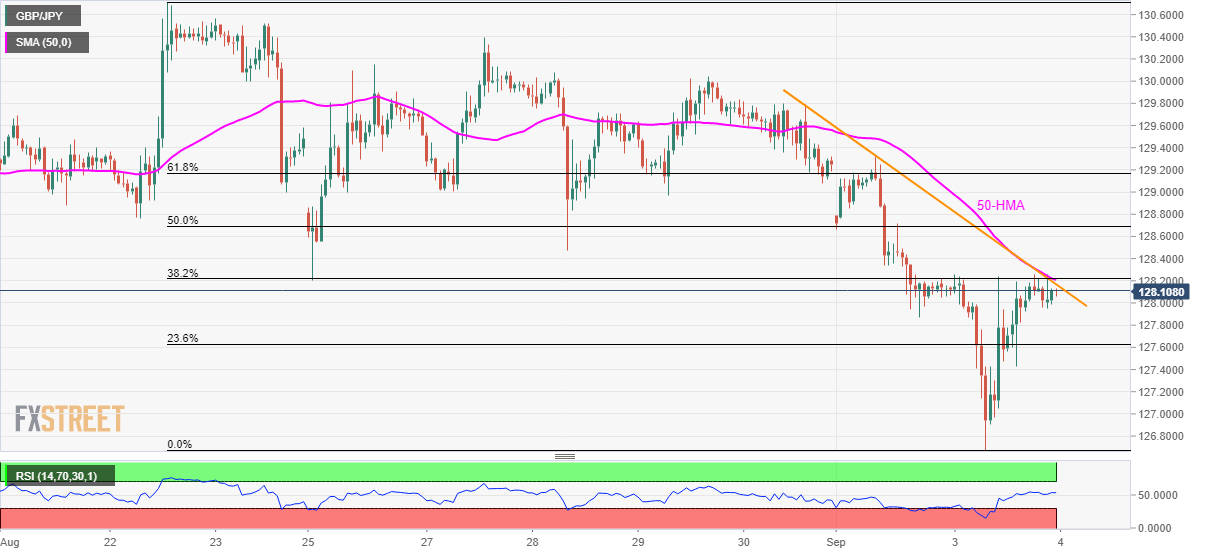

- GBP/JPY remains below 50-HMA, 38.2% Fibonacci retracement level and three-day-old falling trend-line.

- Buyers await a clear break above 128.22 to aim for 128.70, 129.00 and 61.8% Fibonacci retracement level.

Even if the British Parliament raised the hurdle for the no-deal Brexit, GBP/JPY fails to clear the key short-term resistance as trades near 128.10 amid initial Asian session on Wednesday.

Not only 50-hour moving average (HMA) and a three-day-old falling trend-line but 38.2% Fibonacci retracement of August 22 to September 03 downpour also limit pair’s immediate upside around 128.20/22.

However, gradually recovering 14-bar relative strength index (RSI) favors the pair’s upside to 50% Fibonacci retracement level of 128.70 on the clear break of 128.22.

During the pair’s run-up beyond 128.70, 129.00 and 61.8% Fibonacci retracement near 129.17 could please buyers ahead of pushing them to late-August tops surrounding 129.85.

Alternatively, 23.6% Fibonacci retracement level of 127.63 and recent low near 126.68 can offer immediate support to the pair during its declines whereas August 12 low near 126.54 and 126.00 round-figure can please the bears afterward.

GBP/JPY hourly chart

Trend: bearish