GBP/USD posted gains of around 1.0% for a second straight week. The pound climbed 1.1% and came close to the 1.23 line. There are no major British releases in the upcoming week. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

British data was mixed last week. The Confederation of British Industry survey pointed to a drop of -13 in manufacturing orders in August, but this was better than the previous reading of -34. The CBI also found that sales volumes plummeted in August, with a reading of -49. This points to deteriorating business conditions in the U.K. There was positive news as well, as the U.K. posted a rare surplus, which came in at GBP 2.0 billion.

The ongoing trade war between the U.S and China heated up last week, and the pound took full advantage. China has retaliated against U.S. tariffs with its own tariffs on U.S. oil imports and automobiles. U.S. President Trump is not holding back any punches, and has announced new tariffs on hundreds of billions of dollar worth of Chinese imports, which would kick in on September 1 and October 1.

The Fed minutes provided details of the July meeting, in which the Fed cut rates by 25 basis points, the first rate cut in 10 years. FOMC members said that the cut was intended to stimulate inflation and business investment. The Fed was deeply divided over the July cut, with two members in favor of no change, while another two sought a 1/2 percentage cut. With economic conditions looking cloudy, investors are braced for up to three more rate cuts this year, possibly as early as September.

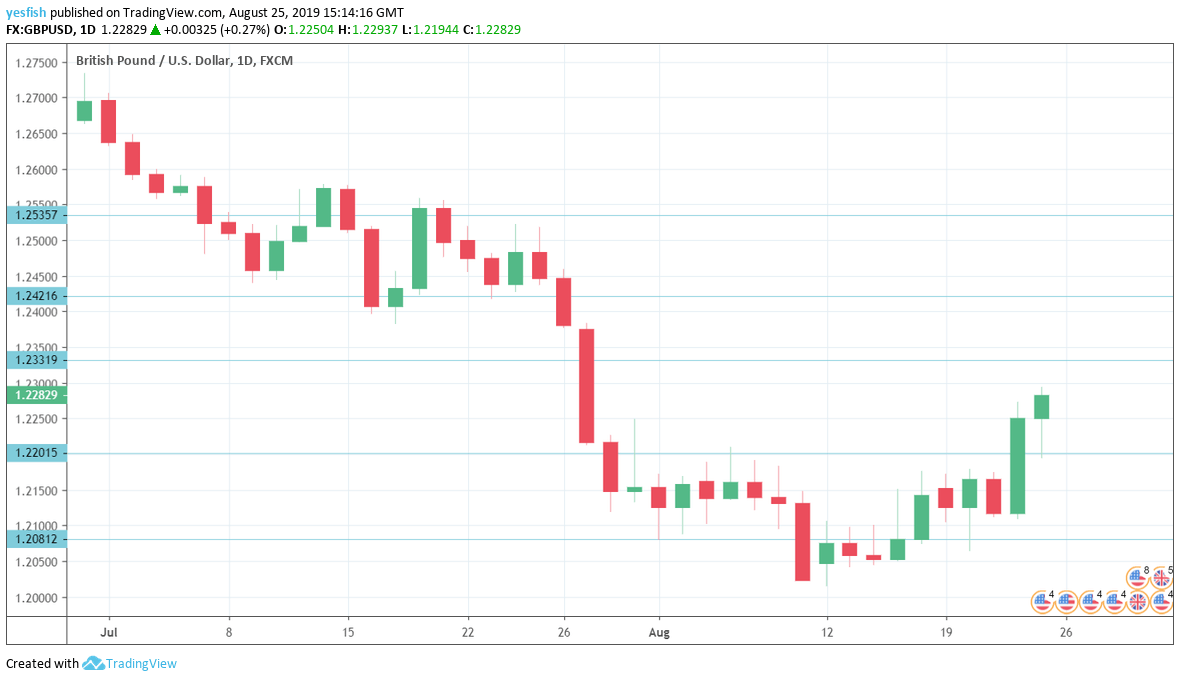

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- High Street Lending: Tuesday, 4:30. The U.K’s major banks sold 42.7 thousand mortgages in July, shy of the estimate of 42.7 thousand. Little change is expected in August, with a forecast of 42.8 thousand.

- BRC Shop Price Index: Tuesday, 19:01. This inflation index has posted two straight declines of 0.1%. Will we see an improvement in the upcoming release?

- GfK Consumer Confidence: Thursday, 19:01. The British consumer remains pessimistic, as weak global conditions and the Brexit stalemate are weighing on consumers. The indicator came in at -11 in July and no change is expected in the August release.

- Net Lending to Individuals: Friday, 4:30. New credit levels jumped to GBP 4.8 billion in June, up from 3.9 billion a month earlier. The estimate for July stands at 4.7 billion.

* All times are GMT

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2610.

1.2535 has held since mid-July. This is followed by 1.2420.

1.2330 (mentioned last week) has held in resistance since the end of July.

The round number of 1.22 remains relevant.

1.2080 is the first support level.

The round number of 1.20 is the first support level.

1.1943 is next.

1.1904 was the low point in October 2016. It is the final support line for now.

I am neutral on GBP/USD

After a sharp slide, the pound has regained its footing and put together back-to-back winning weeks. Will the rally continue? The U.K. is due to leave the EU in just two months, and a no-deal exit remains a strong possibility which could weigh on sentiment towards the pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!