- GBP/USD found some support near 200-DMA and stalled its recent bearish trajectory.

- BoE’s Bailey clarified that the BoE statement did not imply the use of negative rates.

- The USD struggled to preserve its early gains ahead of the Fed Chair Powell’s testimony.

The GBP/USD pair prolonged its recent rejection slide from the key 1.3000 psychological mark and dropped to near two-month lows during the early European session on Tuesday. The downfall was sponsored by fresh coronavirus jitters and rising odds of fresh lockdown measures to curb the second round of the outbreak. This, in turn, continued weighing on investors’ sentiment and benefitted the US dollar’s relative safe-haven status. The British pound lost some additional ground after the UK Cabinet Minister Michael Gove said that new restrictions will be imposed in the UK and Prime Minister Boris Johnson will spell out further details later this Tuesday.

The pair dropped to the lowest level since July 24th, albeit managed to rebound swiftly in reaction to the BoE Governor Andrew Bailey’s comments, saying that the UK economic recovery has been quite rapid and substantial. Speaking at a webinar hosted by the British Chamber of Commerce, Bailey further clarified that last week’s BoE statement did not imply that the central bank would use negative rates. This turned out to be the only factor extended some support to the British pound, instead prompted some intraday short-covering move from the very important 200-day SMA and led to the pair’s strong recovery of around 120 pips.

Meanwhile, the USD struggled to preserve its gains amid expectations that the Fed Chair Jerome Powell will reiterate to keep interest rates lower for longer during his congressional testimony later this Tuesday. Hence, the goodish recovery move could further be attributed to some repositioning trade ahead of the key event risk. In the meantime, the US economic docket – featuring the releases of Existing Home Sales and Richmond Manufacturing Index – will be looked upon for some trading impetus.

Short-term technical outlook

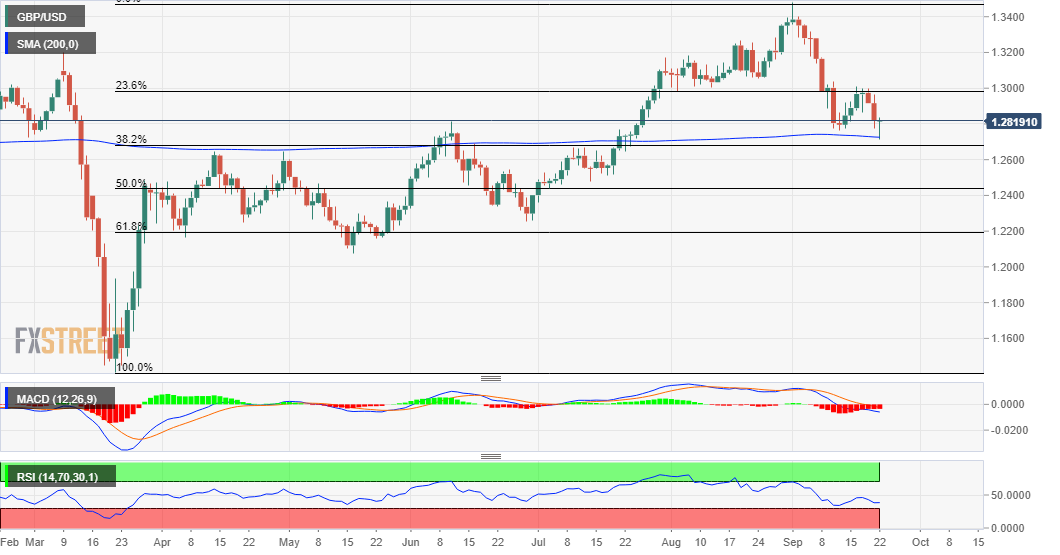

From a technical perspective, the intraday bounce from a technically significant moving average warrants some caution for bearish traders. The mentioned support is closely followed by the 38.2% Fibonacci level of the 1.1412-1.3482 positive move, which if broken will be seen as a fresh trigger for bearish traders. The pair might then turn vulnerable to break below the 1.2600 mark and accelerate the slide towards the 1.2570-60 congestion zone. The downward trajectory could eventually drag the pair back towards the key 1.2500 psychological mark en-route 50% Fibo. level, around the 1.2440-30 region.

On the flip side, any subsequent move up might still be seen as a selling opportunity and remain capped near the 1.2900 mark. That said, some follow-through buying will prompt a short-covering move and push the pair back towards the 1.3000 round-figure mark. The latter marks the 23.6% Fibo. level and should now act as a key pivotal point for the pair’s next leg of a directional move.