- GBP/USD plummeted 130 pips from 1.3900 resistance.

- COVID is still weighing on the British Pound.

- Brexit concerns can raise their heads.

- Fed meeting minutes can provide more impetus to the market.

- Technically, the pair is looking to post more losses.

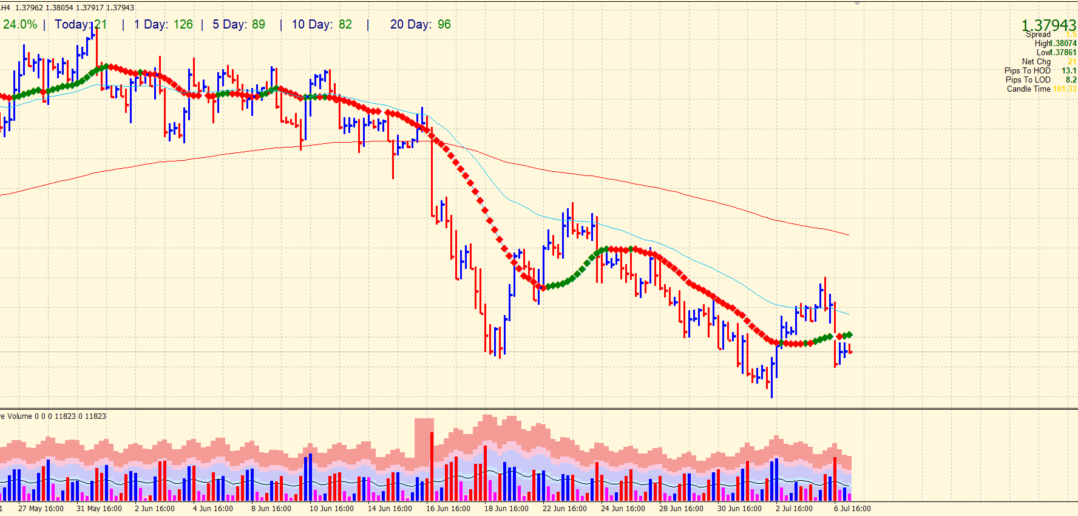

The GBP/USD pair could not hold gains near the 1.3900 resistance and fell more than 130 pips in a single day. The comeback of Greenback heavily weighed on the British Pound.

COVID weighing on GBP/USD

As discussed earlier, COVID is the number one concern for the UK. The country is still fighting the pandemic situation. Many people are considering the recent surge in cases as the fourth wave of the virus. The recent Delta variant has been spreading fast, and the number of infected and hospitalized cases have sharply risen. Although 86% of the adult population has been vaccinated, we do not know whether the vaccine will be enough to combat the Delta variant. Moreover, the Indian variant seems more deadly in spreading.

Brexit issues still lingering

Meanwhile, Brussels left a hard statement that if London does not conform to Brexit agreement provisions and keeps violating the protocol of Northern Ireland, the EU can refer to court. The statement was issued by European Commission Deputy Chairman Maros Sefcovic. Any further comments can fuel negativity in the region that can press the British Pound.

Fed meeting minutes

The Fed meeting minutes are due today in the NY session. But, first, we have to find the consensus of members on policy tightening in the light of the recent US labor market report.

The market can find further fresh impetus from the UK GDP figures due to be published o Friday this week.

GBP/USD technical outlook: Key levels to watch

Technically, the pair has turned bearish as it closed below the 20-period SMA on the 4-hour chart. However, the downside move will find support near yesterday lows of the 1.3770 area. Breaking below the level can turn the pair really bearish and may open the path towards a recent swing low of 1.3630. The 20, 50 and 200 SMAs lie one above another, indicating the probability of further losses. Volume is right now in consolidating mode and indicating a brief correction to the upside before a fall.

Support levels:

S1 – 1.3733

S2 – 1.3672

S3 – 1.3611

Resistance levels:

R1 – 1.3794

R2 – 1.3855

R3 – 1.3916

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.