- GBP/USD pair maintains bullish bias after Fed.

- Covid is slowing down in the UK, supporting the Pound.

- Scotland referendum is another potential risk on the horizon.

- Technical breakout is not yet confirmed.

The GBP/USD price analysis remains broadly bullish after the Fed’s dovish stance. The market showed no net action on the Fed as the price fell down quickly and then recovered all the losses.

–Are you interested to learn more about automated trading? Check our detailed guide-

The British Pound was trading higher on Tuesday and Wednesday and fully recovered from the fall a week earlier. However, the collapse of the British Pound could occur due to the growing number of coronavirus cases in the UK.

At the moment, the fourth wave is slowing down, and the number of new cases of the disease is only 20-25k per day in recent days. But, of course, this is still a fairly high number, given that in other European countries, the strength of the new wave of the pandemic is either much lower or not at all.

Thus, if we consider only the pandemic factor, then the Pound Sterling has been trading in the last two weeks as expected. Therefore, at the moment, this factor can be considered already worked out.

Usually, the cycles in the economy change every 8-10 years. Hence, it is quite possible to expect that the depreciation of the American currency will continue in the coming years.

Moreover, all the fundamental global factors on the part of Britain no longer impact the market as in the recent five years. Brexit has been completed in one way or another. New problems, although looming on the horizon, are still only hypothetical.

Of course, the Pound Sterling could return to the downward track if Scotland will hold an independence referendum, during which it turns out that the majority voted in favor. However, this referendum, if it happens, will be no earlier than the next year. It will be followed by a couple of years of litigation between London and Edinburgh over the legality of such a referendum. Because, at this time, London does not give official permission to hold it. And without permission, the results of the referendum may be invalidated.

So, the Pound Sterling still has excellent prospects for the continuation of the long-term uptrend.

GBP/USD technical analysis: Bulls to keep gains

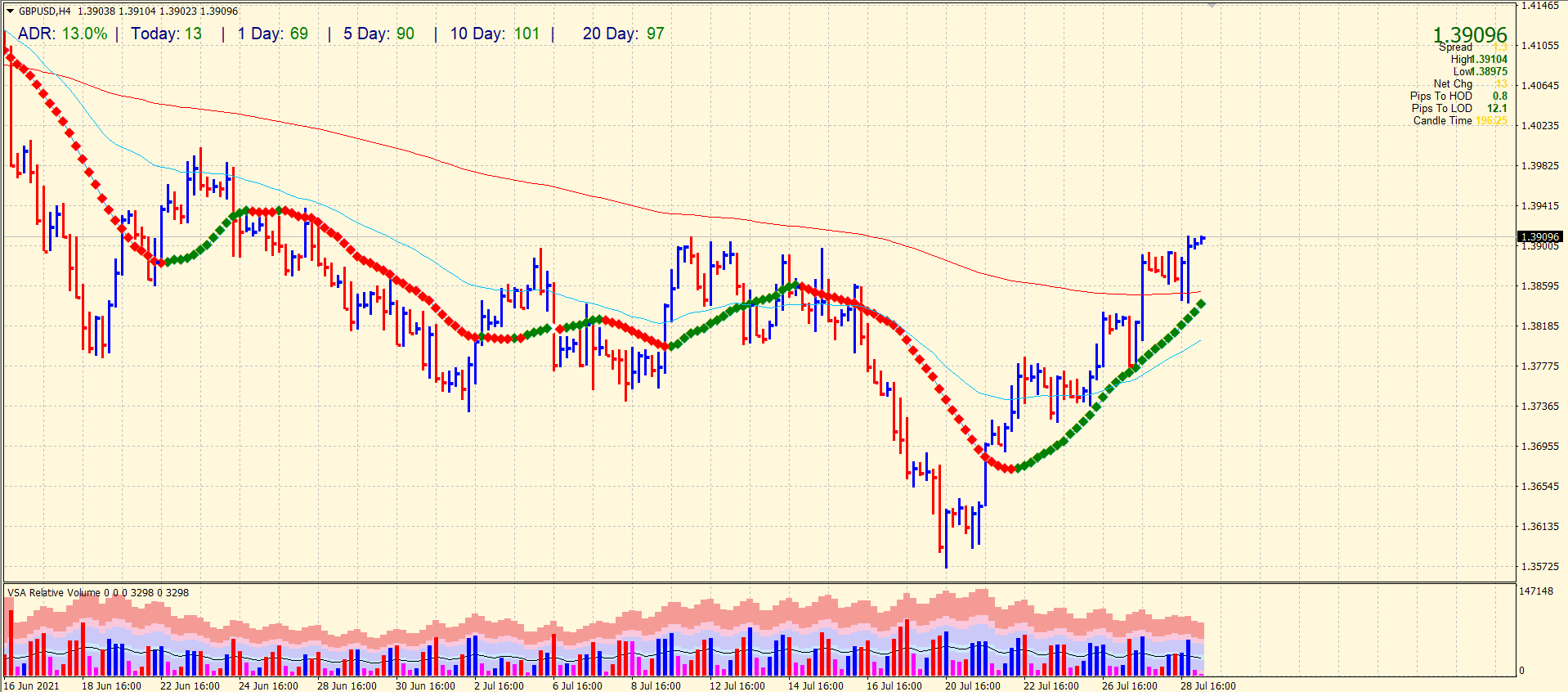

The GBP/USD price maintains a strongly bullish bias as the price managed to find acceptance beyond the key 1.3900 level and the 200-period SMA on the 4-hour chart. However, the price is still wobbling at a strong resistance level of 1.3910, where it found rejection more than once in recent weeks.

–Are you interested to learn more about forex signals? Check our detailed guide-

The volume shows bullish bias, and we may only see a corrective retracement towards the 1.3880 area before bulls continue to push towards the 1.4000 psychological level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.