 (S2 daily pivot-point)