- The GBP/USD is trading flatly after Friday failed to generate a decisive continuation of last week’s bullish reversal.

- An abnormally bullish BoE is running counterpart to bearish waffling on Brexit negotiations.

The GBP/USD is trading into 1.3250, a familiar level recently as Brexit quarrels and swings in broader market sentiment have seen the Pound freeze near recent technical levels after last weeks bounce from the GBP/USD’s bounce from its last major low.

The Sterling rebounded last week after a surprisingly bullish showing for the Bank of England (BoE), which had 3 of its 9 voting members push for a rate hike at the central bank’s last meeting. The BoE’s more-hawkish-than-expected stance has revived hopes for the GBP, but resistance has formed at current levels as Brexit continues to weigh on the UK’s markets.

Prime Minister Theresa May is still ignoring calls to prepare for a hard-Brexit scenario, opting to trust her gut and continue to try and negotiate a workable trade agreement with the EU’s leadership in Brussels, a move that is continuing to raise skepticism on both sides of the Channel. Tempers are beginning to flare for UK-based businesses with supply chains that are excessively exposed to European participants, and Brexit engineers within the UK’s parliament are balking at the shifting public opinion, decrying the growing public backlash as the kingdom’s businesses begin to lose patience with the slow-moving Brexit negotiation process.

Monday is a thin showing for the Sterling, while the week ahead brings a speech from the BoE’s Mark Carney on Wednesday, and traders will be looking ahead for an update to the central bank’s hawkish leanings.

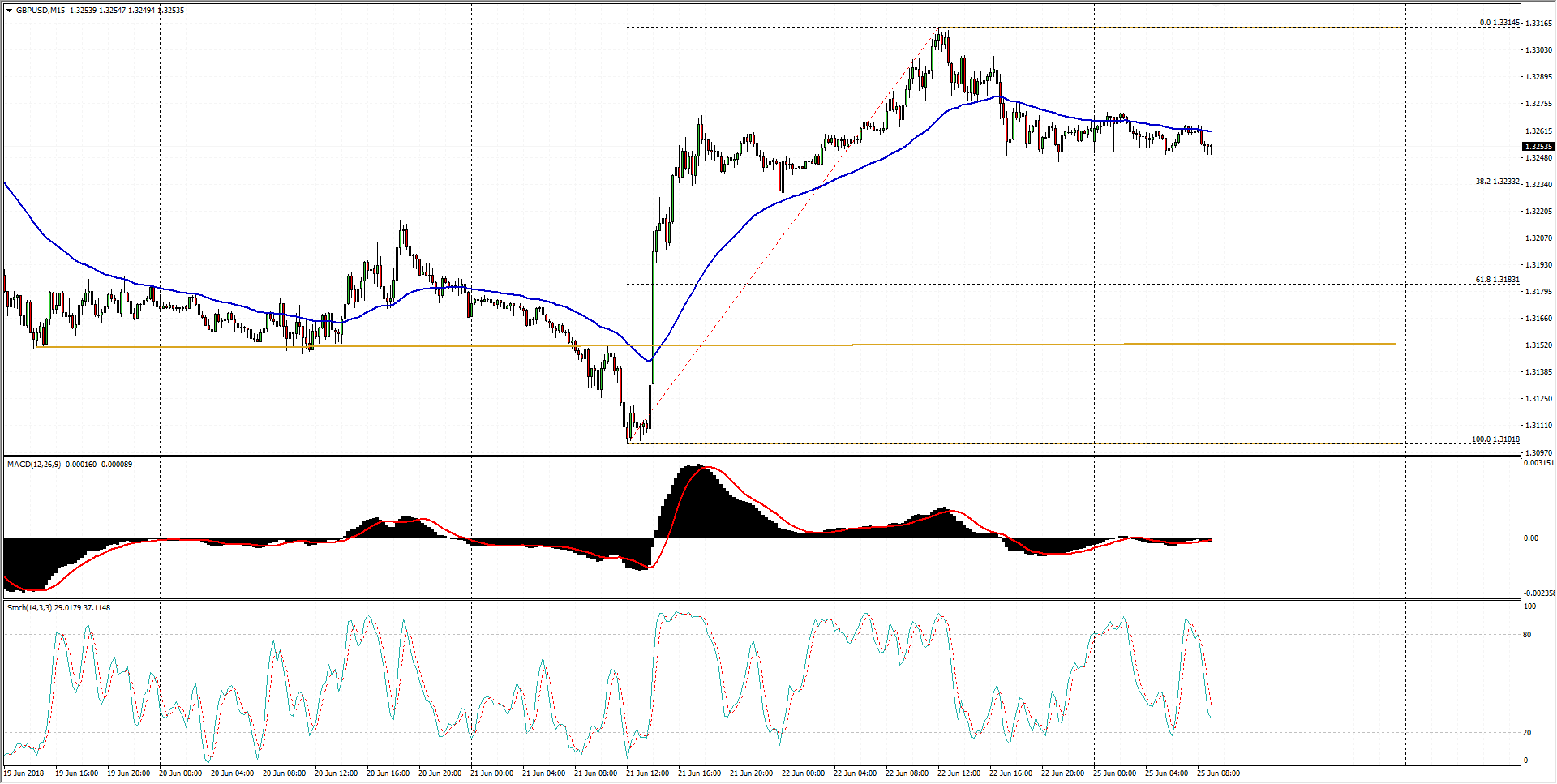

GBP/USD Technical Analysis

The Sterling’s bounce from last week’s technical bottom appears to have run out of gas quickly, and Brexit concerns continue to weigh on the pair. Monday’s thin schedule for the economic calendar will leave market sentiment in the driver’s seat as hourly indicators continue to cycle around their midpoints with little action in the GBP/USD pairing.

GBP/USD Chart, 15-Minute

| Spot rate: | 1.3254 |

| Relative change: | Negligible |

| High: | 1.3271 |

| Low: | 1.3249 |

| Trend: | Flat |

| Support 1: | 1.3233 (38.2% one-week Fibo level) |

| Support 2: | 1.3150 (June 19th swing low) |

| Support 3: | 1.3102 (technical bottom) |

| Resistance 1: | 1.3314 (previous week high) |

| Resistance 2: | 1.3380 (R3 daily pivot point) |

| Resistance 3: | 1.3472 (one month high) |