- GBP/USD reverses from an intraday high on weaker-than-expected British inflation statistics.

- UK CPI hits a new high of 9.0 percent year on year in April, but below the 9.1 percent expected.

- The market’s risk-off mood hinders recovery attempts in the absence of major events.

The GBP/USD forecast remains bearish during the London session as the pair dips -0.57% so far. At the time of writing, the pair is trading at 1.2419.

–Are you interested in learning more about forex robots? Check our detailed guide-

After failing to break beyond the psychological level of 1.2500, the GBP/USD pair saw heavy selling on Wednesday, snapping a three-day gaining streak to a two-week high.

The British pound fell across the board as statistics from the UK revealed that the headline CPI rose to a 40-year high of 9% in April.

In a statement issued on Wednesday, UK Foreign Minister Liz Truss expressed worry over the country’s economic predicament. Truss said that “we’re facing a very difficult economic situation.”

The foreign secretary notified parliament on Tuesday of the government’s intention to assert its version of the Northern Ireland protocol. This threat is intended to compel the EU to renegotiate the 2019 exit deal.

Investors now fear that the legislation would spark a trade war amid a rise in the cost of living, which will harm the UK economy and justify the Bank of England’s pessimistic outlook.

The USD was back in demand, halting its recent corrective decline from a two-decade high, as expectations for the Fed to tighten policy more aggressively rose. The markets believe that the US central bank will need to adopt more dramatic measures to control inflation.

GBP/USD key events to watch

We had Core Inflation figures on the UK docket, which were 6.2%.

We have Building Permits for April and Housing Starts on the US calendar.

The UK inflation figures have weighed on the GBP/USD moves without US events. Brexit and a stronger USD are additional factors that threaten Cable’s upside momentum.

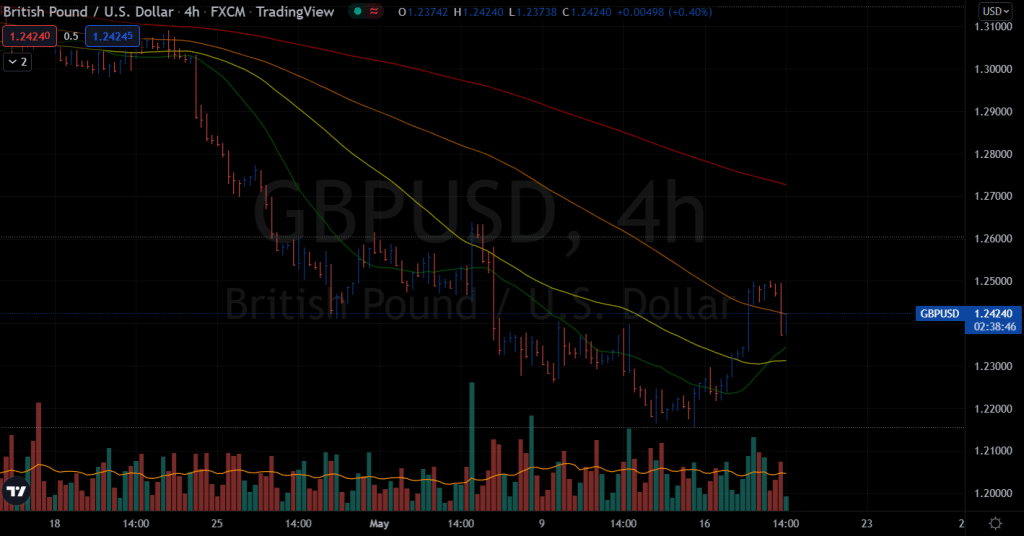

GBP/USD price technical forecast: Dipping below 1.2385

The GBP/USD price forecast remains bearish, with the pair losing its overnight gains. The pair is now trading at 1.23813.

The 4-hour chart shows bearish momentum. The price is above 20 and 50 SMAs below the 100 and 200-period SMAs.

–Are you interested in learning more about South African forex brokers? Check our detailed guide-

GBP/USD is now hitting the 1.2381 level. A fall below 1.2335 will bring the pair towards the 1.2273 support level. If the pair dips below this level again, it will challenge the next support level at 1.2219.

On the upside, the pair can go towards the next resistance level, around 1.2496. A break over 1.2556 will pave the way for a test of the following resistance level of 1.2619.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money