- GBP/USD has been rising after the US Federal Reserve opened the door to rate cuts.

- A busy day awaits pound traders with UK retail sales, the BOE, and the Conservative Contest.

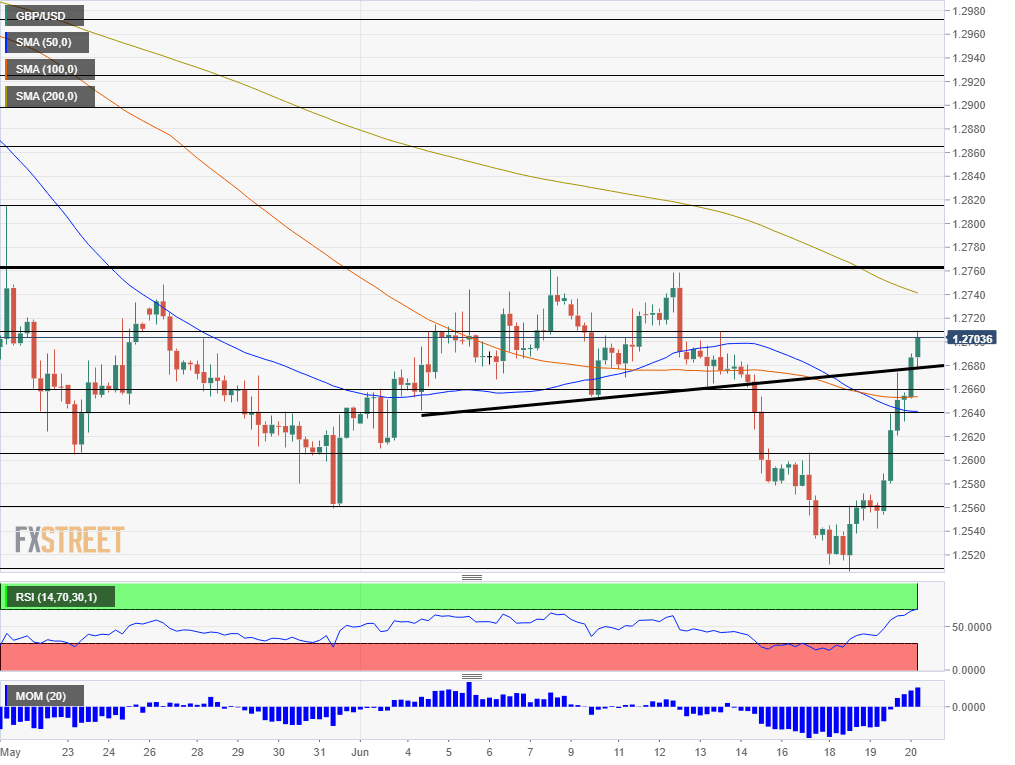

- Thursday’s four-hour chart shows GBP/USD is entering overbought conditions.

Has the pound finally turned around? It has gained around 200 pips from the fresh five-month lows it hit on Tuesday – but the move has been fueled by the dollar’s weakness rather than by Sterling strength.

The US Federal Reserve has signaled readiness to cut interest rates by scrapping its pledge to remain patient and warned about increasing uncertainties. Moreover, many members have indicated they see lower rates this year in the Fed’s updated projections known as the “dot plot.” The central bank is concerned about lower inflation – which it no longer characterizes as temporary – and trade tensions.

The US dollar has been on the back foot since the Fed announced its decision. Commercial banks have added fuel to the fire by publishing new forecasts that foresee the Fed cutting rates as early as July. Further market reactions are due today.

See FOMC: Prelude to a rate cut?

Three top-tier UK events

GBP/USD traders are now shifting their attention to the central bank on the other side of the pond. The Bank of England is set to leave its interest rate unchanged at today’s meeting but may drop its hawkish bias – the BOE has stated it intends to raise rates once it receives some clarity on Brexit.

Recent UK data has been mixed with OK inflation at 2% in May, a low unemployment rate of 3.8% in April, and a shrinking economy – 0.4% in April.

If the BOE follows the Fed, the European Central Bank, and others and scraps its desire to raise rates, the pound may fall. If Governor Mark Carney and his colleagues stick to their optimism, GBP/USD has room to reverse its gains.

See BOE Preview: Will Carney cause carnage to GBP/USD?

Just before the decision, UK retail sales are scheduled and are projected to show a drop of 0.5% month on month in May. The numbers are unlikely to impact the BOE but may certainly rock Sterling.

Last but not least, the Conservative Party holds two additional rounds of voting in its leadership contest. Former foreign secretary Boris Johnson is firmly in the lead after winning 143 votes, around the combined support of the three members after him. Investors fear that he will lead to hard Brexit.

Rory Stewart – the only candidate who rejects exiting the EU without an accord – has been eliminated by fellow MPs in the third round on Wednesday. His drop out of the race followed that of Dominic Raab – which supports a hard Brexit and even bypassing parliament.

Apart from Johnson, current foreign secretary Jeremy Hunt, home secretary Sajid Javid, and environment minister Michael Gove are vying for second place. One of these three will be eliminated in the fourth round and another in the fifth round both held today. Results will be made known at 12:00 GMT and at 17:00 GMT.

The final two candidates will face 160,000 members of the Conservative Party which will vote by post and Tories are expected to install a new leader and Prime Minister by July 22nd.

Overall, markets will likely focus on central banks with one eye on the Conservative contest.

GBP/USD Technical Analysis

GBP/USD has been rising swiftly back by robust upside momentum. On its way up, it has broken above the 50 and 100 Simple Moving Averages. However, the Relative Strength Index on the four-hour chart points to overbought conditions – surpassing 70 – and this indicates a potential downside correction.

The next resistance line is critical – 1.2765 was a double top seen earlier this month. It is followed by the swing high of 1.2815 recorded in May and by the April low of 1.2870. Further above, 1.2900 and 1.2925 await.

GBP/USD has some support at 1.1210 which was a swing high last week. It is followed by 1.2660 and 1.2640 which were both stepping stones on the way up. Next, we find 1.2625 which capped cable late last week.