- GBP/USD continues to slide amid broader Dollar strength.

- Brexit concerns and political headlines are weighing on the Pound.

- Further CPI data and US infrastructure bills can trigger volatility.

The GBP/USD analysis suggests bearish bias to continue. Amidst renewed Brexit fears and the continued strength of the US dollar, the selling pressure around GBP/USD remains unchanged.

The dollar levels continue to rise alongside Treasury yields as the Fed expects a quicker tightening following strong data on Friday.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

According to the Fed, the US economy is approaching the “significant progress” mark and suggests that monetary policy will be normalized sooner than previously thought. Thus, in addition to restrictive rates, Fed officials Rosengren and Bostic are also betting on early cuts.

The migration crisis has brought back concerns about Brexit across the Atlantic. Former Brexit leader Nigel Farage criticized France and the EU for allowing dangerous migration to proceed between the two channels without lifting a finger.

Moreover, UK political concerns about Boris Johnson’s desire to demote Rishi Sunak from the Treasury Secretary position contribute to the Pound’s weakness.

In the midst of a data-scarcity calendar, US dollar price movements and Brexit updates will continue to affect the pair. During this week, we will continue to focus on preliminary UK and US second-quarter CPI data.

The market is expecting some volatility around the US Senate’s infrastructure bill today at 1500 GMT. According to Senator Schummer, the agreement to final passage has already been reached. The even further strengthen the Greenback, resulting in the fall of the British Pound.

–Are you interested to learn more about forex signals? Check our detailed guide-

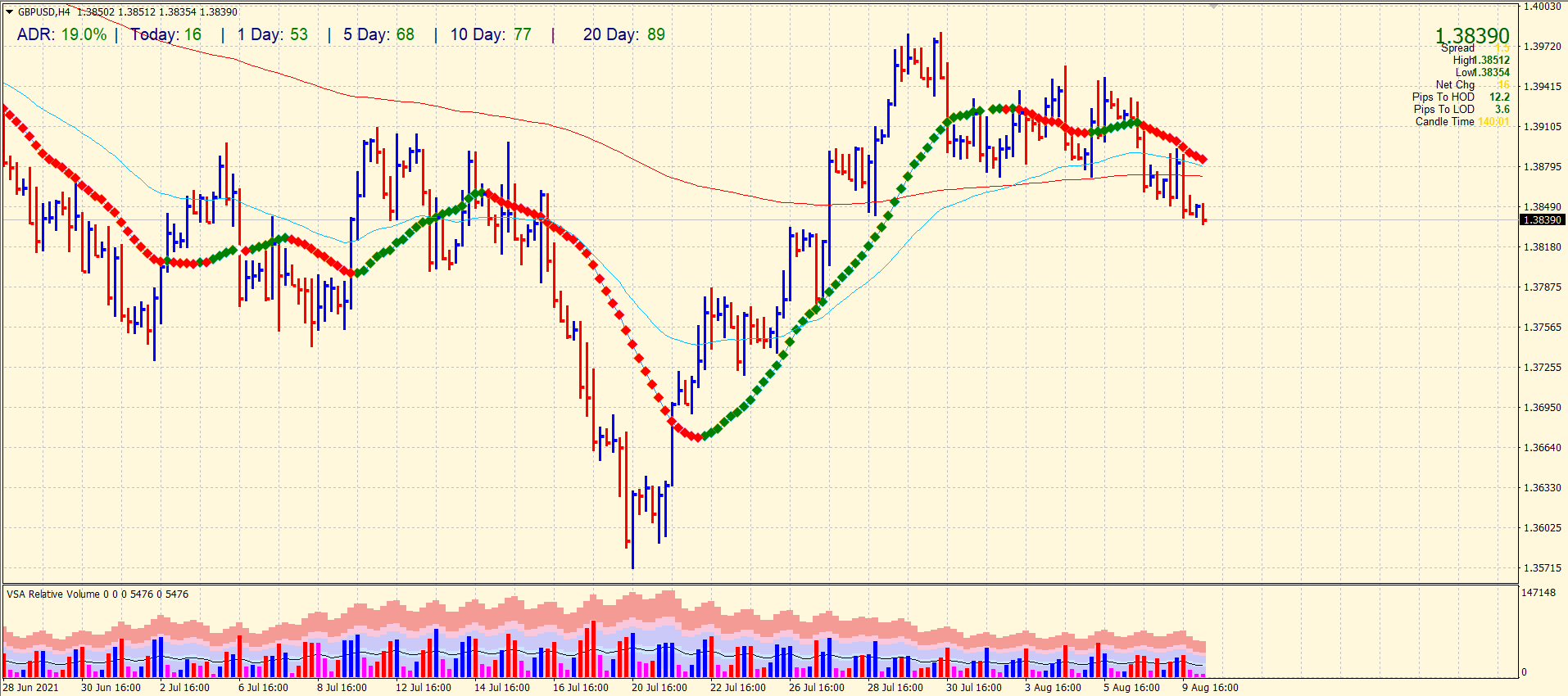

GBP/USD technical analysis: Bulls seen nowhere

Yesterday, the price attempted to take refuge from the 200-period SMA on the 4-hour chart and tried to gain the 20-period SMA as well. However, the broader Dollar strength could not allow it. As a result, the pair has plunged below the mid-1.3800 level. The next key support for the pair is at 1.3800, followed by 1.3770 and then 1.3740. On the upside, 1.3880 continues to act as a strong resistance. The death crossover of 200 and 50 SMAs is under development that can further send the prices lower.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.