- Cable exchanges gains with losses near 1.3050.

- UK CPI rose 1.9% YoY in March, less than expected.

- BoE Governor M.Carney due to speak later today.

The Sterling is alternating gains with losses in the middle of the week and is now taking GBP/USD to the 1.3050 area in the wake of CPI results.

GBP/USD upside halted near 1.3070

Cable faded the initial spike to the 1.3065/70 band and has now refocused to the lower end of the range after UK inflation figures failed to meet expectations in March.

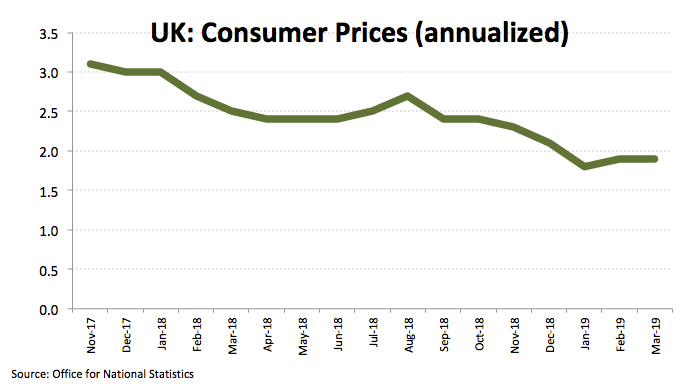

In fact, UK consumer prices tracked by the CPI rose at an annualized 1.9% (vs. 2.0% forecasted) and contracted 0.2% inter-month (vs. an expected 0.2% gain).

In the meantime, the absence of significant headlines around the Brexit process appears to support the ongoing consolidative fashion below 1.3100 the figure and with the downside contained in the vicinity of the critical 1.3000 the figure.

Later in the day, attention will shift to the speech by BoE Governor Mark Carney.

GBP/USD levels to consider

As of writing, the pair is losing 0.03% at 1.3041 and a breach of 1.2976 (low Mar.29) would expose 1.2970 (200-day SMA) and finally 1.2960 (low Mar.11). On the other hand, the initial up barrier emerges at 1.3101 (21-day SMA) seconded by 1.3132 (high Apr.12) and then 1.3196 (high Apr.3).