- GBP/USD has been extending its gains on hopes for a fisheries-related Brexit breakthrough.

- Markets are struggling between coronavirus concerns and vaccine hopes.

- Wednesday’s four-hour chart is pointing to further gains.

France may be forgoing some of its demands on fisheries – opening the door for a Brexit deal next week, at least according to the UK’s Telegraph. The overnight report comes one day after another paper, The Sun, published an article reflecting optimism on the British side for a deal.

The EU and the UK continue intense talks about future relations in Brussels, and these upbeat headlines are pushing the pound higher. While both sides are likely to miss their goal of shaking hands before Thursday’s virtual EU Summit, investors eye a deal early next week. An update from Brussels is due out early on Friday, and speculation is mounting.

GBP/USD is trading closer to 1.33, but can it continue higher? Apart from incessant Brexit headlines, the currency pair is swaying in response to coronavirus related developments.

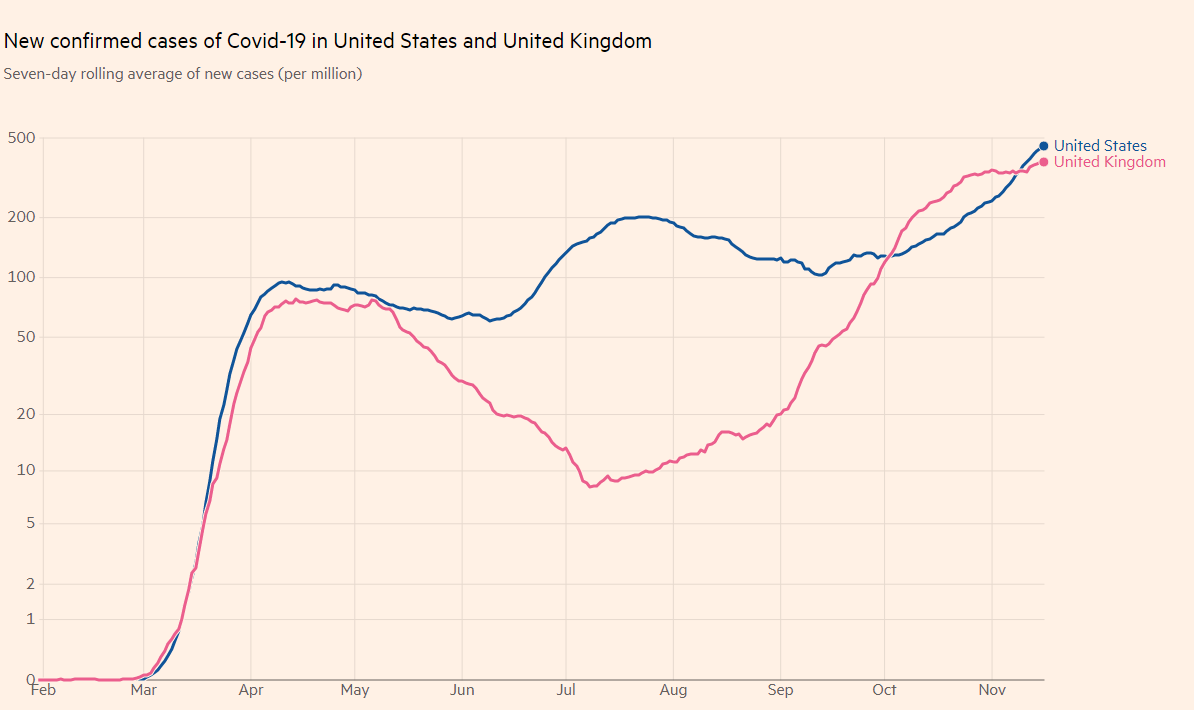

Cases and deaths continue rising on both sides of the Atlantic, with Britain not ruling out extending the nationwide lockdown, which expires on December 2. In the US, hospitalizations hit yet another new record above 78,000 and several reluctant governors have imposed restrictions. Cases in the UK have resumed their rises, yet remain below those in America.

Source: FT

On the other hand, investors are clinging to vaccine hopes. Pfizer and BioNTech announced that their inoculation has passed a key safety milestone, en route to receiving authorization. Earlier this week, Moderna joined Pfizer in announcing promising results for its immunization candidate.

While economic data is on the back burner in comparison to virus and Brexit developments, it also favors cable bulls. Headline UK inflation beat estimates with an annual rise of 0.7% in October while US Retail Sales fell short of expectations, posting a meager growth rate last month.

US Retail Sales expansion slows in October, GDP estimate improves

Overall, sterling has room to rise.

GBP/USD Technical Analysis

Pound/dollar has been extending its uptrend, benefiting from upside momentum on the four-hour chart and continuing to set higher highs. The Relative Strength Index is still below 70, thus outside overbought conditions.

At the time of writing, GBP/USD has surpassed 1.3280, a peak recorded last week. Further above, critical resistance awaits at 1.3310, the November high. The next lines to watch are 1.3360 and 1.3420.

Support awaits at 1.3240, which has been a separator of ranges in recent days. It is followed by 1.3290 and 1.3150.

More GBP/USD Forecast: Three reasons to expect a sustained Santa rally for sterling