- GBP/USD has dropped off the new 2020 highs after encouraging US data.

- BOE Governor Bailey’s speech and the fate of the furlough scheme are eyed.

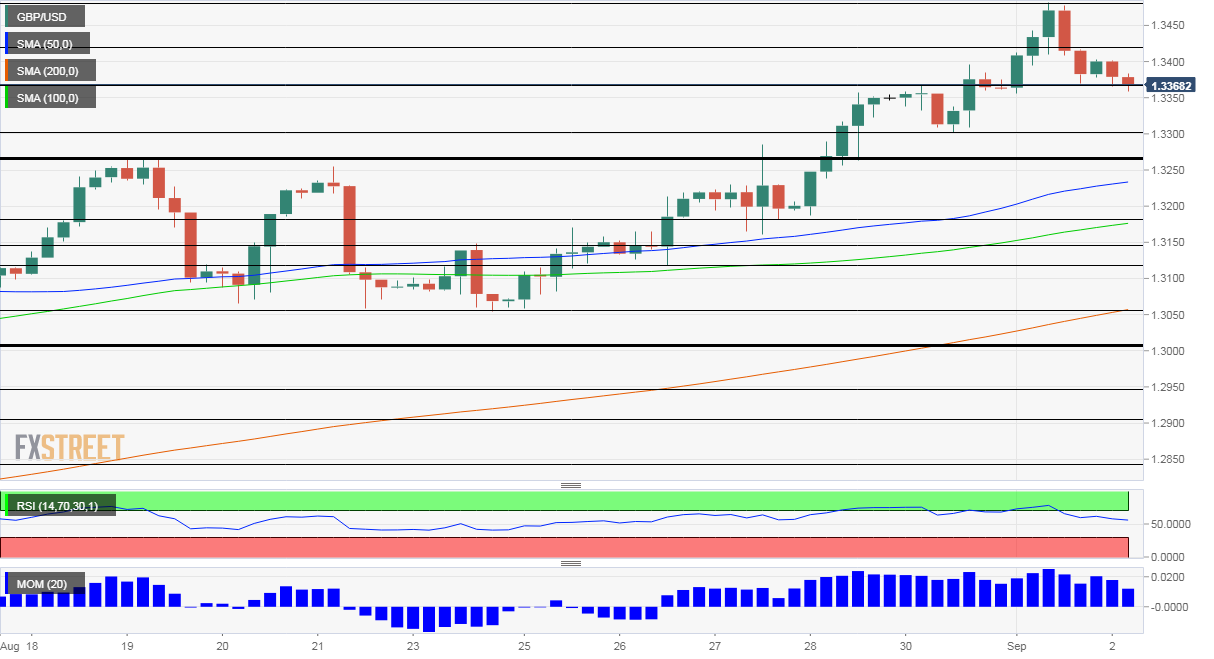

- Wednesday’s four-hour chart is showing bulls are in control.

A new season of Prime Minister’s Questions is back – but PM Boris Johnson may not be entertained. The beleaguered leader – reportedly still struggling with the fallout from his near-death coronavirus experience – is facing criticism about his handling of the crisis.

Johnson was criticized for the lack of medical equipment for doctors, announcing a lockdown too late, and most recently for various U-turns on issues related to the reopening of schools.

The one decision that his government was universally praised for is the furlough scheme – paying workers most of their salaries while they were unable to work. The program kept employees attached to their jobs and helped trigger a rebound in consumption.

However, this scheme is set to expire in October. Chancellor of the Exchequer Rishi Sunak – already considering tax hikes to plug a hole in the government’s finances – reiterated that the program is unsustainable. Will the PM surprise by announcing an extension? That could boost sterling.

Johnson is facing Labour leader Keir Starmer, a former prosecutor who has proved effective in pinning down the government. The face-to-face encounter in the House of Commons could trigger market-moving headlines.

In another part of parliament, Bank of England Governor Andrew Bailey is set to speak with MPs and provide updates on the economy. The bank intends to leave policy unchanged for the time being, after slashing rates to near zero and injecting more funds. Any hint of negative rates could weigh on sterling while increasing the bond-buying tool would boost the pound.

GBP/USD’s drop on Tuesday was driven by a significant correction in favor of the dollar. Apart from profit-taking, the greenback benefited from the upbeat ISM Manufacturing Purchasing Managers; Index which surprised with 56 points in August – the highest since 2018.

On the other hand, the PMI’s employment component contracted, reflecting weak hiring ahead of Friday’s jobs report. Another clue toward the Non-Farm Payrolls is due out on Wednesday’s – ADP’s estimate for private-sector employment. America’s largest payroll provider’s figures significantly diverged from the government’s officials figures, yet it remains a market-moving event.

See ADP Employment Change and Initial Jobless Claims Preview: Hope is not change

The Federal Reserve has been the main downside driver of the dollar with its announcement of a policy shift last week. The Fed will allow inflation to overheat, thus keeping rates lower for longer. John Williams,

President of the New York branch of the Federal Reserve, and Lauretta Mester, his colleague from Cleveland, are scheduled to speak on Wednesday. Other officials reiterated Chairman Jerome Powell’s message and kept the pressure on the dollar.

Will the greenback resume its falls after getting a reminder from the Fed? That remains an open question.

GBP/USD Technical Analysis

Pound/dollar continues benefiting from upside momentum on the four-hour chart and trades above the 50, 100, and 200 Simple Moving Averages – positive signs. Moreover, the Relative Strength Index exited overbought conditions by falling below 70.

Bulls are in control.

Cable is struggling with 1.3370, which held it down early in the week. The round 1.33 level was a stepping stone on the way up, and it is followed by 1.3265, which was a stubborn cap earlier in August.

Resistance is at 1.3410, where GBP/USD shortly paused on its way up, before hitting 1.3480 – the new 2020 high. Further above, 1.3510 is the 2019 high.

More Markets are Fed-dependent as ever, reaction to elections could surprise – Interview with Lior Cohen