- GBP/USD continues to gain but stalls at 1.3800.

- The pair seeks to benefit from Powell’s speech and dollar weakness.

- The rise of COVID cases in the UK may weigh on the Sterling.

The GBP/USD price analysis gained traction as the US dollar continues to lost ground. However, the early NY session may see some retracement.

The GBP/USD pair is trading at 1.3778, up 0.21%, at the press time.

–Are you interested to learn more about ECN brokers? Check our detailed guide-

As the European session began, the GBP/USD pair rose to a two-week high. Bulls are currently consolidating under 1.3800.

In spite of a brief pause on Monday, the GBP/USD pair received fresh bids on Tuesday, and it continued its recent strong return from the 1.3600 area or the monthly lows. However, it is still under pressure from comments made by Fed Chairman Jerome Powell on Friday that drove the upward trend solely.

During the Jackson Hole Symposium, Powell assured investors that the Federal Reserve was not ready to raise rates. Despite Powell’s promise, there was no specific deadline for the end of pandemic-era incentives. Market participants viewed his remarks as cautious.

Bond yields on US Treasury securities continued to decline during this period. On Tuesday, the yield on the 10-year Treasury fell to 1.27% during the first half of trading. As a result, the US dollar’s safe-haven status was further undermined, and the GBP/USD pair thrived.

With the recent surge in COVID-19 cases in the UK, it remains to be seen whether sellers can benefit from this move. Official figures released on Monday indicate that 26,476 people in the UK have tested positive for COVID-19. For the time being, this could be a headwind for the pound sterling and limit the pair’s further rise.

In the absence of any major economic data on Tuesday, the GBP/USD pair will be at the mercy of the price movement of the dollar. However, traders can see the US business quote later, as trade begins in North America and the Chicago PMI and Conference Board Consumer Confidence Index are released.

–Are you interested to learn more about making money in forex? Check our detailed guide-

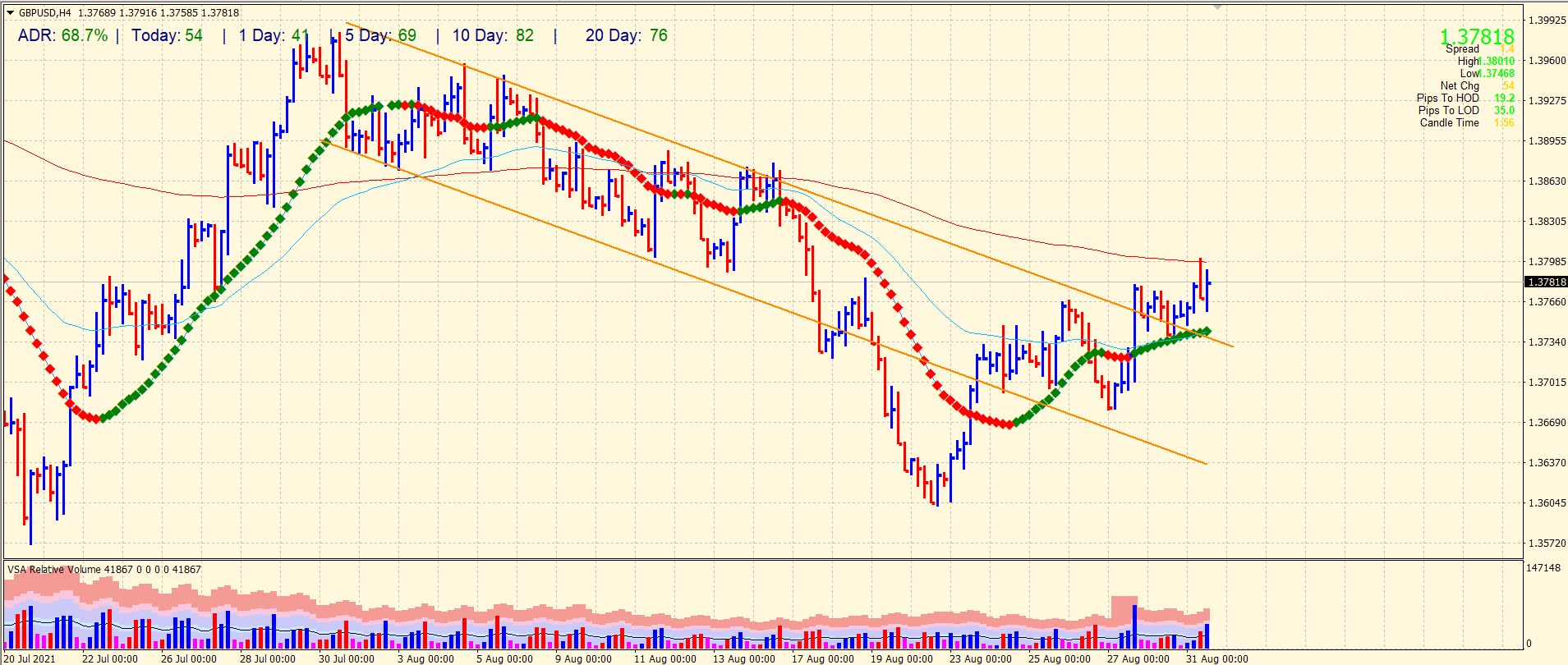

GBP/USD price technical analysis: 200-SMA rejects the bulls

The GBP/USD price found rejection at 200-period SMA on the 4-hour chart. The level coincides with the psychological resistance of 1.3800. The pair has so far done a 68% average daily range. The price slowly retreating and may test the congestion of 20-period and 50-period SMAs near 1.3750. The volume of the current bar is too high but the price is going to close near the mid-range of the bar. It indicates weakness in bulls but no clear signal of bearish reversal.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.