- New virus strains can push economic recovery at back.

- Brexit concerns may rise and weigh on the British Pound.

- Technically, GBP/USD has little support but can’t rule out chances of testing previous swing lows.

The GBP/USD is jumping and dancing this week with no clear bias at the moment. Overall, the news is not healthy for the British Pound while US Dollar is getting bids amid a positive economic outlook.

COVID hitting GBP/USD

Meanwhile, there is traditionally little positive news in the UK. At the moment, several topics remain completely incomprehensible at once. For example, how are the British authorities are going to remove all quarantine restrictions on July 19 and allow the citizens to walk everywhere without masks? Every day 25-30k new cases of the disease are recorded in the country, and doctors worldwide note the Indian strain among the sick.

In addition, several deaths from the Indian strain were found among people already vaccinated in the UK. And in Israel, doctors concluded that Pfizer’s vaccine was only about 60% effective against the “lambda strain.” In general, the news is actually very sad. Boris Johnson, who, it seems, from the very beginning of the epidemic, was not eager to introduce a single quarantine and lockdown, hastened this time. Unfortunately, this haste has already led to a full-scale fourth wave. So far, the British authorities clearly expect that the vaccination rate will allow the entire population of Britain to be vaccinated within a month, a maximum of one and a half. But in practice, things may not turn out so sweet.

Brexit concerns

It is also absolutely unclear how all the proceedings between the European Union and Great Britain will end. At the moment, it is clear that Brussels clearly does not want to escalate the situation. It so far confines itself to threats, offering London to sit down at the negotiating table and stop unilaterally changing the clauses of the agreements already signed. However, any patience sooner or later comes to an end. It is unlikely that the European Union will watch for a long time how London changes the “Northern Ireland Protocol” because it considers it ineffective.

GBP/USD technical view: Key levels to watch

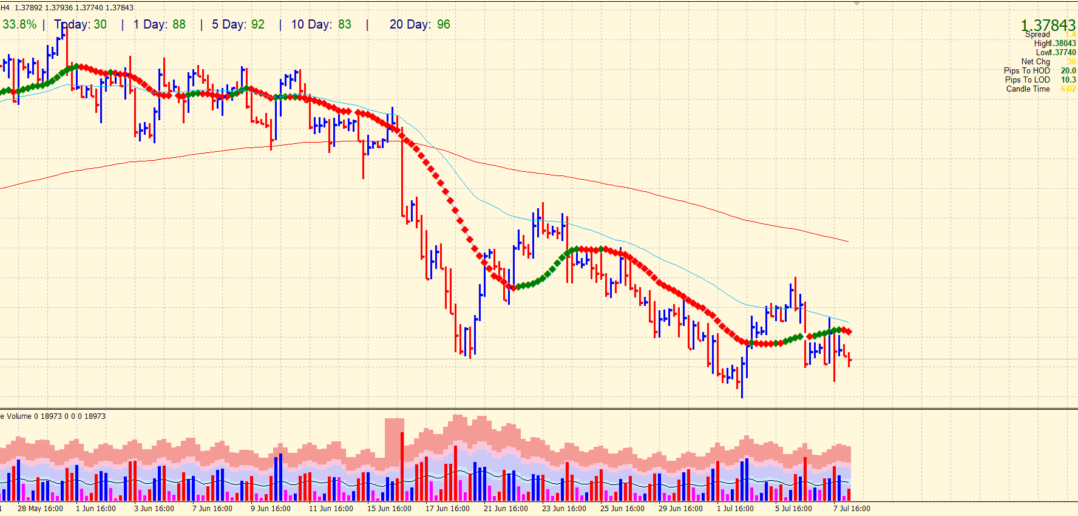

The GBP / USD pair resumed its downward movement on the 4-hour timeframe and consolidated below the moving average (20 and 50). However, the price bar (after Fed meeting minutes) closed off the lows, near the middle with a very high volume. It indicates that there is evident buying in the 1.3730-50 zone. Still, we cannot rule out a test of the recent swing low at 1.3730, leading to 1.3600s.

Support levels:

S1 – 1.3794

S2 – 1.3733

S3 – 1.3675

Resistance levels:

R1 – 1.3855

R2 – 1.3916

R3 – 1.3977

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.