- Cable stays on the defensive in sub-1.3200 levels.

- UK Retail Sales surprised to the upside in February.

- PM T.May will travel to Brussels to the EU Summit today.

The sentiment around the British Pound has deteriorated further on Thursday, although GBP/USD has managed to bounce off lows in the mid-1.3100s following auspicious results the UK docket.

GBP/USD looks contained near 1.3150

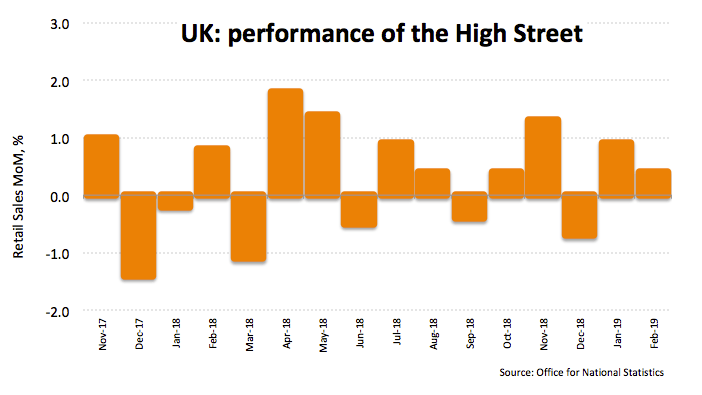

Cable rebounded from daily lows in the 1.3150 region after UK Retail Sales expanded at a monthly 0.4% in February, bettering estimates. On a yearly basis, sales expanded 4.0%.

Further data releases saw Core sales expanding 0.2% MoM and 3.8% from a year earlier. Additionally, Public Sector Net Borrowing shrunk to £0.66 billion last month from January’s £14.15 billion.

In the meantime, PM May will travel to Brussels later in the day to meet her European peers at the EU Leaders Summit. In this regard, there is still conflict between May’s proposal for an extension of Article 50 to June 30 vs. the EU’s offer for an extension to May 26.

Fanning the flames, earlier in the day at a radio interview, DUP’s S.Wilson showed his lack of confidence for another meaningful vote to succeed at the House of Commons, adding he is against both the current Brexit plan and an extension of Article 50.

Moving forward, the BoE is expected to keep rates on hold at its meeting today.

What to look for around GBP

The British Pound came under increasing selling pressure after PM Theresa May asked the EU for a short extension of Article 50, as opposed to MPs’ expectations of a longer one. In addition, the third meaningful vote on May’s Brexit deal at the House of Commons has been postponed and there is still no date for the event.

GBP/USD levels to consider

As of writing, the pair is losing 0.16% at 1.3170 and a breach of 1.3146 (low Mar.21) would aim for 1.3029 (55-day SMA) and finally 1.2960 (low Mar.11). On the other hand, the next hurdle emerges at 1.3311 (high Mar.19) seconded by 1.3350 (high Feb.27) and then 1.3380 (2019 high Mar.13).