- GBP/USD is moving higher in Asia, printing fresh highs for the week.

- US dollar runs out of juice as US yields ease, pound firmer on BoE.

The forex space is dominated by the US dollar which has been licking wounds on Wednesday while US yields sapped momentum from its recent rebound.

The benchmark 10-year Treasury yields lost some 7 basis points from a 10-month high hit on Tuesday and the turnaround capped a three-day streak for the dollar.

Against the pound, the greenback suffered a loss of over 1.7% this week, boosted by the Bank of England governor talking down the prospect of negative rates in the United Kingdom.

Key quotes

Negative rates are a controversial issue.

There are a lot of issues with negative rates.

No country has used negative rates in ‘retail’ end of the financial market.

There are good reasons to think we’re in a world of low rates for a long period of time.

Outlook for interest rates hinges on productivity growth.

Too soon to reach any conclusion about the need for future stimulus.

Expects plenty of further evidence in the next few weeks.

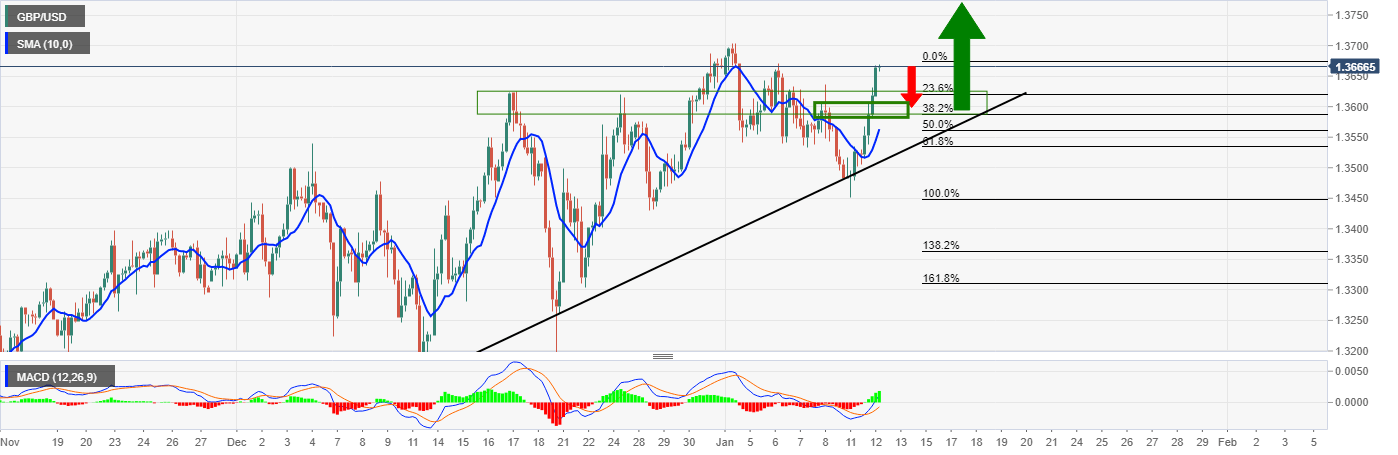

GBP/USD technical analysis

Bulls are on the march in Asia, expanding the upside from overnight trade in New York. However, London could well wipe the floor with the bulls, reversing New York and Asia’s price action which would rhyme with the following prior analysis:

GBP/USD Price Analysis: Bulls back in the driving seat through daily resistance

While the analysis is bullish, prospects for a pullback on the 4-hour chart was illustrated as follows:

The 1.3605 level is a support that is yet to be tested and is, therefore, a compelling corrective target for London’s session ahead.