- GBP/USD has corrected lower amid US coronavirus concerns Biden’s comments.

- Brexit, UK fiscal stimulus, and new COVID-19 statistics are in play.

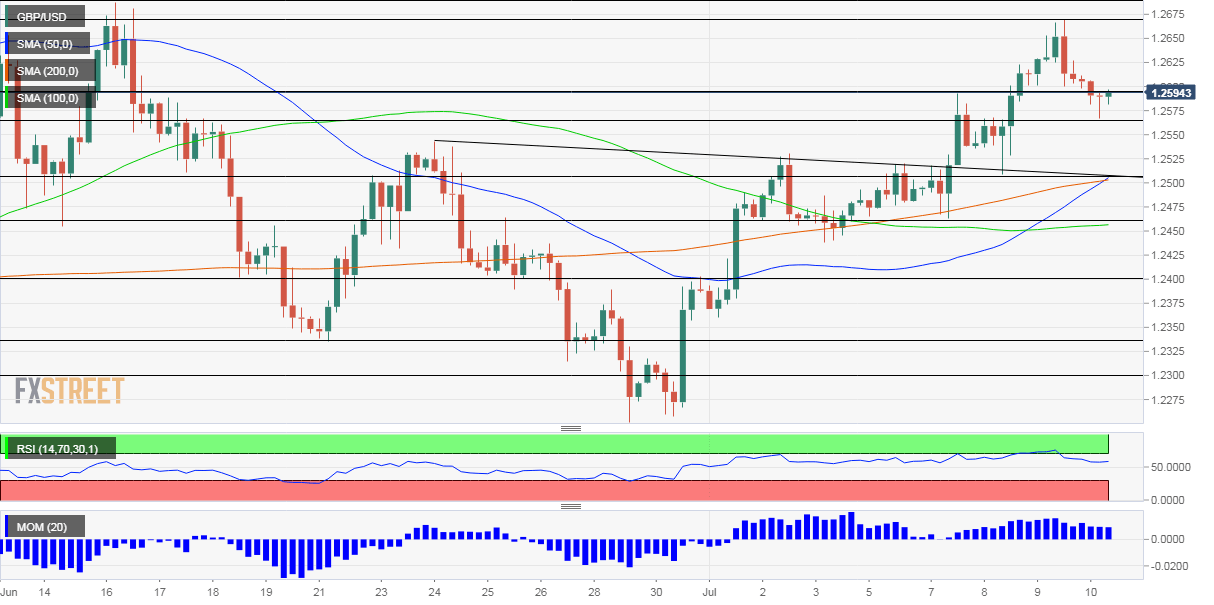

- Friday’s four-hour chart is showing that the currency pair exited overbought conditions.

After one step back, will sterling take two forward? GBP/USD came out of overbought conditions and dropped due to two US factors. Can it rise back up?

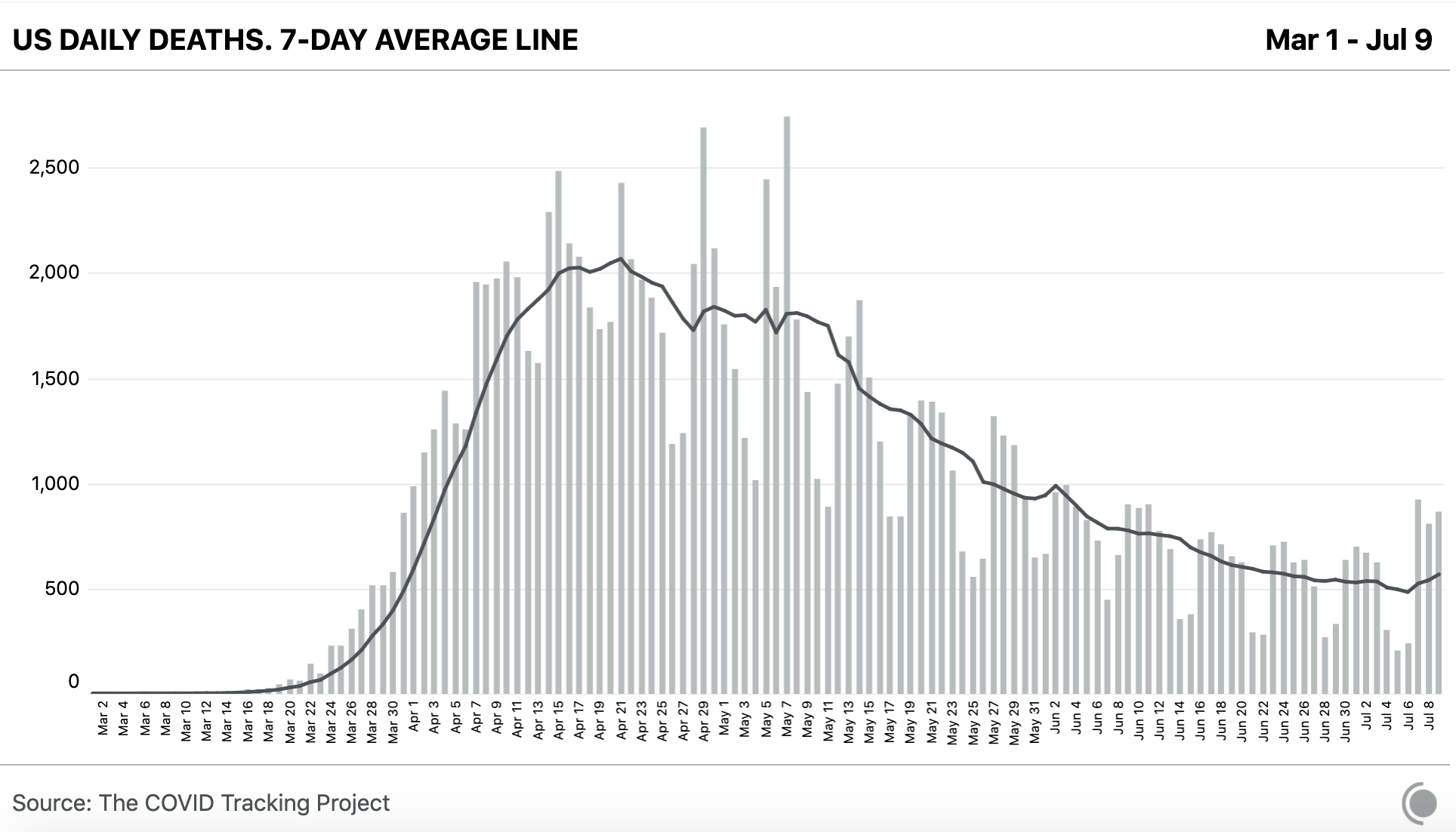

The deterioration in America’s coronavirus crisis may have finally caught the markets’ attention. Apart from record infections, the death toll is beginning to rise once again, joining the worry uptrend in hospitalizations.

The downtrend in mortalities seems to have ended:

See:

Nationally, the 7-day average in deaths has begun to rise after an extended decline. The last three days were the highest numbers we’ve since early June. pic.twitter.com/fRlYZeYrxa

“” The COVID Tracking Project (@COVID19Tracking) July 9, 2020

Stocks markets dropped and the safe-haven dollar advanced across the board, pushing GBP/USD lower.

Another factor weighing on sentiment was Joe Biden’s speech. The presumptive Democratic nominee seems to have veered to the left of his party, stating that “Wall Street CEOs have not built America” and that “the era of shareholder capitalism has come to an end.” That also sent shares lower.

On the other side of the pond, pound bulls may have been encouraged by the reopening of the economy, gradually extending to more sectors. Moreover, Chancellor Rishi Sunak’s £30 billion stimulus plan – which includes encouraging eating out and also job retention – is another backwind.

On the other hand, Brexit talks are going nowhere fast, limiting sterling’s resurgence. Both UK Prime Minister Boris Johnson and German Chancellor Angela Merkel have commented on the option of the UK ending the transition period without a trade deal. Merkel seems busy with the EU recovery fund than with anything else.

All in all, cable’s attempts to recover may falter, especially when new COVID-19 statistics come out of the US.

GBP/USD Technical Analysis

The Relative Strength Index on the four-hour chart is below 70 – outside overbought conditions. Pound/dollar is holding its ground above the 50, 100, and 200 Simple Moving Averages while also benefiting from upside momentum.

Overall, bulls are in control.

Cable is battling 1.2590, a swing high from earlier this week. It is followed by 1.2670, which is the weekly weak. Close above, 1.2690 was a peak in mid-June. 1.2730 is next.

Support is at the daily low of 1.2565, followed by 1.25, the round number where the 50 and 200 SMAs converge. It is followed by 1.2460 and 1.24.