- GBP/USD has been struggling to gain ground amid concerns Brexit, relations with China.

- Coronavirus vaccine hopes, US cases, are set to move the currency pair.

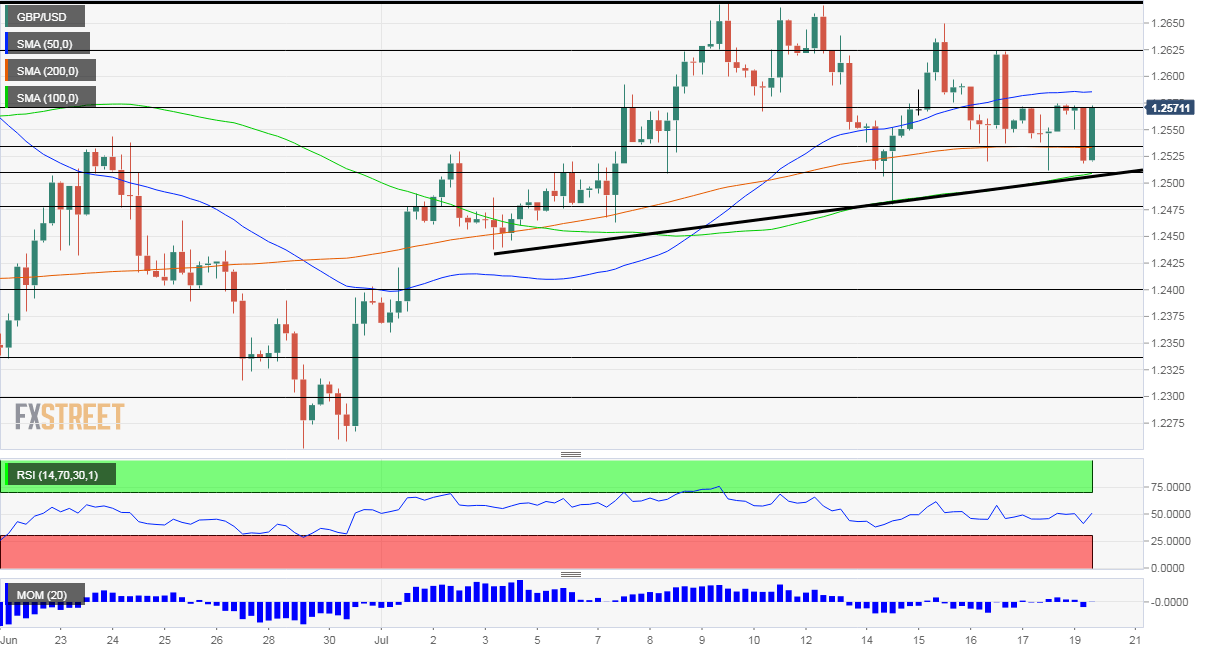

- Monday’s four-hour chart is painting a mixed picture.

“A resolute response” – the words of Liu Xiaoming, China’s ambassador to the UK are keeping the pressure on the pound. Liu referred to the UK’s contemplating of slapping sanctions on Chinese officials – in response to human rights violations in Xinjiang and its tighter grip on Hong Kong.

Britain is likely to cancel its extradition treaty with HK, its former colony as soon as Monday. Prime Minister Boris Johnson and fellow Brexit supporters envisaged the UK striking independent trade deals with the wider world following the exit from the EU. However, worsening relations with the world’s second-largest economy do not bode well.

Brexit talks are set to resume after several rounds of deadlocked talks. Both sides acknowledged that Brussels offered London concessions, but the UK says these are insufficient while the bloc states they have not been reciprocated. Low expectations for any breakthrough during the summer imply a limited downside for sterling – unless one side abandons the negotiation table.

The good news comes from the medical front. Synairgen, a British company, reported positive results for a cure for COVID-19. While a full examination of its treatment is still awaited, the announcement already triggered a triplication of its shares and UK authorities could fast-track its application.

AstraZeneca, a large UK-based pharma firm, may announce results of another phase in its coronavirus vaccine candidate. The Lancet will likely publish an update later on Monday. Both developments are helping the pound and supporting the broader market mood.

Across the pond, America’s COVID-19 cases are on the rise. Deaths have topped 140,000 and the number of infections surpassed 3.7 million. The situation is especially acute around Los Angeles, in Texas, and in Florida. New figures published on Monday will likely be depressed due to the “weekend effect.”

President Donald Trump continues dismissing the disease, to his own political peril – updated polls showed no improvement for the incumbent, who is trailing challenger Joe Biden by around 9%. Markets are more focused on Trump’s next move on the fiscal front. Federal unemployment benefits are set to expire at the end of the month unless Congress extends them. Republicans are unsure about how to extend them and the “fiscal cliff” may come to the forefront for investors.

Overall, the UK’s international relations and coronavirus developments – both devastating and hopeful – will likely set the tone.

GBP/USD Technical Analysis

Pound/dollar is trading above an uptrend support line which has been accompanying it since early July and converges with the 100 Simple Moving Average on the four-hour chart. The currency pair capped by the 50 SMA, trades above the 200 SMA, and experiences minor downside momentum.

All in all, the picture is mixed.

The daily high of 1.2580 is the first level to note, and it is followed by 1.2625, a high point late last week. Further above, the triple top of 1.2670 looms.

Support is at Friday’s trough of 1.2515, followed by the swing low of 1.2480. The next lines to watch are 1.24 and 1.2335.

More Central banks make way for governments to act and move markets, but there is only one real boss