- The pound has been weakened by the possibility of a referendum on Scottish independence.

- The soaring dollar has pushed GBP/USD below 1.2000.

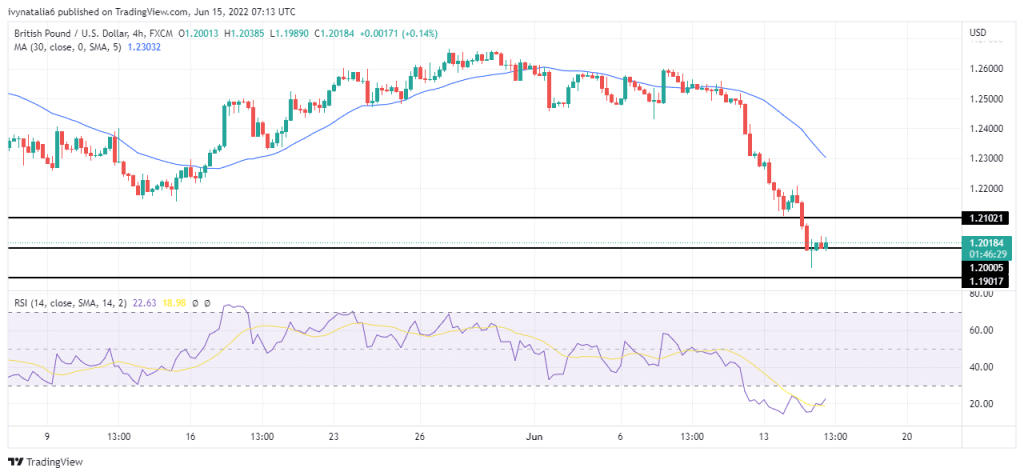

- Bulls might return as the price is oversold on the 4-hour chart.

The GBP/USD forecast remains slightly positive after finding a pullback from multi-month lows. The pair is expected to stay volatile on both sides ahead of the FOMC meeting. The possibility of a new referendum on Scottish independence has not favored the pound. Sterling was at $1.2010 after hitting a 15-month high against the dollar at $1.1934 yesterday.

-Are you interested in learning about forex tips? Click here for details-

When the UK’s finance minister, Rishi Sunak, announced further help for households facing a big cost-of-living hit, economists had thought it might increase confidence in Britain’s economic outlook and, with it, the currency. However, the pound has fallen 4.5% against the dollar since late May.

Sterling was further weakened when US inflation accelerated more than expected, intensifying bets on Fed rate hikes. Worse yet, it could follow if, as the markets increasingly anticipate, the Fed raises its primary interest rate by 75 basis points later in the day, which would be its most significant increase since 1994. The reverse could happen as markets have already priced in the big rate hike.

“In their view, it will take more than a 75-bp hike tomorrow, or a nod to a 100bp hike for the FOMC’s July meeting, to push the USD significantly higher after the FOMC meeting,” said CBA analysts in a morning note.

GBP/USD key events today

Investors will have all their focus on the United States today. The US’s core retail sales are expected to increase to 0.8% from 0.6%, while retail sales are expected to drop to 0.2% from 0.9%.

More weight is placed on the FOMC meeting, ending today with investors waiting to see the interest rate decision.

GBP/USD technical forecast: Supported by 1.2000

Looking at the 4-hour chart, we see the price is holding at 1.2000, a significant psychological level, after a strong bearish move. The RSI is oversold, showing bears cannot go further before resting. At this point, short-term bulls could push the price to retest 1.2100 or higher before the bearish trend resumes.

-Are you interested in learning about the forex basics? Click here for details-

However, if bears are still strong, we could see a direct push to 1.1900 and lower still. The pair is in a bearish market on the 4-hour chart and will remain if the price trades below 30-SMA and the RSI is below 50.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money