- GBP/USD pullback from the seven-day high.

- US dollar consolidates losses after the heavy drop.

- Fed’s Kaplan tried to placate traders, coronavirus cases in the US, the UK continues to rise.

- Brexit talks closed, for now, on a positive note, negotiators will next meet in London on March 18.

GBP/USD buyers catch a breath after consecutive three-day gain as the pair takes rounds to 1.2950, down 0.08%, during Friday’s early Asian session. While the end of Brexit talks and broad US dollar weakness, mainly due to coronavirus (COVID-19) outbreak, recently contributed to the pair’s run-up, prices are likely retracing amid a lack of major catalysts.

Also trying to exert downside pressure on the quote seems the Dallas Fed President Robert Kaplan’s comments that tried to placate traders. The Fed policymakers turned down the odds of another rate cut in the month while saying that the Fed’s rate cut is not about the current stock market. It is about mitigating tightening that may take place weeks from now. The US dollar index registered heavy downside, the most in the current year, during the previous day as calls hike for the Fed to cut rates again in March.

It should also be noted that the first death in the UK and increasing toll in the US, amid a lack of test kits, seem to weigh on the market’s risk-tone.

That said, S&P 500 Futures seem to await fresh clues to extend the latest risk-off as flashing 0.10% gains to 3,025.

Earlier during the day, the EU-UK Brexit negotiators end their first round of trade talks with both the ends terming it constructive. However, no conclusion has been derived off-late while fisheries and the EU jurisdiction continues to remain as the key hurdles.

Further, the Bank of England (BOE) Governor, Mark Carney, earlier reiterated the UK central bank’s readiness to act if needed. However, no clear signals for the much-anticipated rate cut have been received.

Given the lack of major UK data on the economic calendar, coupled with the end of Brexit talks, investors are more likely to concentrate on the coronavirus headlines ahead of the key US employment report for February.

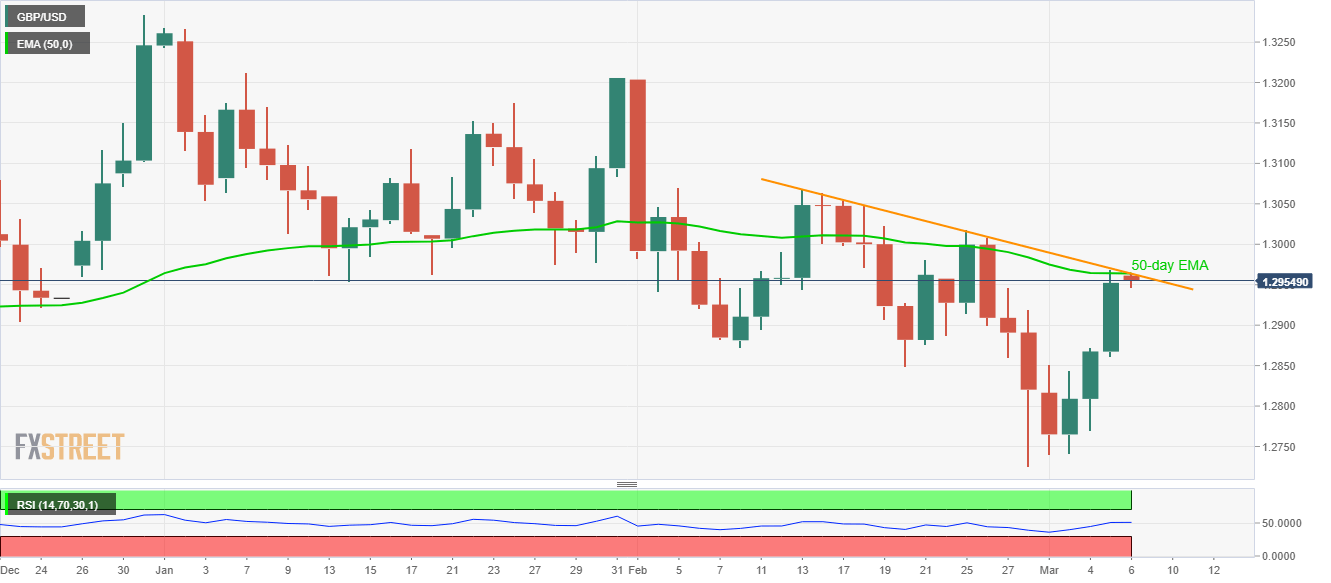

Technical Analysis

With a confluence of 50-day EMA and a downward sloping trend line limiting the pair’s immediate upside around 1.2965, sellers may again target 1.2900 and February 20, 2020 low near 1.2850 during further declines. On the upside, 1.3000 and the previous month top surrounding 1.3070 acts as additional resistances to challenge the buyers.