- GBP/USD has pushed above the 1.3600 level and broken above a crucial downtrend in recent trade.

- Also supporting GBP on Tuesday is vaccine optimism and markets reducing bets on BoE negative rates.

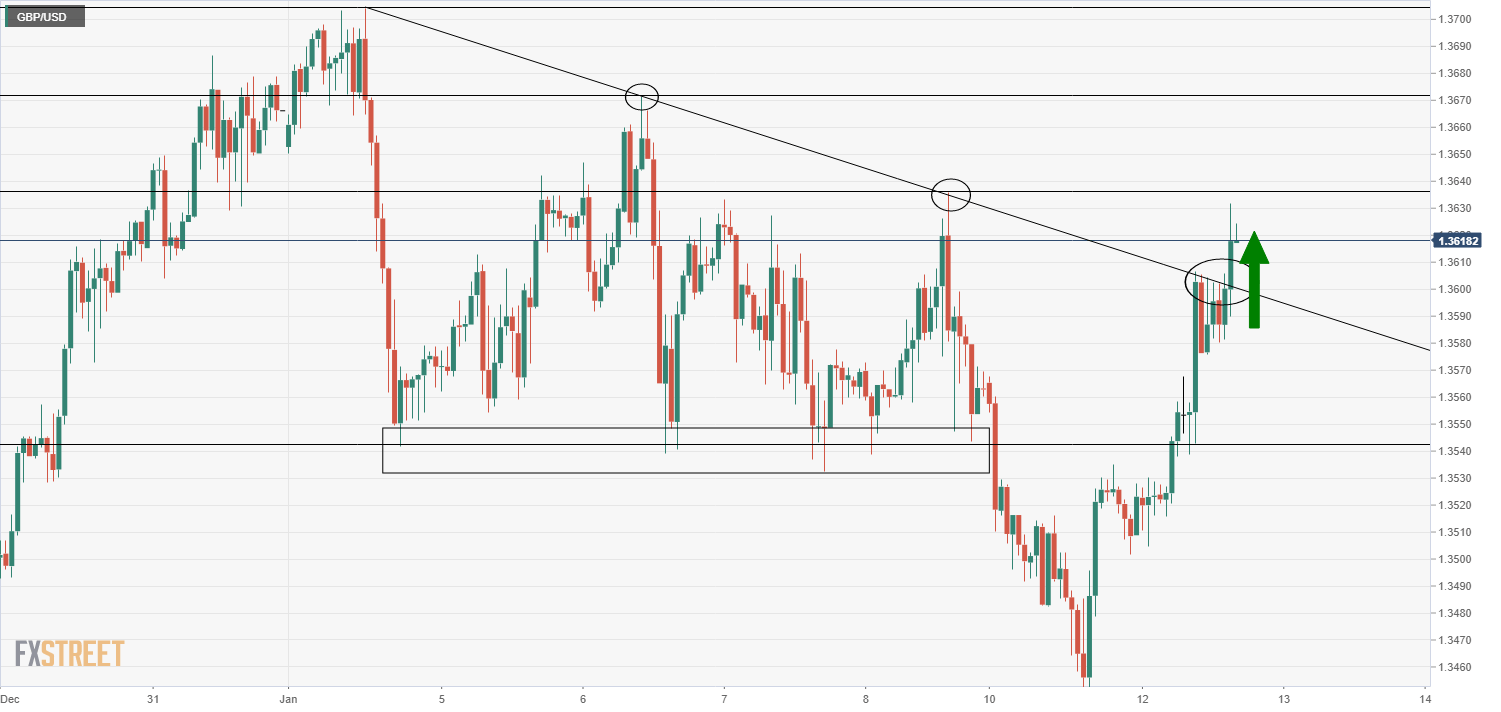

GBP/USD looks to finally be making some headway to the north of the 1.3600 level, an area which the pair had struggled to crack over the last few hours. Since breaking to the north of this area, cable is making serious headway towards last Friday’s high at 1.3636. At present, the pair trades with gains of well over 100 pips on the day or about 0.8% and is close to 1.3620. On the day, GBP is far and away the best performer of the G10 currencies.

A bout of technical buying appears to be supporting the action; not only has the pair broken to the north of the 1.3600 level, but also above a downtrend that had been intact since the start of the year, linking the 4, 6 and 8 January highs at just above 1.3700, around 1.3670 and 1.3636 respectively. Technically speaking, the pair is likely to maintain a short-term bullish bias going forward, with these above-noted levels likely to be the key areas of resistance. Meanwhile, recently broken above downtrend may well come back into play as support if GBP/USD slips back towards 1.3600 again.

Reasons for GBP outperformance

Technical buying is one factor working in favour of GBP on Tuesday, but a number of fundamental themes also seem to be helping.

Firstly, markets appear to have interpreted comments from the Bank of England Governor Andrew Bailey earlier on during the European morning session as tilting hawkish and are subsequently paring their bets that the bank will take interest rates into negative territory in the coming months. Bailey called negative rates a “controversial issue” and said that there are a lot of “issues” with negative interest rates, in what markets appear to be taking as his strongest rebuke of the potential policy yet.

Note that he, nor any other BoE members, have completely ruled the option out and, indeed, other BoE policymakers like Gertjan Vlieghe seem to strongly favour negative rates. Nonetheless, Bailey’s comments have seen the money market interest rate expectations for the end of 2021 rise to around -10bps from -15bps on 5 January. Meanwhile, expectations as to where the bank’s key lending rate will be in August 2022 has risen to above -10bps from previously around -17bps on 5 January.

Elsewhere, GBP appears to be deriving some support from the UK ongoing vaccination race lead over its major developed market peers; the country has already given roughly 4% of the population their first jabs (versus 3% in the US). Monday’s updated government vaccine numbers suggested that 2.3M people had received the 2.6M vaccines already administered and that vaccinations per day had hit a pace of 200K, which is expected to be further supported by the opening of 50 mass injection hubs around the country. The government seems increasingly confident that it can hit its target to have vaccinated 13M people by the middle of next month.

“The speed at which the population is being vaccinated will influence economic performance in 2021″ says Jefferies, who continues that the UK economy has “the potential to surprise on the upside”. The bank continues that “having been slow to lockdown in 2020, the UK is rolling out the vaccines at a relatively fast rate”, which the bank thinks means there is a chance that the UK could re-open its economy sooner than its peers.

Looking ahead, while the UK’s strong vaccination performance coupled with an increasingly negative interest rate averse BoE might support GBP versus its G10 peers, the return of Brexit talks could pose a downside risk; UK/EU discussions on financial services will begin next week and the UK PM Boris Johnson said he is aiming to clinch a deal by March.

GBP/USD hourly chart