- GBP/USD is rising as the BOE is expected to raise interest rates again.

- The dollar lost ground against its rivals, especially the Pound.

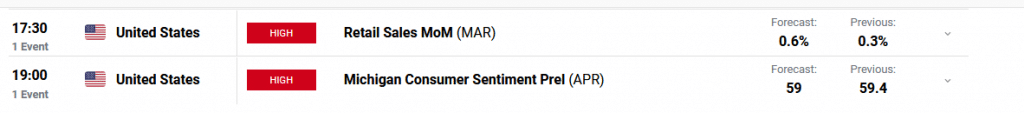

- For today, investors will be focused on US Retail Sales.

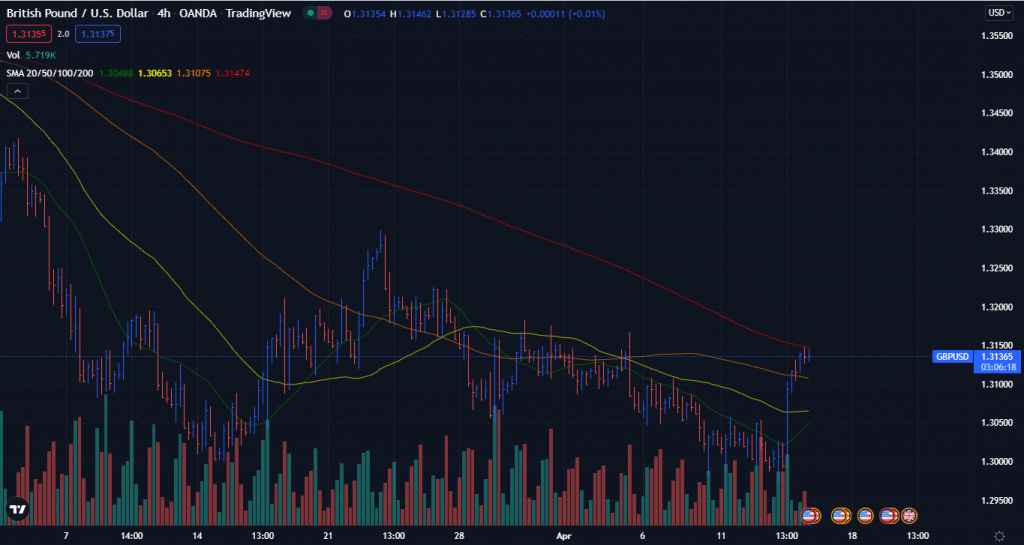

The GBP/USD forecast suggests the pair are looking to recoup some of its previous losses. At the start of the London session, GBP/USD is moving above 1.3130. Today, traders and investors look to US Retail Sales for fresh impetus.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

The case for Sterling

Sterling rose after falling to its lowest level versus the greenback since November 2020, after British consumer price inflation surged to its highest level in three decades.

British consumer prices rose to an annual rate of 7.0 percent in March, the most since March 1992 and up from 6.2 percent in February, casting doubt on how aggressively the BoE will tighten monetary policy.

Greenback blues

Meanwhile, the US Dollar remains turbulent against its rivals today. After the prospect of greater US inflation dissipated, the DXY is auctioning below the psychological level of 100.00.

The 12-month US Consumer Price Index (CPI) hit 8.5 percent, a multi-year high, prompting Federal Reserve (Fed) officials to boost interest rates by 50 basis points (bps) in May.

Party-gate scandal

Prime Minister Boris Johnson and Chancellor Rishi Sunak have been fined for violating COVID lockdown regulations.

So far, most Tory MPs who have commented on the subject have defended Johnson. However, if additional Conservatives begin to push for Johnson’s resignation, the Pound may suffer greatly due to the political instability.

GBP/USD data events ahead

Today investors will focus on US Retail Sales and Michigan Consumer Index.

Across the pond, the docket remains quiet.

What’s next to watch for GBP/USD forecast?

The GBP/USD pair may continue to sway lower as markets absorb the UK CPI, particularly if risk sentiment continues to be unsettled. In addition, the new party-gate revelations may further weigh on the Pound.

GBP/USD technical forecast: Bulls folding their sleeves

The GBP/USD price is moving above 1.3130 at the time of writing. The 4-hour chart shows the pair is above its 20, 50, and 100-day SMAs. It signifies a bullish trend. However, it is slightly below the 200day SMA.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The next key resistance level for the Cable lies around 1.3165. If the price goes above this level, we can see the next relevant resistance near the 1.3214 level.

On the flip side, the next support is at 1.3021. If the price declines below this level, we can see it further drifting towards the 1.2925 level.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money