- GBP/USD has been trading in a narrow range amid mixed political news.

- Comments from Boris Johnson and Donald Trump are set to move the currency pair.

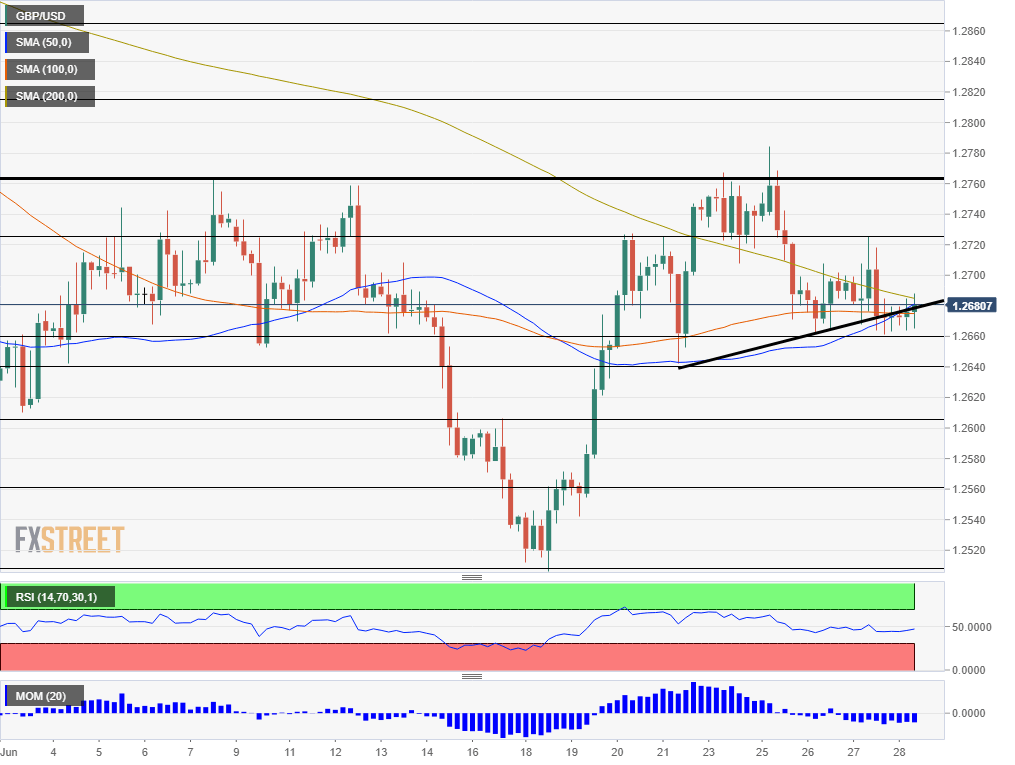

- Friday’s four-hour chart shows GBP/USD continues clinging to uptrend support.

How long will GBP/USD be waiting for some clarity? End-of-quarter may trigger an increase in volatility if politicians do not move currencies beforehand.

Boris Johnson – the favorite to become the UK’s next PM – has refused to rule out suspending parliament in order to ram through a no-deal Brexit. On the other hand, the former foreign secretary previously said that there is only a “million to one” chance that the UK will leave the EU without a deal. Markets fear a disorderly exit on October 31st which would inflict damage to the UK economy.

Perhaps we will need to wait for Johnson to enter Downing Street before his policies become clear – and that is uncertain as well.

The upcoming summit between presidents Donald Trump and Xi Jinping is another source of anxiety. The US and Chinese leaders will meet at the sidelines of the G-20 meeting in Osaka, Japan and will attempt to thrash out the way forward on their trade dispute. Recent reports suggest that Trump is optimistic but he continues threatening new tariffs on China. In turn, the world’s second-largest economy wants all punitive duties to be lifted.

In the meantime, data has failed to ignite price action. First quarter UK growth has been confirmed at 0.5% on a quarterly basis and 1.8% year on year – as broadly expected. US growth was confirmed at 3.1% annualized on Thursday.

The Fed’s preferred inflation measure is due later today – the core price expenditure index for May. It will likely remain below the Federal Reserve’s 2% target, contributing to the Fed’s intention to cut interest rates in July.

The last day of the week, month and quarter will likely see high volatility – especially around the London fix at 15:00 GMT. Money managers need to adjust their portfolios ahead of the close.

All in all, politics is in the spotlight with other factors likely to have a short-lived impact.

GBP/USD Technical Analysis

GBP/USD is battling the uptrend support line that has accompanied it since late last week. It is important to note that the 50, 100, and 200 Simple Moving Averages on the four-hour chart are converging around this line, making it even more significant. Momentum is to the downside and the Relative Strength Index is stable just below 50.

Overall, the picture is balanced.

Some support awaits at the recent lows of 1.2660. The next cushion is close by – 1.2640 is where uptrend support began. Next, 1.2605 capped GBP/USD in mid-June. 1.2558 and 1.2505 are next.

Resistance awaits at 1.2725, which held the pair down on Thursday and also last week. The former double-top of 1.2765 follows. Next up, 1.2815 was a swing high in May and 1.2870 was April’s low.