- GBP/USD has been regaining lost ground amid Brexit and vaccine hopes.

- The fate of fisheries may determine sterling’s direction.

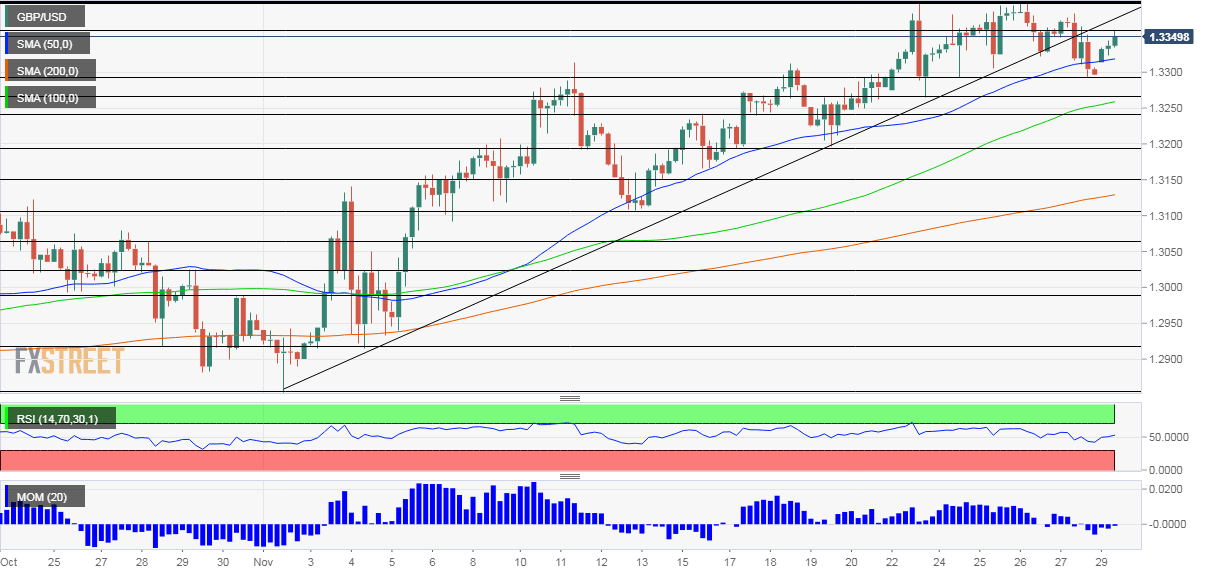

- Monday’s four-hour chart is painting a mixed picture.

A deal on fish “ought” to be achievable this week – these words by Dominic Raab, the UK’s Foreign Secretary, have helped sterling recover from the lows under 1.33. Commenting on Sunday, Raab insisted that controlling fisheries is a matter of sovereignty and that the EU needs to understand that.

Fisheries are only a small part of the British and European economies, but they are politically sensitive. Michel Barnier, the EU’s Chief Negotiator remains in London for ongoing in-person talks that resumed on Friday. The French statesman’s home country has also been defiant on the topic of fish.

The upshot is that Raab noted progress on other topics such as governance and state aid, which may have larger economic implications, yet are not as visible and symbolic as the creatures swimming underwater.

How imminent is a Brexit deal? It seemed close in recent weeks, but as negotiators say “nothing is agreed until everything is agreed” – and a few more days may be needed for a full accord.

Apart from cautious optimism on a deal, the pound has been benefiting from potential progress on a COVID-19 vaccine. While the AstraZeneca/University of Oxford effort may suffer a delay, British authorities are set to approve the immunization coming from Pfizer and BioNTech. The American-German project has completed its Phase 3 trial and Brits may receive the first jabs as early as next week.

GBP/USD has also been benefiting from some dollar weakness. Investors are taking profits on stocks and rotating into bonds. In turn, Treasury yields are dropping, making the greenback less attractive.

Volatility may increase due to end-of-month flows, especially around the London fix around 16:00 GMT. Sterling tends to be sensitive around this hour.

Overall, cable’s trend is to the upside amid hopes, yet the all-important break above 1.34 may have to wait once again.

See Three reasons to expect a sustained Santa rally for sterling

GBP/USD Technical Analysis

Pound/dollar has recaptured the 50 Simple Moving Average on the four-hour chart but it previously lost the uptrend support line that had accompanied it. Momentum is flat and the Relative Strength Index is balanced.

All in all, the picture is mixed.

The daily high of 1.3357 is the first hurdle to watch. It is followed by the November high of 1.34, and then by 1.3420 and 1.3495.

Some support is at the daily low of 1.3310, followed by Friday’s low of 1.3285. The next lines to watch are 1.3265 and 1.3245.

See: GBP/USD Weekly Forecast: Brexit, Powell and Nonfarm Payrolls promise a hectic start to December