- GBP/USD has suffered from weak UK data but benefited from the US-Sino deal.

- The UK jobs report and forward-looking PMIs are critical to the next moves of the BOE and the pound.

- Early January’s daily chart is painting a bullish picture.

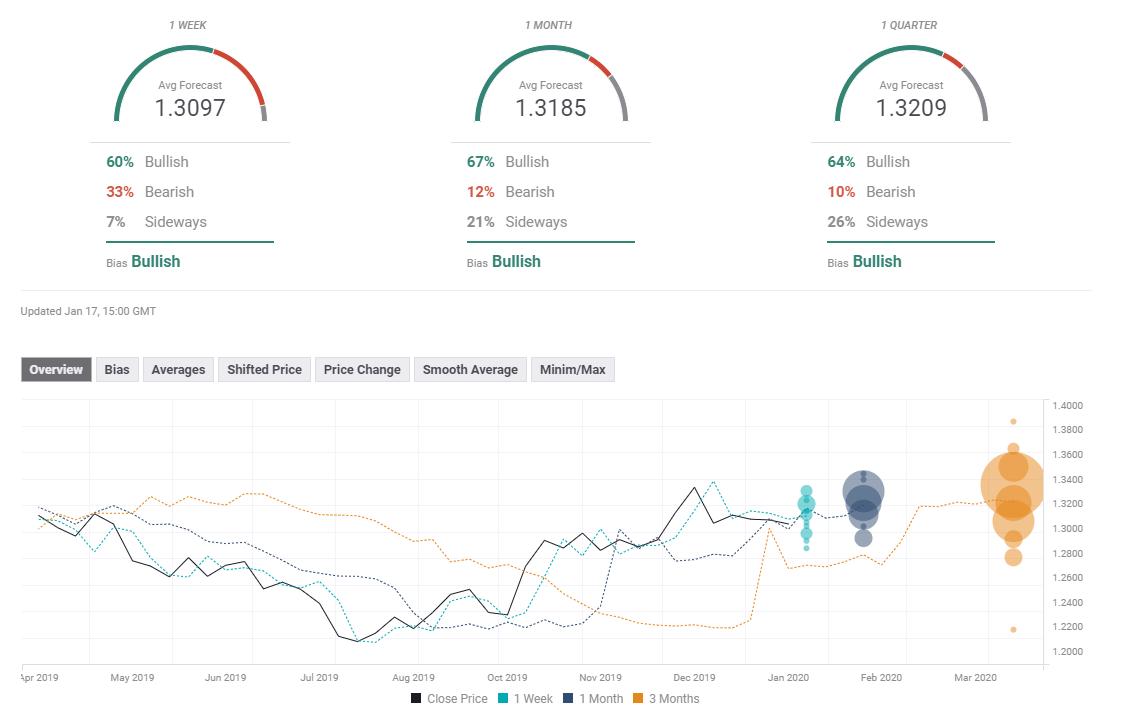

- The FX Poll is pointing to higher levels for pound/dollar.

Almost everything is pointing to a rate cut this month – and this week’s data is critical that decision and the next moves in GBP/USD. UK data will likely overshadow US figures, while trade and Brexit headlines may also rock cable.

This week in GBP/USD: Disappointing data, dovish comments

Gertjan Vlieghe, a member of the Bank of England Monetary Policy Committee, sent sterling lower earlier in the week. Vlieghe – who previously laid the first hint for a rate hike – said he would vote for cutting rates if the data remains weak.

And the data was weak indeed.

The economy contracted by 0.3% in November – showing that Brexit uncertainty continued weighing on the UK. Headline, Consumer Price Index, missed expectations with 1.3% yearly – the lowest since 2016.

The third and last disappointment came from retail sales figures for December, which plunged by 0.6% on top of downward revisions to November’s numbers.

The BOE’s Michael Saunders – a hawk turned dove – echoed Governor Mark Carney’s desire for “prompt” action. A rate cut became a question of time. Bond markets are pricing in a high chance that the BOE reduces borrowing costs in its upcoming meeting at the end of the month.

GBP/USD suffered from downbeat data and dovish comments but managed to recover. The safe-haven US dollar was sold off as markets celebrated the Sino-American trade deal.

China pledged to increase purchases of US goods, but only if prices are “competitive” – leaving room for buying less than demanded. Moreover, the agreement does not include further tariff reductions that markets wanted to see. While it is unclear when or if Phase Two talks will begin, the upbeat mood has persisted.

US data was satisfactory with Core CPI holding up at 2.3% in December. More importantly, Retail Sales beat expectations and showed that November’s disappointing statistics were only a one-off.

UK events: Jobs and PMI to seal the fate of the rate cut

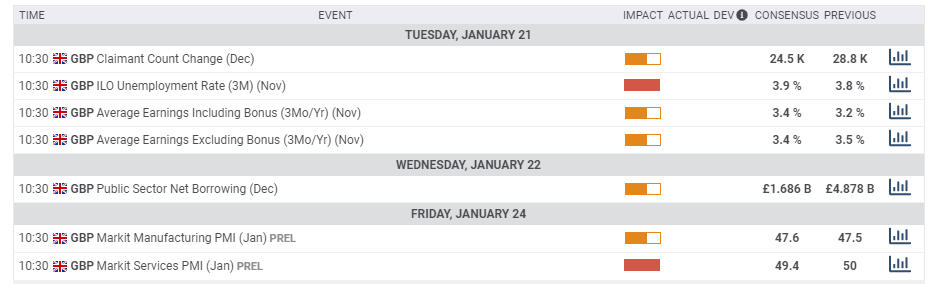

The jobs report for November kicks off the week with mixed expectations. On the one hand, the Unemployment Rate is forecast to edge up from 3.8% to 3.9%, but that would leave it at low levels. On the other hand, Average Earnings, both including and excluding bonuses, are set to converge at 3.4%.

Perhaps more importantly, the preliminary Markit/CIPS Purchasing Managers’ Indexes for January provide critical hints toward the BOE’s decision. These forward-looking gauges are set to score below 50 – reflecting ongoing contraction – in both the manufacturing and services sectors.

High volatility is expected in both these critical releases, as investors try to gauge the bank’s policy moves in the following week.

The UK leaves the EU on January 31, and that is when the transition period kicks in. That temporary phase expires at the end of the year, and both sides will enter negotiations about future relations. Statements from Prime Minister Boris Johnson and EU officials may move the pound, but investors will likely focus on economic data rather than Brexit in the upcoming week.

Here is the list of UK events from the FXStreet calendar:

US events: Further trade comments

Further comments on trade and Chinese implementation of the deal may move markets. President Donald Trump’s Senate trial is projected to kick off on Tuesday, but the Republican majority is forecast to end it quickly. Markets have ignored US politics of late.

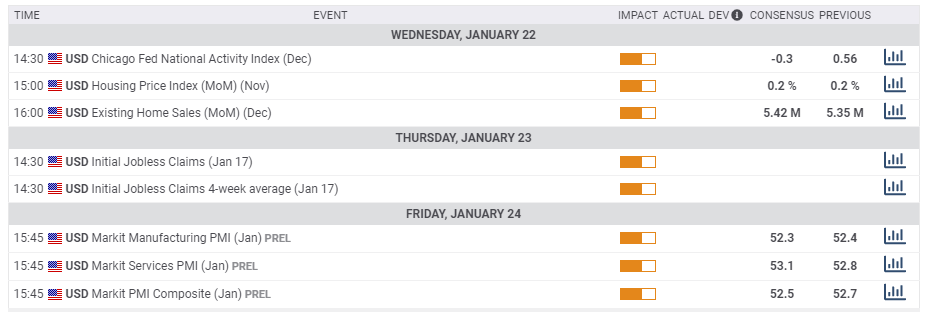

Elsewhere, the economic calendar is lighter than usual. Housing figures are of interest on Wednesday, with Existing Home Sales set to remain around November’s 5.35 million annualized level.

Markit’s preliminary PMIs are of interest on Friday. The forward-looking gauges for both the manufacturing and services sectors are set to reflect moderate growth.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

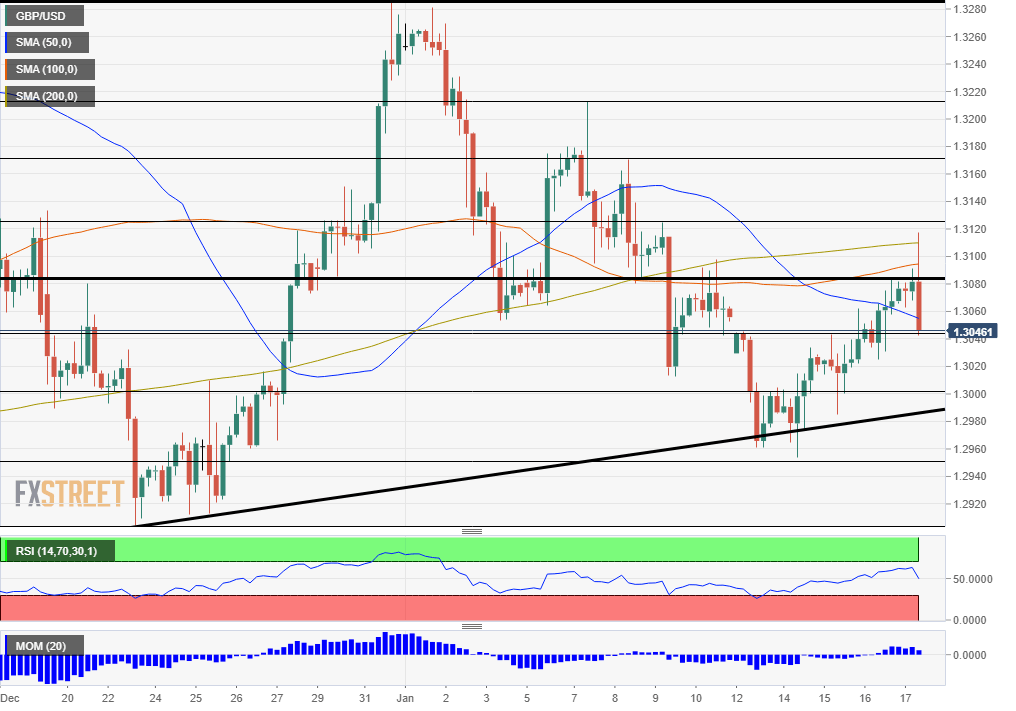

Pound/dollar made a false break above the downtrend resistance line that capped it since mid-December. At the time of writing, it is still holding above the 50-day Simple Moving Average and the long-term uptrend support line that accompanies it since early November. The track has worked well in the past week, an encouraging sign for bulls, showing that the battle is still not over.

While momentum is not going anywhere fast, the pair is holding above the 100 and 200-day SMAs.

Overall, the pair is down but not out.

Support awaits at 1.3010, October’s top price, and also a separator of ranges in January. It is followed by the 2020 low of 1.296. Further down, 1.29, was a low point around Christmas. Next, 1.2820 and 1.2775 await the currency pair.

Resistance is at 1.3120, the mid-January high. It is followed by 1.3210, a swing high from early January, and 1.3285, the holiday season high. Next, 1.3420 and 1.3510 await GBP/USD.

GBP/USD Sentiment

While the jobs report may disappoint, PMIs are more of a wildcard. Nevertheless, further pricing of a BOE cut will likely weigh on the pound.

The FX Poll is pointing to gains on all time frames. Experts may already be pricing in the rate cut. The short and medium-term targets have been upgraded while the long-term objective has been left unchanged.

Related Forecasts

- GBP/USD Price Forecast 2020: Pound may continue to fall on hard Brexit deadline

- USD/JPY Forecast: How high can the trade deal take it? Eyeing US PMIs and the BOJ

- EUR/USD Forecast: US growth hopes overshadowed risk-appetite