- GBP/USD remains in a narrow range near the lows.

- Upbear UK employment data could not entice buyers.

- UK CPI missed expectations, but the pair remains unchanged.

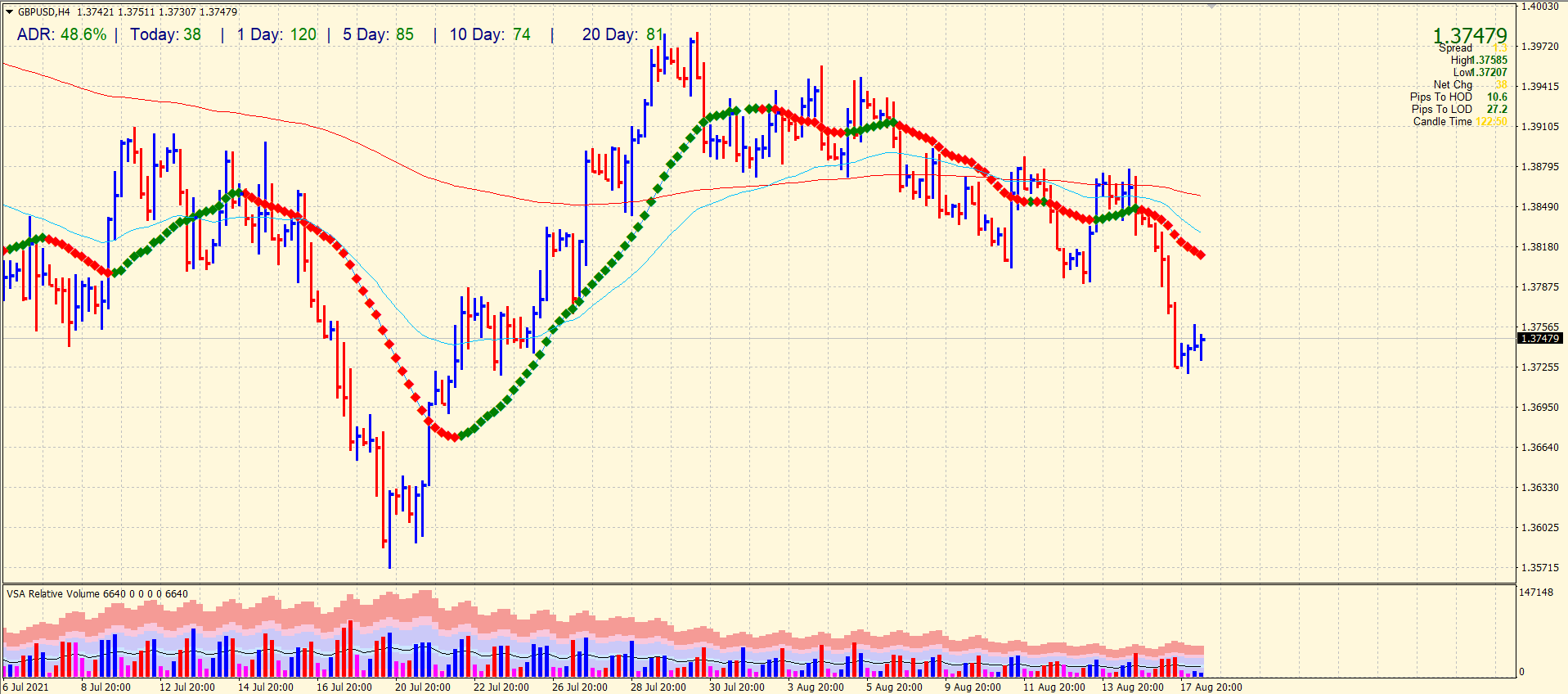

The GBP/USD analysis suggests a bearish picture as the price is far below the key level of 1.3800 and fundamentals support no gains at the moment.

Following its biggest fall since June, the GBP/USD exchange rate is hovering around 1.3740 in a sluggish opening Asian session on Wednesday. Though there isn’t any new catalyst for the pair and buyers are cautious before major dates/events, the UK’s risk-averse sentiment and grim catalysts give sellers hope.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

Despite positive UK employment figures, the US dollar declined against major currencies the previous day, causing the GBP/USD to depreciate. ON TUESDAY, the US Dollar Index (DXY) gained 0.56%, finishing the North American session at around 93.15 after a two-day uptrend.

According to official figures, the overall unemployment rate in the UK fell below the expected 4.8% and to 4.7% in the three months to June, but the change in the number of applicants fell below -114.8k. It had been -7.8k previously. In addition, it is noteworthy that the median income improved during the three months preceding June.

Apart from the Delta variant, dismal US retail sales and fears of a Fed cut drove DXY prices on Tuesday. At the same time, the dollar ignored the somewhat weaker yield on US government bonds.

Based on the UK Office of National Statistics (ONS), the consumer price index (CPI) rose by 2.0% year-on-year in July. It rose from 2.5 percent in June.

Furthermore, core inflation (excluding volatile food and energy prices) fell to 1.8% y/y from + 2.3% in June, not in line with expectations of + 2.2%. Compared to expectations of + 0.3% and + 0.5%, consumer prices in the UK reached 0% in July.

–Are you interested to learn more about forex signals? Check our detailed guide-

GBP/USD technical analysis: Bearish under 1.3800

The 4-hour chart shows a very narrow price range at the moment. The pair remains near the support area but seems directionless. The volume is very low for the last few bars. The key SMAs on the chart are pointing downwards. However, the pair can correct to test the 20-period SMA followed by the 1.3800 level. But staying below the 1.3800 mark will keep the pair bearish. The bears may target 1.3700 ahead of 1.3660.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.