- GBP/USD has been falling amid the Brexit deadlock and US coronavirus fears.

- Looser UK restrictions and PM Johnson’s Brexit meeting are eyed.

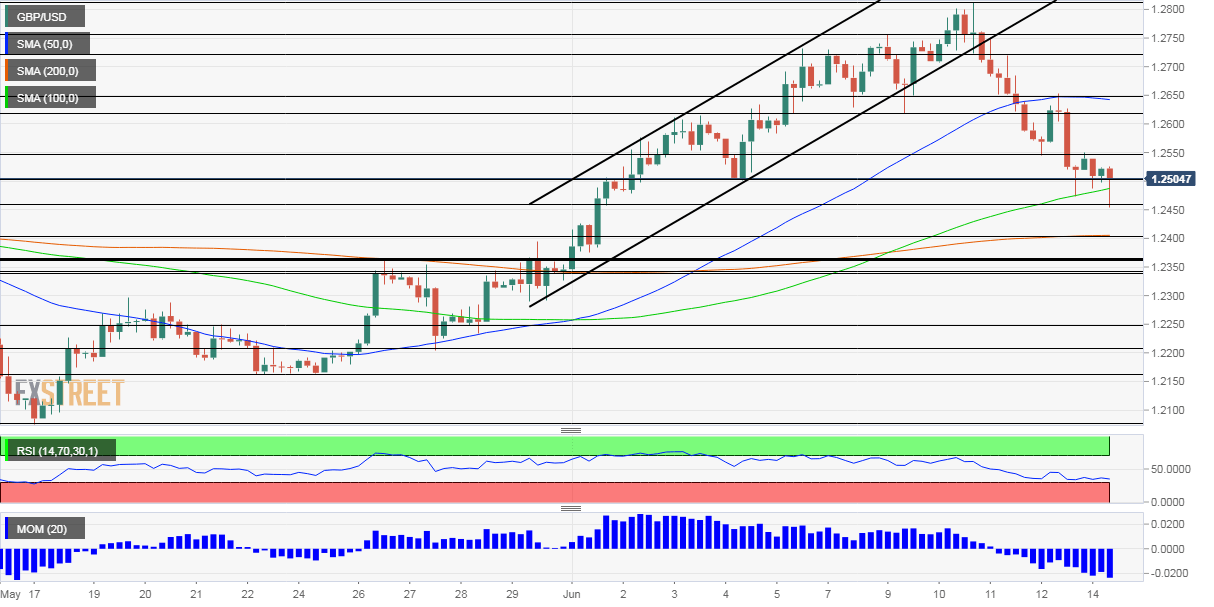

- Monday’s four-hour chart is pointing to further losses.

Non-essential shops are opening – and Prime Minister Boris Johnson is encouraging consumers to gradually return to normal.

The pound is unimpressed.

GBP/USD has lost more than 300 pips from the recent peak amid a mix of gloom from the UK and the US.

The PM may turn the tide by attempting to reach a Brexit breakthrough. The UK and the EU are at loggerheads in talks about future relations, on topics ranging from fisheries and regulations. He will have a call with European Commission President Ursula von der Leyen and other top bloc officials.

London has insisted it will not ask to extend the current transition period that expires at year-end – with the UK potentially falling to World Trade Organization rules in 2021. A group of MPs from different parties is urging the government to change tack amid the coronavirus crisis.

While UK cases are edging lower and restrictions are lifted, people entering the UK from abroad are required to quarantine for 14 days – all but killing tourism and slowing the recovery. British Airways and other airlines will reportedly sue the government for the move.

On the other side of the pond, increases in COVID-19 infections in nearly half of the states – including several large ones – is souring the mood. Daily figures from Florida, Texas, Arizona, and California are watched closely.

So far, officials have resisted reimposing restrictions, buoyed in part by optimism from the White House. Larry Kudlow, President Donald Trump’s adviser, insisted that the US is opening up and that a V-shaped recovery is at hand. However, markets seem to believe the Federal Reserve’s more downbeat assessment of a slow return to pre-pandemic output.

The Fed’s Empire State Manufacturing Index is on the calendar today, but COVID-19 news – including from Beijing which is suffering an outbreak – will probably have a greater impact on markets.

GBP/USD Technical Analysis

Pound/dollar is suffering from downside momentum on the four-hour chart, falling and it is fighting to hold onto the 100 Simple Moving Average after losing the 50 SMA beforehand. The Relative Strength Index is above 30, outside oversold conditions, and allowing for fresh falls.

Support is 1.25, a round number that also served as support in early June. Next, the daily low of 1.2455 and 1.24, which is where the 200 SMA hits the price, are the next lines to watch.

Resistance is at 1.2550, the daily high, followed by 1.2615, a swing high from last week, followed by 1.2650, a peak on Friday. Further above, 1.2725 and 1.2755 await.