- GBP/USD has been plummeting from the highs amid tensions with China.

- Reports about abandoning Brexit talks are also weighing on sterling.

- Hopes for a vaccine made way to doubts about antibodies.

- Wednesday’s four-hour chart is showing bulls are still in the lead.

Houston, we have a problem – and this time it is not related to strained hospitals in America’s fourth-largest city but rather to Sino-American relations. That is the latest GBP/USD downer and others are also weighing.

1) Houston consulate closure

The US has ordered the closure of China’s consulate in Houston. The state department says that it comes amid Intellectual Property (IP) violations – stealing trade secrets. Earlier, images coming of the Texan city showed a fire coming out of the consulate – potentially workers burning documents.

The safe-haven US dollar is on the rise, recovering part fo its losses.

Sino-British relations had intensified earlier in the week, as the UK canceled its extradition treaty with Hong Kong following Beijing’s tightening grip on the city-state. Britain will also phase out the usage of Huawei’s 5G technology.

2) Bye-bye Brexit talks?

The Daily Telegraph – a UK media outlet with ties to the Conservative Party – reported that Prime Minister Boris Johnson’s government is contemplating abandoning Brexit talks. Negotiations with Brussels have been stuck in recent months, but both sides have been committing to continuing talks.

While this report may be a negotiating tactic, it dampens the mood and weighs on the pound.

US Secretary of State Mike Pompeo visited London and while both counties seem united on the Chinese front, an Anglo-American trade deal is still far off.

3) Vaccine cooldown

Early in the week, sterling and broader markets benefited from the University of Oxford’s progress toward a COVID-19 vaccine. The encouraging news of the Phase 1/2 trial conducted in collaboration with AstraZeneca has now made a place for some skepticism.

Doubts about the efficiency of that vaccine candidate have taken some of the wind out of the pound’s gains. Another blow came from the New England Journal of Medicine, which reported that recovered coronavirus patients saw their antibodies fading away after an average of 73 days.

The long road toward resolving the issue is weighing on stocks and boosting the dollar.

While UK COVID-19 cases are declining, US figures remain elevated, with deaths surpassing the 1,000 mark for the first time since early June. President Donald Trump made an abrupt U-turn, calling on people to wear masks and warning things could worsen before they improve.

Overall, fundamentals are pointing to further falls for GBP/USD.

GBP/USD Technical Analysis

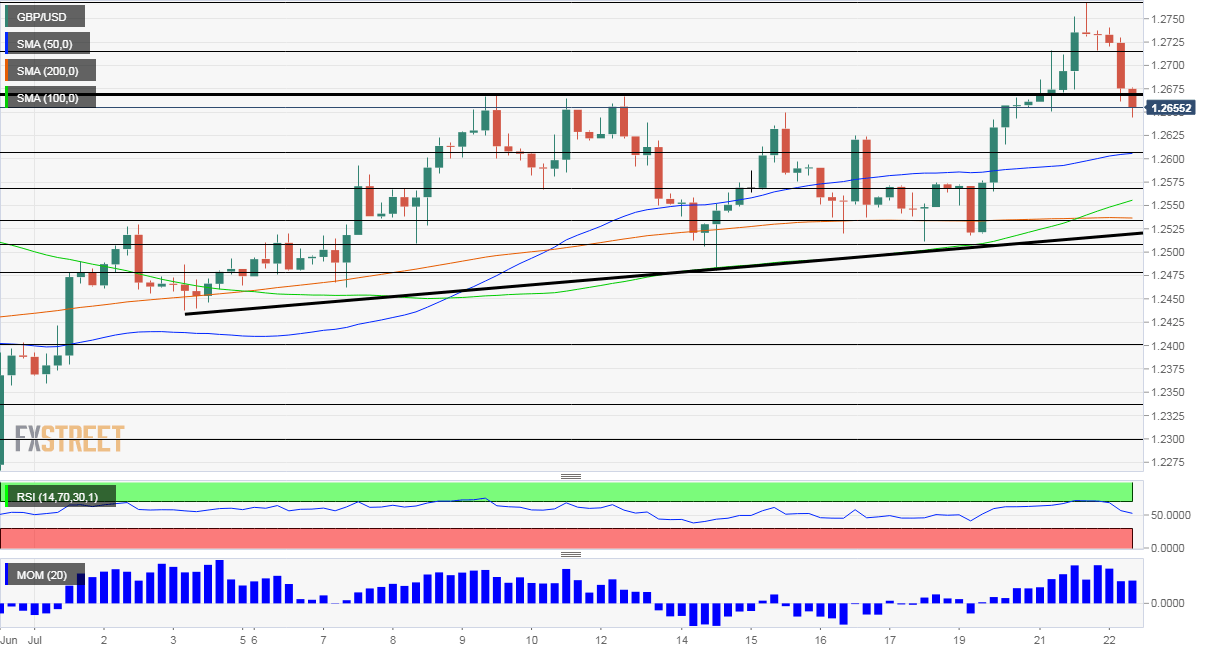

Contrary to news developments, technicals remain upbeat. Pound/dollar is benefiting from upside momentum and trades above the 50, 100, and 200 Simple Moving Averages. Moreover, the Relative Strength Index has dropped below 70, exiting overbought conditions.

All in all, bulls have the upper hand.

Support awaits at 1.2610, where the 50 SMA hits the price. The next cushion is at 1.2565, a swing low from mid-June. It is followed by 1.2530 and 1.2510.

The former triple top of 1.2670 returns to its role as resistance, followed by 1.2715, a stepping stone on the way up. July’s high of 1.2770 and June’s peak of 1.2815 are next.

More 2020 Elections: Trump is losing his economic edge, for three robust reasons