- GBP/USD wobbles up and down after US NFP.

- The US NFP came up with dismal jobs figures but showed a growth in wages and a decline in the unemployment rate.

- The US dollar remains on the backfoot after the data release. ISM services PMI could not help bulls.

The GBP/USD forecast is bullish after the dismal US NFP, bearish US dollar and prevailing risk appetite in the market.

Over the past hour, the GBP/USD pair slightly weakened after its bullish surge following the NFP and retreated 40 pips from a three-week high of 1.3865 hits over an hour ago. However, the pair managed to regain the losses but lacks follow-through to post fresh highs.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

As the GBP/USD pair was consolidating briefly during trading, it caught some new bids and continued to push towards 1.3800. However, the dollar weakened for the third day in a row amid doubts about the US labor market’s recovery.

After a closely watched NFP report showed that 235,000 new jobs were added to the economy in August, well below the 750,000 expected, selling pressure on the dollar increased. However, the downward revision of the previous month to 1053K from 943K initially reported somewhat offset the disappointing headline pressure.

Market expectations were met with a decrease in unemployment to 5.2% from 5.4% in July. Furthermore, median hourly wage data beat consensus and indicated strong growth. However, the data may have led investors to further doubt the likelihood of an announcement soon.

The US ISM services PMI data came in line with the expectations. Hence the market did not find any volatility after the event.

In the meantime, the weaker than expected US economic data now appears to raise concerns about the dangers posed by the rapidly spreading Delta Coronavirus. As a result, there have been some moderate pullbacks in US stocks, boosting the US dollar and limiting the upside potential of the GBP/USD pair.

–Are you interested to learn more about forex signals? Check our detailed guide-

GBP/USD price technical forecast: Bullish crossover to support

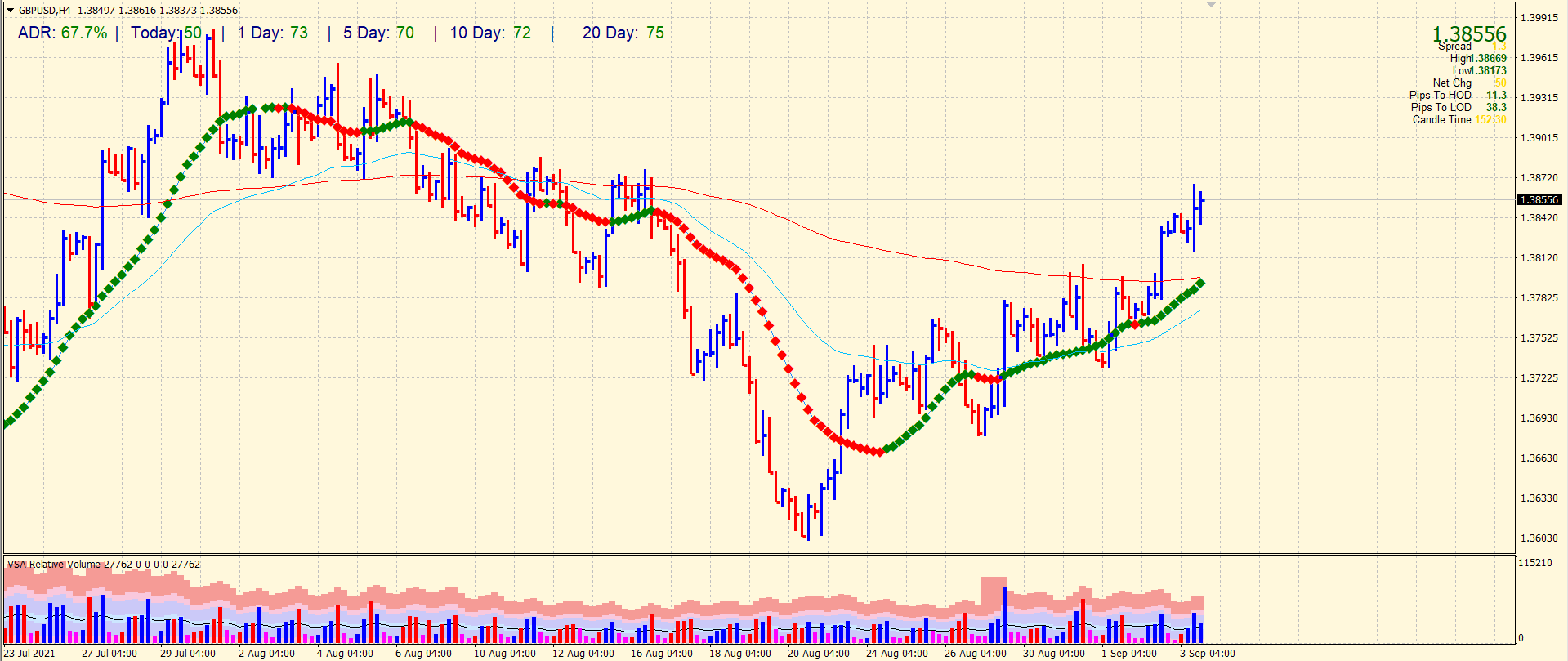

Despite a high impact event, the GBP/USD has covered 67% average daily range. It indicates that the market participants are still cautious to enter the market. The 20 and 200 SMAs on the 4-hour chart will make a bullish crossover that may provide further support to the bulls. However, the previous 4-hour bar closed off the highs while the volume was ultra-high. It indicates that the pair may consolidate further before take a directional move.

The upside targets are at 1.3910 ahead of 1.3950 and then 1.4000. On the flip side, 1.3800 is the immediate support ahead of 1.3770 and then 1.3730.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.