GBP/USD posted strong gains last week, climbing 1.8%. The upcoming week has four events. Here is an outlook for the highlights and an updated technical analysis for GBP/USD.

The decline in British factory orders eased in July, with a reading of -46, up from -58 beforehand. Retail sales climbed 13.9% in June, after a gain of 12.0% in the previous release. The Manufacturing and Services PMIs both improved, with readings of 53.6 and 56.6, respectively. A reading above 50.0 indicates expansion.

For the first time since April, US weekly unemployment claims were higher than the previous week. Last week’s reading of 1.41 million was up from 1.30 million. Analysts had expected jobless claims to remain steady at 1.3 million. The US Manufacturing PMI has been showing contraction for the past four months, with readings below the 50-level. Still, the index has been moving upwards and showed strong improvement in June, climbing from 39.8 to 49.6. The upswing continued in July, with a reading of 51.3, but this was shy of the forecast of 52.0.

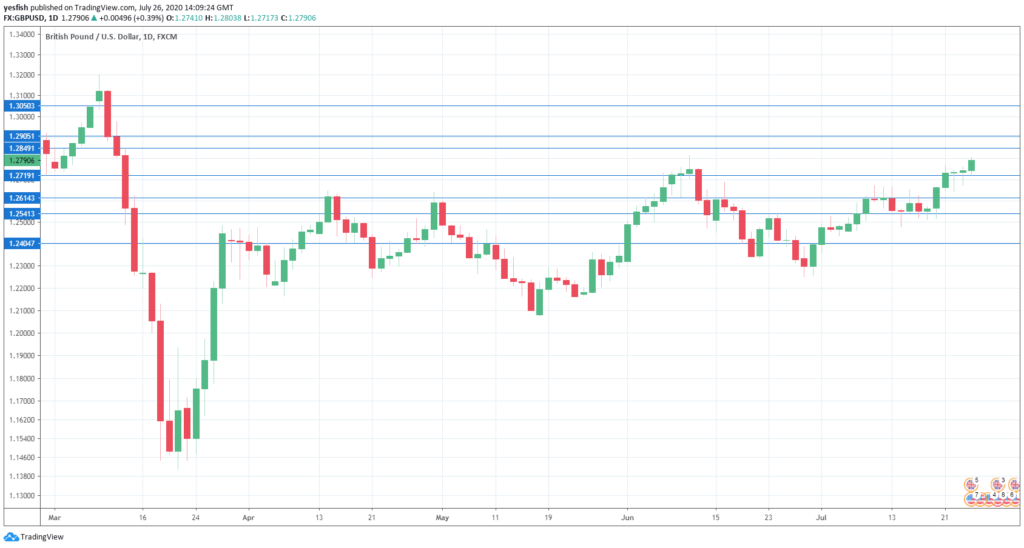

GBP/USD daily graph with resistance and support lines on it. Click to enlarge:

- CBI Realized Sales: Tuesday, 10:00. Sales volume fell sharply in June, with a sharp fall of -37. This follows a read of -50 in May. Analysts are projecting another reading deep in negative territory, with an estimate of -27.

- BRC Shop Price Index: Tuesday, 23:01. This index continues to point to falling inflation, as the index has not mustered a gain in 13 months. The June release came in at -1.6%.

- Net Lending to Individuals: Wednesday, 8:30. Debt levels have fallen in the past two months, pointing to a drop in consumer spending and confidence. In May, the indicator fell by 3.4 billion pounds, but beat the estimate of -4.0 billion. The June report is expected to show a small decline of -0.4 billion.

- GfK Consumer Confidence: Thursday, 23:01. British consumer confidence remains mired deep in negative territory. The indicator has been pegged at -27 for the past two months and no change is expected in the upcoming release.

Technical lines from top to bottom:

We start with resistance at 1.3050.

1.2905 has held in resistance since mid-March.

1.2850 is next.

1.2718 has switched to a support level after strong gains by GBP/USD last week.

1.2616 is next.

1.2540 (mentioned last week) has some breathing room in support.

1.2403 is the final support line for now.

I am bullish on GBP/USD

The UK economy is struggling, but the broad weakness of the US dollar has allowed the pound to make significant inroads. With many parts of the US struggling to gain control of Covid-19, it could be another good week for the British pound.

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!