- GBP/USD struggled as Parliament rejected all options.

- Additional Brexit frenzy in the House and some data will impact the cable.

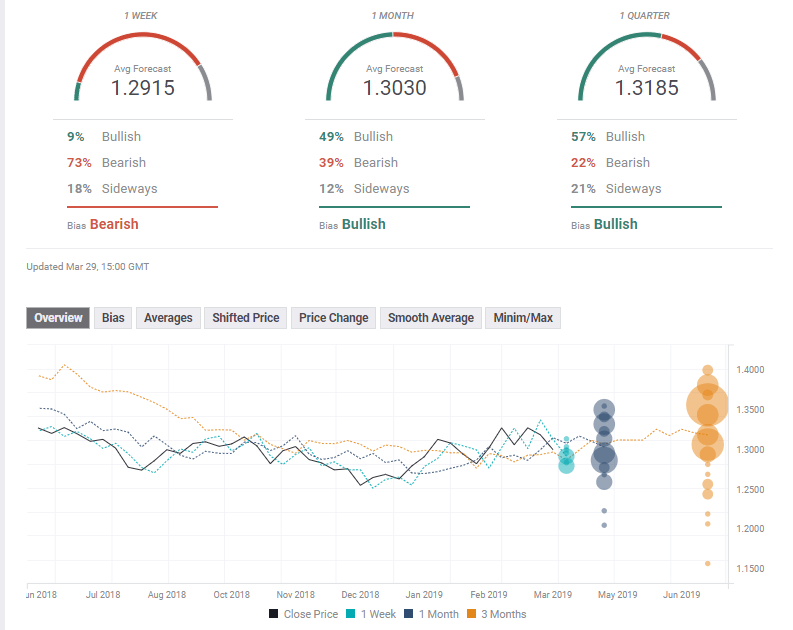

- The technical picture is not bullish anymore. Experts see a short term fall and higher levels afterward.

This was the week: No to everything

Parliament is yet to say what path it wants with Brexit. Parliament voted in favor of “taking control” and held non-binding, indicative votes. However, MPs rejected all eight options ranging from a no-deal Brexit to no Brexit at all. A softer version of Brexit, with closer economic ties to the EU, was the closest to winning, while the option that got the most support was for a second referendum. Many MPs abstained.

Parliament is not inclined to rally around PM Theresa May’s agreement either. The embattled PM announced she would resign after the Brexit deal passes, allowing another leader to negotiate the future relations with the EU. Her move convinced some MPs to rally around the deal, but quite a few hardliners Tthe Nothern Irish DUP Party has not changed its mind either.

The government eventually brought the Withdrawal Agreement to a vote on Friday only to see it defeated by a margin of 58. PM May said that the House is nearing the end of the process, hinting at elections, but other options are open as well.

The European Council immediately announced a special emergency summit on April 10th, two days before the updated Brexit Day.

The pound occasionally advanced as the PM got more support and as Parliament seemed to show a softer path of Brexit. However, Sterling dropped as no breakthrough was eventually reached, and the clock keeps on ticking.

UK Q4 2018 GDP was confirmed at 0.2% QoQ but was upgraded to 1.4% YoY. Sterling edged up for a while before turning down on Brexit concerns.

GBP/USD also dropped due to the downturn in stock markets and the accompanying fall in bond yields. The yield curve inversion in the US causes fears of a recession. Also, US data was mostly disappointing, with a downgrade of Q4 2018 GDP to 2.2% and the slide in the CB Consumer Confidence back to January’s levels. Despite weak data, the greenback attracted demand on safe-haven flows. The lack of progress in US-Chinese trade talks did not improve the mood.

All in all, it was a lousy week for cable, mostly due to Brexit, but also on USD strength.

What’s next with Brexit?

If nothing changes, the UK leaves the EU on April 12th, but many things can happen in the interim. The only certainties are that Parliament will hold a second round of Indicative Votes (IV2) on Monday. Supporters of a soft Brexit and Remainers will try to find a formula they can vote in favor of. They may fail in the second attempt on Monday but may go for a third attempt on Wednesday.

If the government is forced to change tack on Brexit due to the Indicative Votes, the UK will likely seek a long delay and that would be pound-positive.

There are also reports that the government could try to bring the Brexit accord to a fourth Meaningful Vote on Thursday or Friday. House Speaker John Bercow may not allow a vote after he ruled out a repeat vote on the exact same motion. In addition, the EU will still need to approve an extension. The May 22nd option was only valid if Parliament had passed the accord by March 29th. And finally, it is unclear if the government can make it across the line.

Approval of the deal will be positive for Sterling, as it would remove uncertainty.

The best option for GBP would be a general election. Going to the people would automatically imply a long Brexit extension. Despite the uncertainty, markets hate Brexit more than the unknown.

At the moment, uncertainty is extremely high and this weighs on the pound. The only certainty is that volatility will remain high.

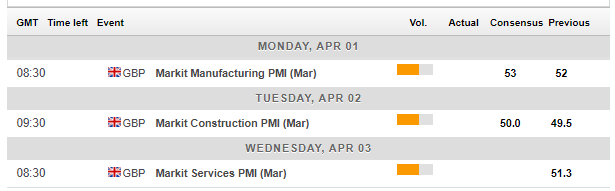

Other UK events: PMI data

British economic indicators have a limited and short-lived impact on the pound but are indeed worth noting. The calendar remains light, but Markit’s forward-looking Purchasing Managers’ Indices for March will provide a snapshot of what businesses see for the future.

The Manufacturing PMI kicks off the week and will likely continue projecting slow growth, with a score above 50 points. A slide below this level will serve as the first warning shot.

Tuesday sees the Construction PMI which was already below this level in February, with 49.5 points. A bounce above 50 would be encouraging.

The last figure for the services sector is the most important one. The Services PMI stood at 51.3 points in February, getting closer to 50. A drop below this level in the largest sector can already have a more significant impact on Sterling.

Here are the events lined up in the UK on the forex calendar:

US events: Extra-busy week

The US calendar is even busier than a regular start of the month due to the publication of delayed data due to the government shutdown. The long list culminates with the all-important Non-Farm Payrolls report.

Retail sales for February may rise at more moderate levels after a considerable bounce in January. Consumption is critical to the economy. Another event scheduled for Monday is the ISM Manufacturing PMI which disappointed in February with 54.2 points. An increase will raise hopes for a bounce in jobs later in the week. The figure is the first hint towards Friday’s NFP.

Durable Goods Orders are scheduled for Tuesday. After a much-needed increase in January’s non-defense ex-air figure, we may see a smaller increase in the upcoming report. Like retail sales, the data feed into Q1 GDP.

Two NFP hints are due on Wednesday. The ADP NFP measure proved too optimistic in February with a rise of 183K jobs, and we can expect a downward revision in addition to the private sector for March. The second figure to watch is the ISM Non-Manufacturing PMI that was quite upbeat in February with 59.7 points. It may turn down now alongside the global sentiment.

Investors will want to see a bounce in positions in Friday’s NFP data for March after a meager gain of only 20K beforehand. Wages may ease after jumping by 0.4% MoM and 3.4% YoY. The labor market has been a bright spot in the economy, and most economists believe that February’s number was only a one-off. That will come to the test now.

Here are the scheduled events in the US:

GBP/USD Technical Analysis – Neutral

It is important to remember that the nature of Brexit and the higher volatility mean that support and resistance lines may be shattered easily.

At the time of writing, GBP/USD is battling the 50-day Simple Moving Average which is at 1.3105, a level that served as both support in March and resistance in February. It is trading above the 200-day SMA which is around 1.2975.

Cable continues trading in the broad uptrend channel as depicted in the thick black lines but is leaning toward the lower part of it. Momentum is slight to the downside, and the Relative Strength Index is remarkably stable around 50.

All in all, it is mostly a mixed picture with a minor tendency to the downside.

1.3005 is a double bottom after providing support twice in March. 1.2960 worked as support in March and was a swing high in February. 1.2895 was a gap line in February, and 1.2830 worked as support in both February and January. 1.2775 was February’s low and 1.2700 held the pair up in the early days of the year.

1.3190 worked as both support and resistance in March. It is followed by 1.3220 that was a high point in January and by 1.3270 which was the recent swing high. 1.3350 was a peak in late February, and 1.3388 is the cycle high.

GBP/USD Sentiment

It may be darkest before dawn. If Brexit is extended due to an election or a second referendum, the pound can skyrocket. And if Brexit is delayed due to Parliament finally saying I do, it is also good news. The chances of a cliff-edge Brexit seem lower.

The FXStreet Poll shows a bearish sentiment in the short term but a bullish one immediately afterward. The targets rise with time frames. The short-term target has been slashed but the average targets for the longer terms are only moderately lower.

-636894522601259835.png)