GBP/USD posted sharp losses for a third straight week, as the pair fell 1.1% last week and fell to its lowest level since January 2017. The upcoming week will be busy, with the focus on employment data and consumer spending and inflation reports. Here is an outlook for the highlights of the upcoming week and an updated technical analysis for GBP/USD.

The U.K. services sector showed a slight improvement in July. The services PMI rose to 51.4 in July, its highest level since October. Still, the reading points to stagnation. GDP data was unimpressive. The monthly GDP release slowed to zero in May, down from 0.4% a month earlier. Preliminary GDP for Q2 declined 0.2%, after the final reading for Q1 posted a gain of 0.5%. These readings point to a slowdown in the British economy.

In the U.S., the ISM Non-Manufacturing PMI slowed to 53.7 in July, its lowest level in almost three years. This is indicative of weaker expansion in the services sector. The week wrapped up with inflation data, which remains at low levels. The producer price index was unchanged at 0.2%, matching the forecast. The core release declined by 0.2%, its first decline of the year.

U.S. equity markets had their worst one-day fall in 2019 on Monday, after China devalued its currency to a 10-year low against the dollar. The move prompted the U.S. to label China as a “currency manipulator”. China also retaliated against the U.S. pledge to hit Chinese products with a new 10% tariff, as Beijing said it would no longer purchase any U.S. agricultural products.

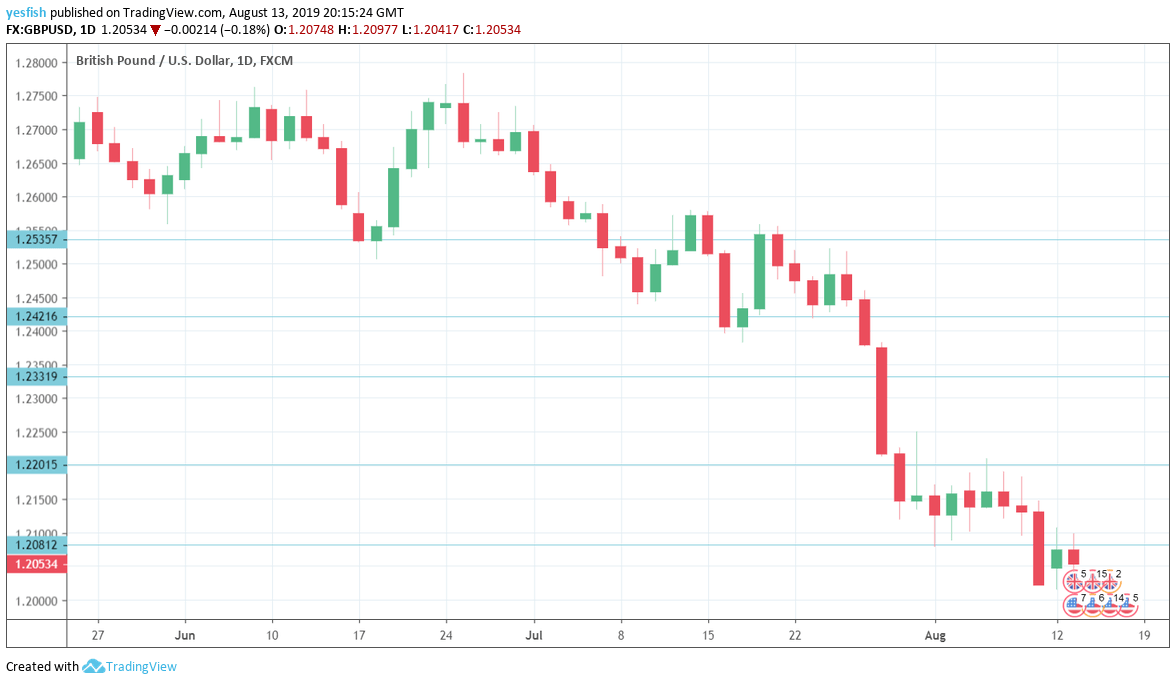

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- Employment Data: Tuesday, 8:30. Wage growth improved to 3.4% in June, up nicely from 3.1% a month earlier. The upward trend is expected to continue, with a forecast of 3.7%. Unemployment claims jumped 38.0 thousand, much higher than the estimate of 18.9 thousand. This was the highest level since 2009. The estimate for July stands at 42.0 thousand. The unemployment rate remains very low, and has been pegged at 3.8% for the past three months. No change is expected in the upcoming release.

- CB Leading Index: Tuesday, 13:30. The Conference Board index declined by 0.4% in May, pointing to weakness in the economy. Will we see any improvement in the June release?

- Inflation Data: Wednesday, 8:30. The BoE has an inflation target fo 2.0%, so policymakers are no doubt pleased that CPI has come in at 2.0% for the past two months. The estimate for July stands at 1.9%. PPI Output has not been as strong, posting a sharp decline of 1.4% in June. The markets are expecting better news in July, with an estimate of 0.6%.

- Retail Sales: Thursday, 8:30. Retail sales is the primary gauge of consumer spending. The indicator declined 0.5% in May, but rebounded in June with a gain of 1.0%. This easily beat the estimate of -0.3%. The markets are braced for another decline, with an estimate of -0.3%.

* All times are GMT

GBP/USD Technical analysis

Technical lines from top to bottom:

We start with resistance at 1.2420.

1.2330 (mentioned last week) has strengthened as a resistance line as GBP/USD continues to head lower.

The round number of 1.22 follows.

The pair broke through support at 1.2080 late in the week. This line had protected the symbolic 1.20 level.

1.1943 is next.

1.1904 was the low point in October 2016. The round number of 1.18 follows.

1.1650 is the final support level for now.

I remain bearish on GBP/USD

The pound slipped over 4.0% in July and the downward trend has continued into August. With an upredictable Boris Johnson at the helm, the likelihood of a hard Brexit is growing, and that scenario is weighing on the pound. The escalation of the trade war between the U.S. and China isn’t good news for the pound, as nervous investors are flocking to safe-haven assets, such as the U.S. dollar.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!