- GBP/USD has rebounded amid end-of-quarter flows and upbeat US figures.

- Brexit, the Leicester lockdown, and doubts about Johnson’s plan may send sterling lower.

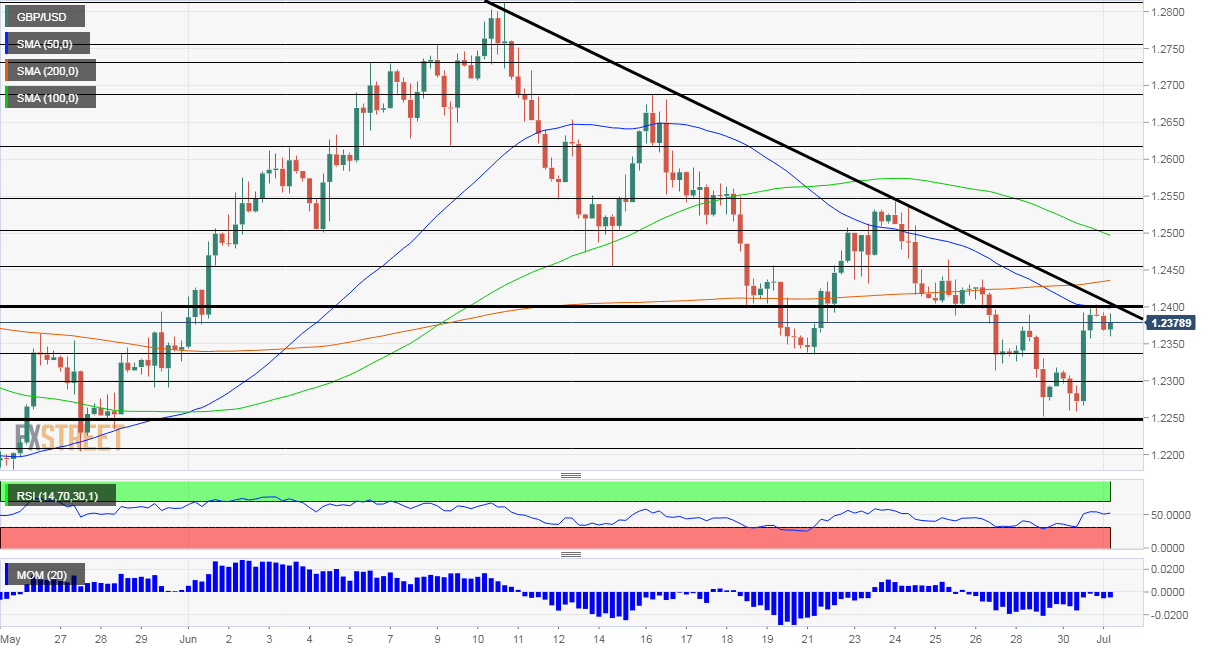

- Wednesday’s four-hour chart is showing downtrend resistance remains intact.

A cat is said to have nine souls and also the volatile found its mojo amid end-of-quarter flows – but it may be yet another “dead-cat bounce.” Money managers’ adjustment of portfolios sent sterling surging on Tuesday, with a 100+ pip bounce – yet it failed to break above the downtrend resistance line.

GBP/USD also benefited from dollar weakness, stemming from diminishing demand for the safe-haven currency. Stocks advanced and the greenback gave ground as the Conference Board’s Consumer Confidence measure surprised with a stronger than expected bounce to over 98 points.

Nevertheless, the pound continues struggling with a plethora of issues. Michel Barnier, Chief EU Negotiator, hinted that talks are not going anywhere fast despite the face-to-face meetings and the previously reported new impetus. June 30 marked the official deadline for the UK to ask for an extension of the Brexit transition period that expires at year-end – and that deadline is now gone. Without an accord, Britain will fall to World Trade Organization rules in 2021.

Another issue is the coronavirus situation in the UK, with Leicester coming under a new lockdown – the first localized one – amid a cluster of cases. The UK has been shunned out of a list of countries whose people can visit the bloc, despite elevated spending by British tourists.

Hopes for a substantial fiscal boost – a la the FDR’s New Deal – have also faded. Reports suggest that Prime Minister Boris Johnson’s grand words “Build, build, build” may only be touting plans already approved. More details are awaited from Rishi Sunak, Chancellor of the Exchequer. The downgrade of first-quarter Groos Domestic Product from -2% to -2.2% makes his job more difficult.

More Five reasons to extend the 500-pip fall and levels to watch

On the other side of the pond, lawmakers approved extending support to small businesses, yet a broader fiscal plan is still under discussion. Steven Mnuchin, America’s Treasury Secretary, expressed hope to reach a deal. Jerome Powell, Chairman of the Federal Reserve, who appeared alongside Mnuchin, reiterated that a return to pre-pandemic output depends on defeating the disease.

Coronavirus cases remain on the rise in America – with infections hitting records on an almost daily basis. Additional states are slapping restrictions or halting the reopening yet investors still see the upside.

That will come to test with two significant releases on Wednesday – ADP’s private-sector jobs report and the ISM’s Manufacturing Purchasing Managers‘ Index. Both are projected to recover and will shape expectations for the official Non-Farm Payrolls release due out on Thursday.

See:

- ADP Employment Change Preview: Positive but a long way to go

- ISM Manufacturing PMI Preview: Will the pandemic thwart a second pending recovery?

Updated COVID-19 statistics from US states – and especially from Texas where hospitals are under pressure – will later move markets. The last word of the busy start to the third quarter belongs to the Fed. Meeting minutes from the June meeting may reveal the level of optimism about the recovery or fear of permanent damage to the economy.

See FOMC Minutes Preview: History happens quickly in a pandemic

Overall, a busy day awaits traders, with more chances than not for cable to crumble.

GBP/USD Technical Analysis

Pound/dollar is trading under a downtrend support line that has been accompanying the currency pair since mid-June. The recent rise tested the line. Momentum on the four-hour chart remains to the downside and the 50 Simple Moving Average recently broke below the 200 SMA, a bearish sign. The Relative Strength Index is back to balanced levels after flirting with oversold conditions.

All in all, bears remain in control.

Support awaits at 1.2340, a support line from mid-June, followed by 1.23, a round number that provided support in late May. It is followed by 1.2250 – now a double-bottom after preventing further falls on Tuesday.

Resistance is at 1.24, a stubborn cap, and where the downtrend resistance line hits the price. The next levels to watch are 1.2450, 1.25, and 1.2550.

See 2020 US Elections: Three reasons why Biden’s lead over Trump is far greater than Clinton’s in 2016