- GBP/USD bulls take on higher highs towards critical monthly resistance.

- A break of monthly resistance opens prospects of a rally to the 1.38 levels through low volume nodes.

In a follow-up to the prior session’s analysis, GBP/USD Price Analysis: 2 bearish scenarios, 1 bullish, the pound has note played out according to either of the bearish scenarios.

Instead, the price has extended deeper into the supply zone with on-going Brexit and US stimulus noise.

The prospects of a bearish weekly close are now slimmer as we draw towards the final sessions of the week.

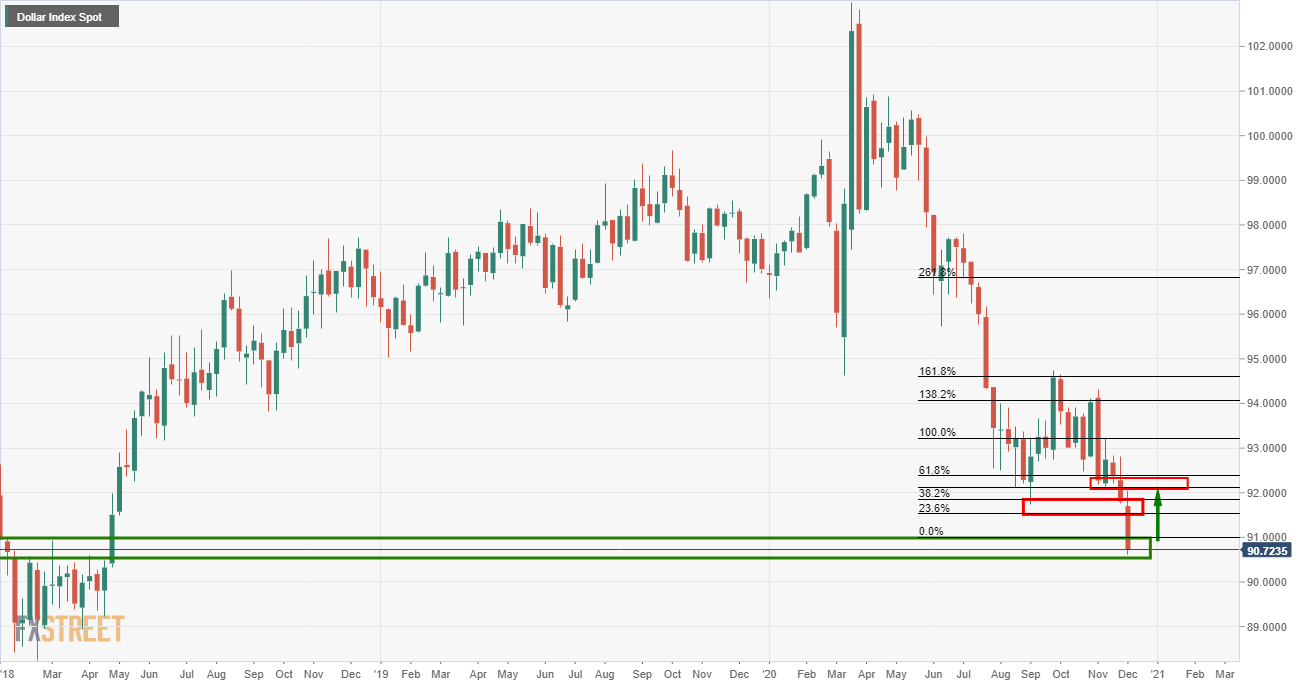

However, the prospects remain technically bearish for cable and bullish for the greenback, according to the DXY.

The DXY is printing fresh lows but it is now testing the weekly support area where a bullish correction would now be expected.

Still, if cable can get above 1.3514, the monthly resistance, then there are low volume nodes all the way to 1.3820.

Meanwhile, bears will be waiting patiently for a bearish structure to form below 1.3514 before setting up for a short.

Monthly chart

Daily chart

If the US dollar manages a rebound, then bears will be looking for cable to form bearish structure.

4-hour chart

From a 1-hour perspective, a bearish opportunity could already be in the making:

A correction to the 38.2% Fibonacci could encourage sellers.

-637425390049072850.png)

-637426285683417321.png)

-637426288489898120.png)

-637426289372310277.png)