GBP/USD had a great week rising to the highest levels since January as the mood in markets improved. A very busy week awaits the pound: inflation, employment, and retail sales stand out. Here are the key events and an updated technical analysis for GBP/USD.

China and the US traded pleasantries about trade relations, Trump mused about returning to the TPP, and also hope for Brexit talks on trade which begin now all pushed the pair higher. Worries about Syria were ignored. Over the weekend, the US, the UK, and France launched airstrikes against the Assad regime’s chemical weapons but the wider effects may be limited. In the US, the Fed expressed confidence about the economy and inflation reaching its targets while inflation indeed increased to 2.1% on the core. What’s next?

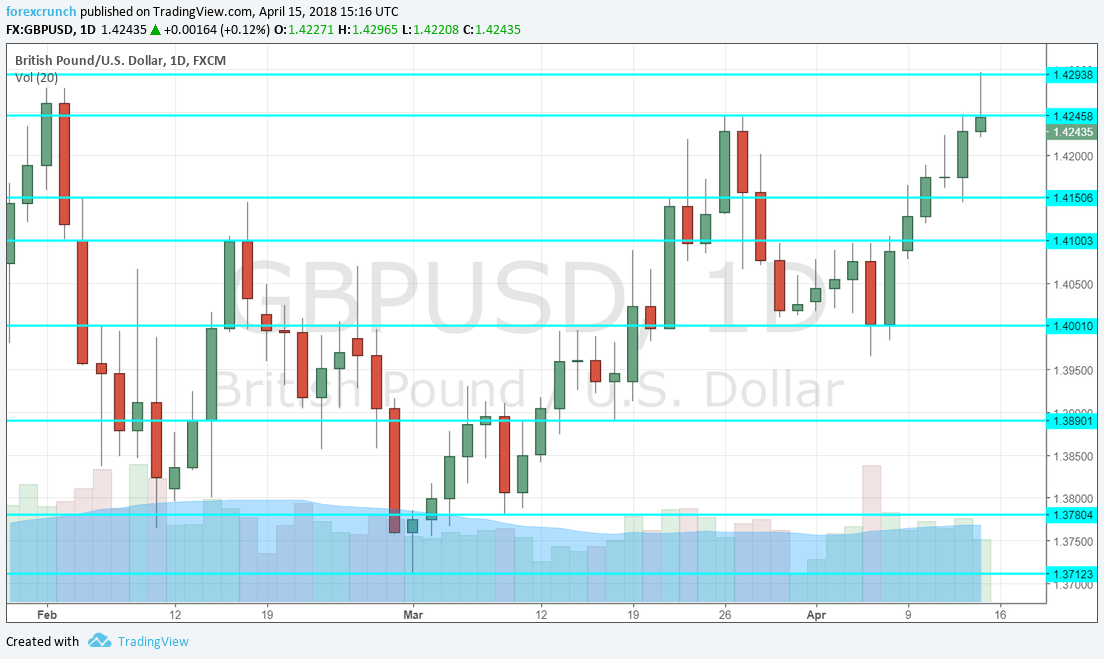

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. Early in the week, Britain’s earliest House Price Index is out. It last showed a big rise of 1.5% m/m in March. This time, the report for February may be more modest.

- CB Leading Index: Monday, 13:30. The composite index by the Conference Board has remained flat in January. The report for March may show an uptick. Note that most of the seven indicators that make this gauge have already been published.

- Jobs report: Tuesday, 8:30. The last jobs report was quite mixed. Wages rose by 2.8% y/y in January but the Claimant Count Change rose by 9,200 in February, worse than expected. The unemployment rate reverted back to 4.3% in January and that is unlikely to change in the report for February. The focus remains on the wages: the ongoing acceleration in pay implies a growing case for a rate hike in May. A rise to 3% is expected. However, another rise in jobless claims could trigger worries: an increase of 13.3K is forecast.

- Inflation report: Wednesday, 8:30. Britain publishes key data day after day. Inflation slowed down to an annual pace of 2.7% in February, off the edge of the 1-3% range that is mandated by the Bank of England. The same level is expected for March. The stronger pound has pushed prices of imported goods lower. Another slowdown could be seen in the data for March. Core CPI was at 2.4% (2.5% projected now) while the PPI Input fell by 1.1% m/m back then (+0.4% expected now).

- Retail Sales: Thursday, 8:30. After two disappointing months, sales rebounded by 0.8% in February. A drop of 0.5% is projected for March, countering that rise. While the indicator is volatile, consumption is a significant part of the economy in the UK.

- Jon Cunliffe talks, The Deputy Governor of the Bank of England attends the IMF Meetings in Washington and apart from speaking, he will answer audience questions. Cunliffe is usually within the consensus of voters.

- Michael Saunders talks: Friday, 9:30. The external member of the Monetary Policy Committee (MPC) speaks in Glasgow and may reiterate his hawkish views. Saunders voted for a rate hike more than once.

GBP/USD Technical Analysis

Pound/dollar initially batteld with the 1.4150 level (discussed last week) before moving higher and nearing 1.43.

Technical lines from top to bottom:

1.4345 is the January 2018 swing high that is worth watching. 1.4300 capped the pair in mid-April. .

1/4260 was the high point in March and provides another line of defense. 1.4150 capped the pair in mid-February.

1.41 capped the pair in early April and also in mid-March. It is followed by the round level of 1.40, which is eyed by many.

1.3890 served as support in mid-March and maintains its role. 1.3790 was a swing low in mid-March.

I am neutral on GBP/USD

While Brexit negotiations may get stuck at some point, the current optimism will probably be good enough to counter the US Dollar. The greenback does not price in the rise in US inflation.

Our latest podcast is titled Volatility venting and Brexit can-kicking

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!