- After a minimal spike the day before, the UK saw 32,181 new COVID-19 cases every day and 50 virus-related deaths

- Another former leader of the Democratic Unionist Party (DUP), Arlene Foster, expressed fear about the consequences of a deadlock in the Northern Ireland Protocol (NI).

- The low PMI in China for comparison to Australia’s strong recovery enhances the US dollar’s status as a safe-haven asset.

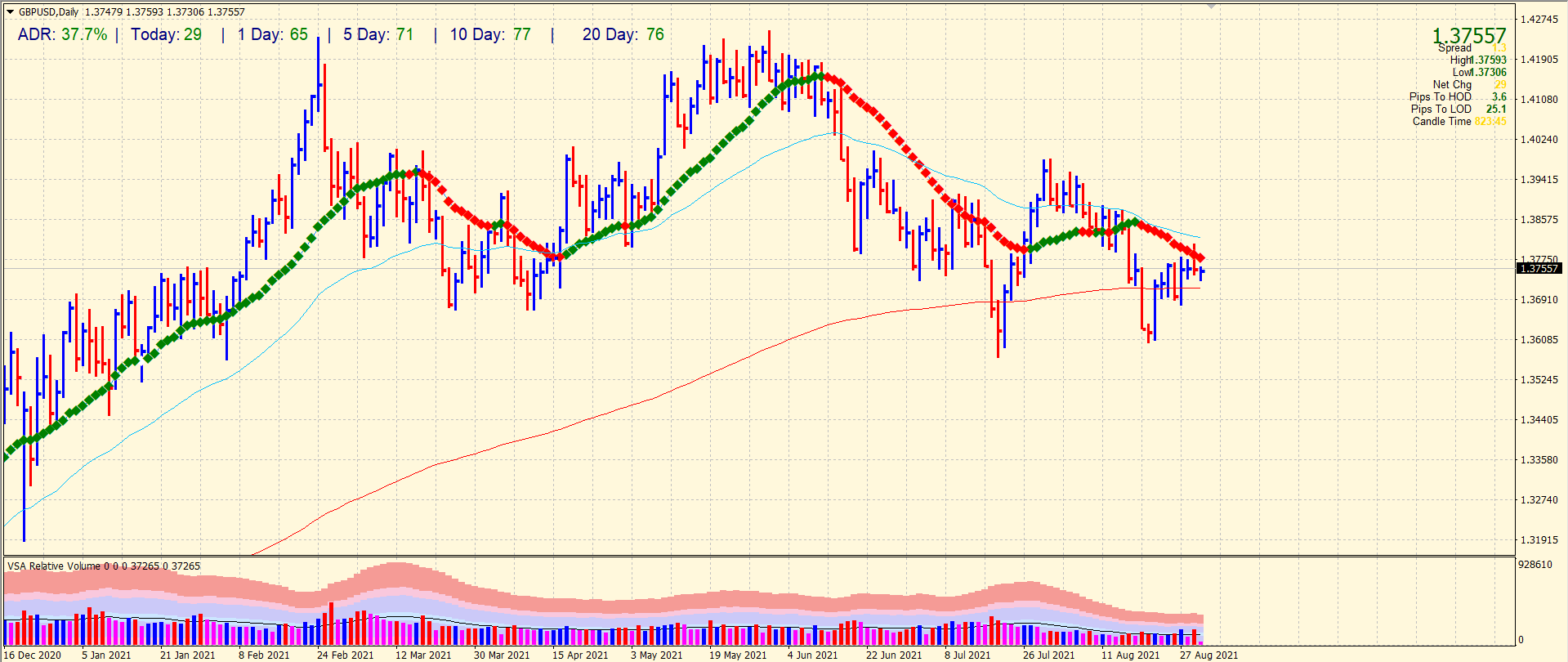

The GBP/USD analysis looks bearish as the Brexit and COVID worries may weigh on the pair. The US dollar is slowly recovering.

The GBP/USD pair is trading at 1.3753, up 0%, at the time of writing on Wednesday.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

The GBP/USD exchange rate fell 0.13% to 1.3735 for the third straight day ahead of Wednesday’s London opening. The cable pair is now the biggest loser within the group of ten currencies (G10).

In addition to the broad rally in the US dollar, pessimism about the Coronavirus situation in the UK and Brexit headlines are weighing on the listing. In contrast, the US Dollar Index (DXY) continued its recovery from its lowest level since Aug. 4, posting an intraday gain of 0.08%, around 92.72.

After a minimal spike the day before, the UK saw 32,181 new COVID-19 cases every day and 50 virus-related deaths. Furthermore, the UK is preparing a final decision on revaccination in light of fears the vaccine’s main effectiveness will decrease in five to six months, according to the UK ZOE COVID study.

According to Sky News, Scotland’s National Clinical Director, Jason Leitch, “Britain may soon face a volatile situation in how it handles the coronavirus crisis,” he said.

As the country struggles with delivery problems, the managing director of retail giant Next criticized the British government’s decision to ban foreign truck drivers. Another former leader of the Democratic Unionist Party (DUP), Arlene Foster, expressed fear about the consequences of a deadlock in the Northern Ireland Protocol (NI).

As evidenced by the market’s cautious optimism ahead of key UK and US data releases, risk appetite is improving. Furthermore, the low PMI in China for comparison to Australia’s strong recovery enhances the US dollar’s status as a safe-haven asset.

Meanwhile, despite these games, the 10-year US Treasury yield extended the prior day’s uptrend to 1.33%, or three basis points, by the time of publication.

The second reading of the UK Manufacturing PMI, which is expected to confirm the original estimate of 60.1, is the closest indicator to changes in ADP employment and ISM manufacturing PMI for August.

The GBP/USD pair may continue to decline as a result of weaker US data supporting dollar bulls.

–Are you interested to learn more about forex signals? Check our detailed guide-

GBP/USD price technical analysis: Weakness to prevail below 200-DMA

Until the 200-DMA moves above the monthly moving average, GBP/USD sellers will be forced to pick up the August monthly low of 1.3600 before breaking above the weekly support line of 1.3720. Short-term resistance for the sterling pair lies around 1.3765, ahead of the 200-day moving average at 1.3810.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.