- GBP/USD remains nervous on the day after overnight fall towards 1.3726 lows.

- Fed members are keen to curtail the asset purchase program soon.

- UK economy is struggling amid supply chain disruption and Brexit woes.

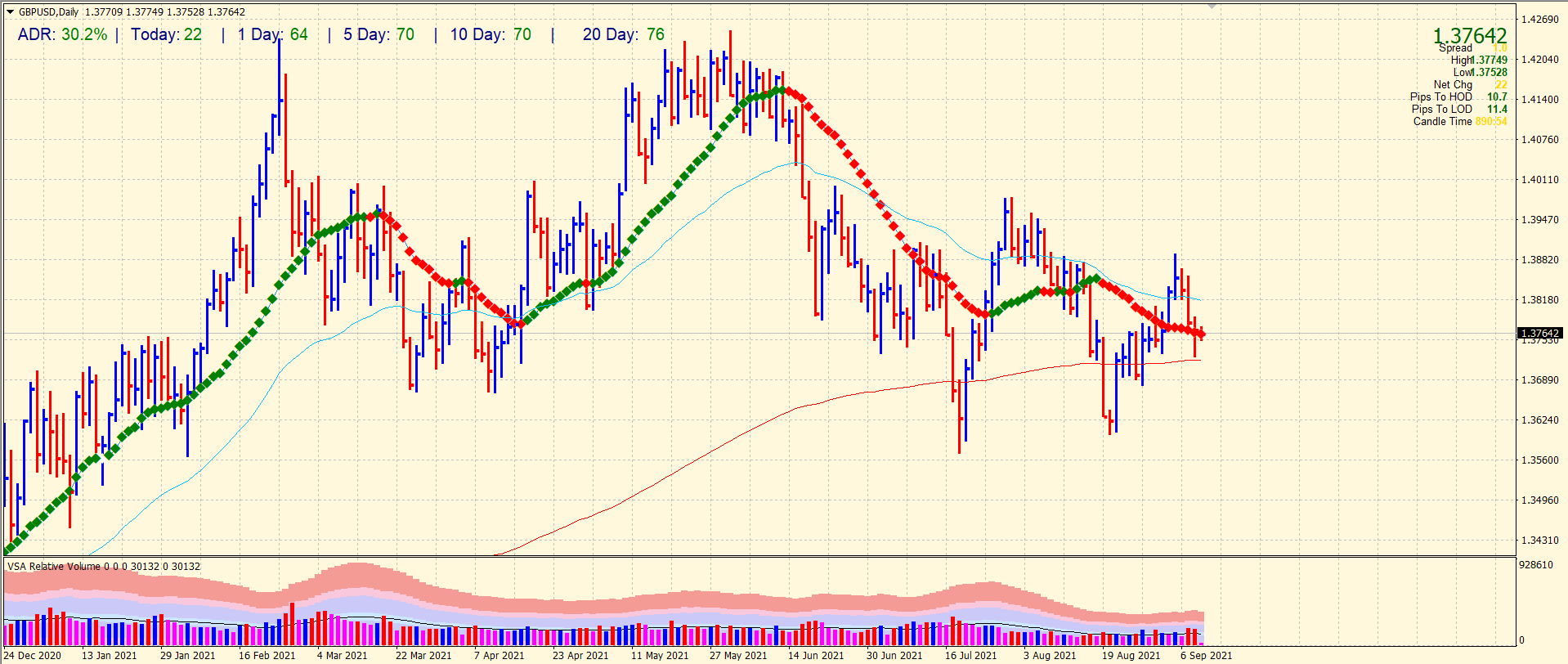

The GBP/USD price analysis is bearish to neutral as long as the price remains under the 1.3800 level. Fed tapering and poor UK economy may keep bears alive.

The GBP/USD pair is nervous ahead of Thursday’s London session due to pressure around the US dollar. The GBP/USD pair fell as low as 1.3726 during the overnight session but recovered to 1.3780.

-Are you looking for automated trading? Check our detailed guide-

At the time of writing, the GBP/USD is trading at 1.3764, down 0.05% on the day.

With a gain of 0.06% to 92.70, the US Dollar Index (DXY), which tracks the dollar against its six major peers, continues to show its strength.

Robert Kaplan, the Dallas Federal Reserve Bank president, said he wants to cut asset purchases as soon as possible because of the COVID-19 resurgence’s negative impact on travel, hospitality, and leisure. However, in spite of slowing employment growth, James Bullard, the president of the Fed in St. Louis, said the Fed should maintain its plan of tapering its asset purchase program.

Despite the stabilization of the pound, the UK economy is hampered by supply chain disruptions and staff shortages, according to Governor Andrew Bailey of the Bank of England (BOE).

Michael Saunders, one of nine members of the MPC, said Wednesday that the Bank of England might have to raise rates next year if inflation remains high.

Due to Brexit-related costs, Irish commercial buildings are also feeling the pinch.

For now, investors are watching initial unemployment claims to spur new trade.

-If you are interested in forex day trading then have a read of our guide to getting started-

GBP/USD price technical analysis: More losses to follow

The GBP/USD price finds respite near the 200-period SMA on the 4-hour chart. Although the price is below the 50-period SMA and the previous 4-hour bar came up with very high volume closing near the lows, next was down the bar, closing near the highs with very high volume. It indicates that the technical bias is mixed as the bulls and bears are holding equal strength. The bears may target 1.3700 ahead of 1.3660.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.